A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

China’s Imports of U.S. Soy Rose in 2021, as Administration Walks “Fine Line” on Phase One Trade Deal, Negotiations Continue

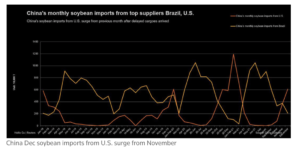

Reuters writers Hallie Gu and Dominique Patton reported last week that, “China’s soybean imports from the United States in 2021 rose from the previous year as it stepped up agricultural purchases under a trade deal agreed with Washington, while annual Brazilian shipments fell, customs data showed on Thursday.

“The world’s top soybean importer brought in 32.3 million tonnes of U.S. soybeans in 2021, up 25% from 25.89 million tonnes in 2020, data from the General Administration of Customs showed.

“Annual soybean imports from Brazil came in at 58.15 million tonnes, down 9.5% from 64.28 million in 2020, the data also showed.”

Recall that China’s total soybean imports in 2021 fell from the previous year.

#China's 2021 ag imports were larger than in 2020 except for in #pork and #soybeans. The Jan-Dec soy volume of 96.5 mmt is the second best after last year. #Corn imports reached 28.35 mmt, up 150% from 2020. pic.twitter.com/itD8i4WZFq

— Karen Braun (@kannbwx) January 18, 2022

Despite the increase in U.S. soybean purchases by China, Bloomberg’s Mike Dorning reported last week that, “U.S. Agriculture Secretary Tom Vilsack said China hasn’t lived up to its promises under the Phase One trade agreement Beijing made with President Donald Trump.

“Vilsack was asked Thursday during testimony to the House Agriculture Committee whether China has met its commitments on farming under the deal.

“‘No,’ he responded. ‘They’re $13 billion short on purchases and there are seven key areas where they have yet to perform.'”

Reporting on the same House Ag Committee hearing, DTN Ag Policy Editor Chris Clayton reported last week that, “U.S. Trade Representative Katherina Tai is taking the lead to convince China to meet its obligations under the phase-one deal, Vilsack said. The secretary added, though, that the administration is figuring out ways to ‘walk a fine line’ with China, given that the country is the top destination for agricultural products again.

“‘It’s not correct to suggest we haven’t done anything. It is indeed correct to suggest that we have asked the Chinese to increase more,’ Vilsack said. He noted the trade war under the Trump administration caused commodity prices to decline. ‘We’ve seen better commodity prices in the last year, which is good news for farmers.’

“Overall, agricultural exports for fiscal year 2021 (Oct. 1, 2020, through Sept. 30, 2021) saw exports hit a record $172.2 billion, up 23% from fiscal year 2020. On a calendar basis, Vilsack said, preliminary numbers for 2021 forecast a record as well.”

In addition, U.S. agricultural exports are currently forecast at record ($175.5 billion) for fiscal year 2022.

Meanwhile, Bloomberg writer Jenny Leonard reported last week that, “Tai and China’s Vice Premier Liu He held two virtual meetings last year to discuss China’s performance under the deal as well as longstanding irritants in the relationship, including subsidies and other state support for companies Beijing has designated as national champions. Tai’s deputy, Sarah Bianchi, also engaged in conversations with her Chinese counterparts, which were not publicized by the agency. The talks have yielded no breakthroughs so far, say people familiar with their substance, who spoke on condition of anonymity.

“USTR spokesman Adam Hodge says the negotiations are ongoing and ‘it is not in the U.S. interest at this time to get ahead of them.'”

In other developments, Bloomberg News reported last week that, “China will keep scooping up more and more global wheat supplies after record imports last year, with changing diets in an increasingly affluent society set to be a key driver of future demand.

“Overseas purchases jumped 17% to about 9.8 million tons in 2021, customs data show. Increased use of wheat for animal feed because of high domestic corn prices and a difficult harvest played a major role in pushing up imports.”