A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Illinois Crop Production Costs Could Hit Record Levels This Spring- Fertilizer Prices a Driver

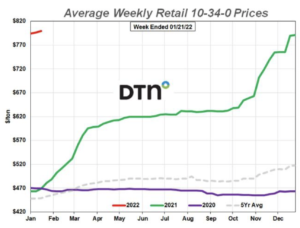

DTN writer Russ Quinn reported last week that, “Most retail fertilizer prices were slightly higher the third week of January 2022. But as was the case last week, one fertilizer was lower in price looking back a month.

“Seven of the eight major fertilizers were slightly higher, although none were up a considerable amount. DTN designates a significant move as anything 5% or more.

“DAP had an average price of $863 per ton compared to last month, MAP $932/ton, urea $916/ton (all-time high), 10-34-0 $800/ton, anhydrous $1,433/ton (all-time high), UAN28 $585/ton (all-time high) and UAN32 $683/ton (all-time high).”

Quinn pointed out that, “10-34-0 hit the $800/ton level for the first time in this historic rise of retail fertilizer prices. The last time it was this high was the first week of March 2012 when starter fertilizer was $807/ton.

“Like last week, one fertilizer was just slightly lower in price compared to a month ago. Potash was down just slightly and had an average price of $807/ton.”

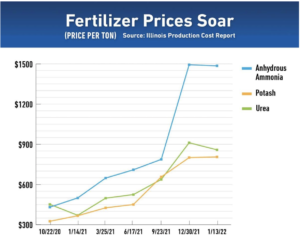

Also last week, Daniel Grant reported at FarmWeekNow that, “Farmers should be able to obtain fertilizer for the upcoming spring season in most areas around the state, despite tight supplies.

“But prices are expected to remain near historic highs, according to Josh Linville, director of fertilizer for StoneX. He discussed the market outlook during the Illinois Fertilizer and Chemical Association’s annual convention in Peoria.”

#Illinois Production Cost Report, https://t.co/eOoTGbyarV - @USDA_AMS

— Farm Policy (@FarmPolicy) January 27, 2022

* #fertilizer costs, #diesel fuel. pic.twitter.com/3fQBCQabb7

And in a separate FarmWeekNow article last week, Daniel Grant reported that, “A large jump in input costs, driven by skyrocketing fertilizer prices, puts farmers on pace to plant the most expensive crops on record in Illinois this spring.

“That’s according to the latest farm production costs and break-even price estimates released by the University of Illinois’ farmdoc team.

‘Get ready for a high-cost year,’ said Gary Schnitkey, Soybean Industry Chair in Ag Strategy at the U of I. ‘Coming into 2022, I don’t see costs coming down much.’

Grant explained that, “Total corn costs on highly productive ground in central Illinois are pegged at $1,064 per acre in 2022 (up from $915 last year) with soybean costs estimated at $785 per acre (compared to $652 last year), based on the farmdoc estimates. If realized, it would be the first time corn costs averaged more than $1,000 per acre in Illinois.”

Nonetheless, Lisa Foust Prater reported at Successful Farmer last week that, “When it comes to those inputs levels, Schnitkey says, ‘That is just reality and it’s going to raise our break-even levels.’ Still, he says, ‘Right now, if we’re looking at prices for fall delivery, it could be a profitable year.'”

#Illinois Grain Bids- Jan. 28th, https://t.co/S5XWBLFj2Q

— Farm Policy (@FarmPolicy) January 28, 2022

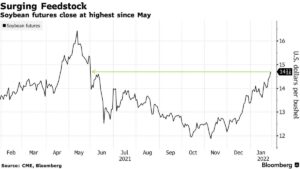

Central Illinois Average Price:

* #Corn: 6.22

* #Soybeans: 14.44 pic.twitter.com/qp8E4eHu67

And on Thursday, Russ Quinn reported at DTN that, “A Russian invasion of Ukraine will most certainly affect the global fertilizer market, but to what extent is not known. Several factors, including what sanctions Russia would see and if those sanctions included crop nutrients, would dictate how fertilizers are affected.

“We do know a conflict in the Black Sea region would probably lower the prospects of less-expensive fertilizer prices for U.S. farmers in 2022, according to fertilizer analysts.”