A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

As Fertilizer Prices Climb, Acreage Decisions Loom, and Wheat, Soybean Prices Surge

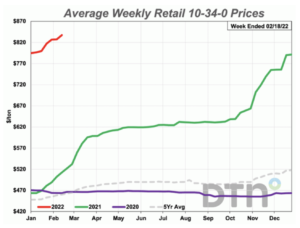

DTN writer Russ Quinn reported on Wednesday that, “Average retail prices for most fertilizers continued to climb the second full week of February 2022, according to sellers surveyed by DTN. For the second week in a row, prices of all but one of the major fertilizers were higher compared to last month.

“Seven of the eight major fertilizer prices were higher, with one fertilizer up a considerable amount, which DTN designates as anything 5% or more.”

Quinn stated that, “The average retail price of 10-34-0 was 5% more expensive compared to a month ago. The starter fertilizer had an average price of $837 per ton.

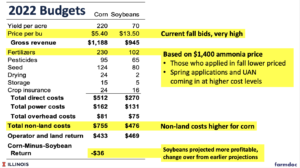

“DAP had an average price of $874/ton compared to last month, MAP $935/ton, potash $815/ton, anhydrous $1,488/ton (all-time high), UAN28 $603/ton (all-time high) and UAN32 $703/ton (all-time high).”

In Tuesday’s farmdoc webinar, Krista Swanson discussed the surge in #fertilizer prices, and noted that the price of anhydrous ammonia had recently reached a record high (Clip, 90 seconds). pic.twitter.com/9fpIfsQuz8

— Farm Policy (@FarmPolicy) February 16, 2022

The DTN article added that, “UAN32 was $700 per ton for the first in the history of the DTN dataset. This is an all-time-high price for the liquid nitrogen fertilizer.

“One fertilizer was lower in price from the prior month. Urea was slightly lower with an average price of $891/ton.”

Also Wednesday, Bloomberg writers Jen Skerritt and Elizabeth Elkin reported that,

More price hikes for fertilizer are on the horizon as the Russia-Ukraine crisis adds to fears of global shortages, stoking concerns about rising food costs.

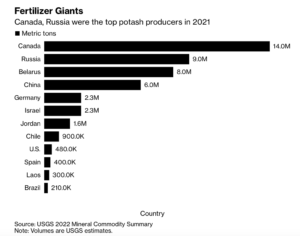

“Russia is a low-cost, high-volume global producer for all major fertilizers, and it’s the world’s second-largest producer after Canada of potash, a key nutrient used on major commodity crops and produce. The conflict in the region as well as sanctions on Russia could hurt trade flows. U.S.-based Mosaic Co., a major fertilizer producer, warned of potash shortages in a call with analysts Wednesday.”

The Bloomberg writers explained that, “Also contributing to turmoil in fertilizer markets is the force majeure declared last week by a Belarusian potash miner largely due to U.S. sanctions and being cut off from global markets. Belarus accounts for a fifth of global supply. Global potash contracts have already settled at the highest price since 2008.”

Meanwhile, Reuters writers Mark Weinraub and Julie Ingwersen reported on Wednesday that, “Global supply chain problems and inflation have sent fertilizer prices soaring and left many suppliers sold out. Limited plantings of wheat and corn, which require heavy use of high-cost fertilizer, could drive up the cost of bread, cereal and other staple foods. And demand for U.S. wheat and corn could rise further if Ukraine and Russia engage in a full-blown war and disrupt shipments from those two key export countries.

“Russia is a major potash producer and exporter of natural gas, a key input in producing nitrogen fertilizer.”

The Reuters article also pointed out that, “U.S. farmers did boost their winter wheat seedings in the fall but a dry winter in places like Kansas and Oklahoma has raised concerns about a crop shortfall that could provide a further shock to prices.”

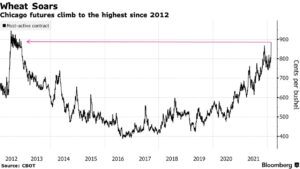

With respect to the revenue side of farm profitability considerations, Bloomberg writers Megan Durisin and Allison Nicole Smith reported on Wednesday that, “Wheat climbed to a nine-year high in Chicago on worries about potential supply disruptions in the Black Sea region, further buoying costs of food staples around the world.”

“Wheat futures rose as much as 2.8% to $8.7675 a bushel, the highest since 2012,” the Bloomberg article said.

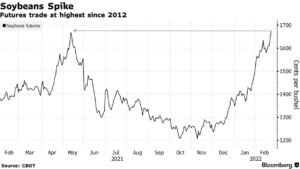

And Bloomberg writers Kim Chipman and Megan Durisin reported on Wednesday that, “Soybeans climbed to a nine-year high as dimming prospects for South American harvests threaten global supplies.

“Futures advanced as much as 2.4% to $16.75 a bushel in Chicago, the highest for a most-active contract since late 2012, when drought in the U.S. hampered production.”