As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Ukraine Planting Area in Focus, as Global Fertilizer Sourcing Evolves

Reuters News reported yesterday that, “The area sown with Ukraine’s 2022 spring grain crops could fall 39% to 4.7 million hectares due to Russia’s military invasion, the APK-Inform agriculture consultancy said on Tuesday.”

‘After the invasion of Russian troops into the territory of Ukraine and as a result of ongoing and further active hostilities in many key regions, there is no physical opportunity to start sowing,’ APK-Inform said in a report.

The article stated that, “The consultancy did not give a 2022 grain harvest forecast.”

“It also said that around 2 million hectares of winter wheat, barley and rye sown for 2022 harvest could be damaged or unavailable for harvest due to the hostilities and only around 5.5 million hectares of winter grain crops could be threshed.

“‘It means 28% losses,’ the consultancy said.”

The Reuters article added that, “Ukraine traditionally starts spring field work in late February or in March but this year’s cold spring delayed that significantly.”

Last week, Ukraine President Volodymyr Zelenskiy urged farmers to plant as many fields as possible.

And Reuters News reported yesterday that, “Ukrainian Prime Minister Denys Shmygal said on Tuesday the government would finance a loan programme for farmers worth 25 billion hryvnias ($846 million) as part of a raft of new measures to ease the economic shock of war.”

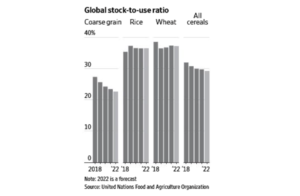

Writing in today’s Washington Post, Laura Reiley reported that, “Before the invasion, it was assumed that about 24 million tons of wheat sown last fall would be shipped out of Ukraine starting in the summer, said Joe Glauber, senior research fellow at the International Food Policy Research Institute in Washington and former USDA chief economist. The USDA has downgraded that to 20 million, but Glauber said he has heard it could be as little as 6 or 7 million, ‘with Russia cutting most of the rail lines down from the main wheat-producing areas to the port, to Odessa and on that side of Crimea.'”

Wall Street Journal writer Carol Ryan reported in today’s paper that, “Commercial activity in Ukraine’s ports has stopped since Russia’s invasion began on Feb. 24, and it will be hard for farmers to harvest their crops later this summer and export grains if fighting cuts them off from the land. Agricultural producers may also face shortages of fuel, which is needed for military use.

“Russian farmers don’t face the same physical hurdles, but economic sanctions are already impacting demand for the country’s agricultural goods. Skyrocketing insurance premiums for vessels in the Black Sea are also adding to the cost of grain shipments from the region. Last week, price quotes for Russian wheat were $405 a ton compared with $460 and $539 for European Union and U.S. wheat respectively, according to the U.S. Department of Agriculture.”

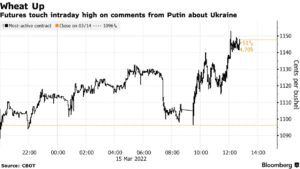

Dow Jones writer Kirk Maltais reported yesterday that, “Wheat for May delivery rose 5.3% to $11.54 1/4 a bushel on the Chicago Board of Trade Tuesday following new USDA data showing declining crop conditions for U.S. winter wheat.”

Also yesterday, Bloomberg writers Megan Durisin, Tarso Veloso Ribeiro, and Allison Nicole Smith reminded readers that, “U.S. [wheat] prices touched an all-time high above $13 earlier this month;” and reported that, “Major importer Turkey is seeking wheat later this week, and Iraq is looking for 50,000 tons. Algeria wants to buy barley, and some European countries are after American corn to help plug a gap as the war in Ukraine stalls its supplies abroad.”

Meanwhile, Reuters writers Gus Trompiz, Michael Hogan and Sarah El Safty reported yesterday that, “A vessel is loading about 30,000 tonnes of wheat in France bound for Egypt, according to shipping data, in what traders said was a rare French sale to Egypt’s private sector as Russia’s invasion of Ukraine squeezes supply availability for importers.”

And Bloomberg writers Abdel Latif Wahba and Salma El Wardany reported yesterday that, “Egypt is offering incentives to farmers to produce wheat and setting an output quota for subsidies as the country rushes to safeguard supplies amid the war in Ukraine.”

The Bloomberg article explained that, “The new rules are part of the country’s efforts to tighten control over the local market to maintain price stability and secure reserves of basic foodstuffs amid the fallout from the war.

“Large-scale farmers who deliver at least 90% of this season’s yield to the government will receive incentives in the form of subsidized fertilizers for the summer season, according to the document.”

Also with respect to fertilizer, Reuters News reported yesterday that, “India is boosting fertiliser imports from nations including Canada and Israel to ensure sufficient supplies for the coming summer sowing season after the disruption of shipments caused by Russia’s invasion of Ukraine.”

In separate news regarding Canada, Reuters reported yesterday that, “Thousands of workers at Canada’s second-biggest railway, Canadian Pacific Railway Ltd, have threatened to strike this week, potentially disrupting the movement of grain, potash and coal at a time of soaring commodity prices.”