A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Ukrainian Farmers Ask: “Plant or Not to Plant,” Even if Fighting Stops, Yields Could Suffer as Input Worries Loom

David L. Stern, Joby Warrick, Kareem Fahim, Dan Lamothe and Missy Ryan reported on the front page of today’s Washington Post that, “Russian forces pounded key airfields in central Ukraine and launched a fresh assault on the besieged port city of Mariupol on Sunday, Russian and Ukrainian officials said, as Moscow pressed ahead with its invasion in defiance of new Western economic threats and fierce resistance from Ukraine’s outgunned defenders.”

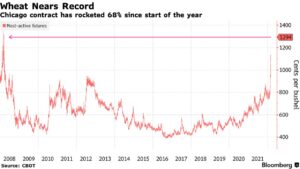

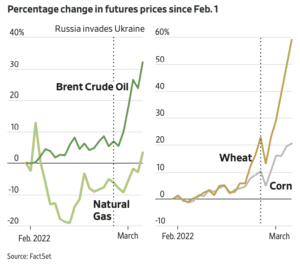

Financial Times writer Emiko Terazono reported late last week that, “Russia and Ukraine supply almost a third of the world’s wheat exports and since the Russian assault on its neighbour, ports on the Black Sea have come to a virtual standstill. As a result, wheat prices have soared to record highs, overtaking levels seen during the food crisis of 2007-08.”

The FT article stated that, “‘If farmers in Ukraine don’t start planting any time soon there will be huge crisis to food security. If Ukraine’s food production falls in the coming season the wheat price could double or triple,’ said [Kees Huizinga] the Dutch national, who has been farming for two decades in Cherkasy, 200km south of Kyiv. He is part of a farming union, whose 1,100 members cover just under 10 per cent of the country’s farmland.

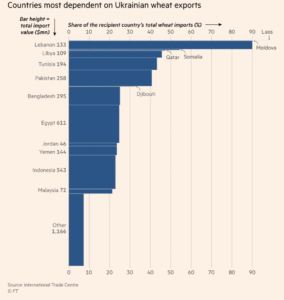

“While well stored wheat, such as that on Huizinga’s farm, can last several months, agricultural experts and policymakers have warned of the impact of delayed shipments on countries reliant on the region for wheat, grain, sunflower oil and barley.”

Terazono indicated that, “Sitting in his friend’s house in Siret close to the Romania-Ukraine border, Huizinga said the main question raised during a call with 75 fellow Ukrainian farmers was whether to plant or not to plant. They may struggle to get fertiliser and crop protection and it is unclear whether they could actually harvest and ship the crop. ‘The supply chain is broken,’ he said.”

Bloomberg writers Megan Durisin and James Poole reported on Monday that, “Wheat prices soared closer to record levels as Russia’s intensifying war in Ukraine cuts off supplies from one of the world’s leading breadbaskets.

“Futures in Chicago jumped by the daily limit for the sixth straight session, rising 7% to $12.94 a bushel. That builds on a massive surge of 41% last week, the most in data spanning six decades, and puts prices at their highest since 2008. The Paris contract breached an all-time high after jumping as much as 11%.”

The Bloomberg article stated that, “‘The escalation of the conflict is now putting markets into serious turmoil,’ the Agricultural Market Information System said Monday in a report. ‘Any serious disruption of production and exports from these suppliers will no doubt drive up prices further and erode food security for millions of people.'”

“Food costs have already risen to an all-time peak, according to the United Nations, and are set to go even higher, deepening the woes of importers,” the article said.

And Patrick Thomas and Alistair MacDonald reported on the front page of today’s Wall Street Journal that, “Ukrainian farmers are supposed to plant their spring crops soon. Yet even if the fighting were to stop, they may not have enough fertilizer and pesticides. Agriculture industry executives are warning of smaller yields in Ukraine, which normally has some of the world’s most productive fields.

“‘Depending on what crop you’re looking at, it could have rather severe impacts already in the first growing season,’ said Svein Tore Holsether, chief executive officer of Norway-based Yara International AS A, one of the world’s largest fertilizer makers. ‘Yields could drop by 50%.'”

More broadly, Thomas and MacDonald pointed out that, “Fertilizer supplies were already tight, and prices have reached record highs. That adds to the pressure on farmers, who are paying significantly more for fuel, weed-killing chemicals, crop seeds and seasonal labor.

“If fertilizer supplies run short—or get too expensive—some farmers may shift acres toward less fertilizer-intensive crops such as soybeans. Others could cut back on fertilizers, potentially slimming harvests, analysts said.”