A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Russian Grain Exports Persist, as Rail Delays Impact U.S. Fertilizer Supply

Bloomberg News reported yesterday that, “Seven weeks after its invasion of Ukraine, Russia is still exporting grain to some of its biggest customers, even as shipping costs soar.

“The main buyers remain Egypt, Turkey and Iran, said Dmitry Rylko, general director of the Moscow-based Institute for Agricultural Market Studies. The resilience of grain exports, despite sanctions and moves by some traders to shun Russian commodities, is pushing some market observers to raise their estimates for shipments this season.”

“The U.S. Department of Agriculture last week also raised its estimate for Russian wheat exports in the current season to 33 million tons, though that remains short of the 35 million tons it forecast before the war,” the Bloomberg article said.

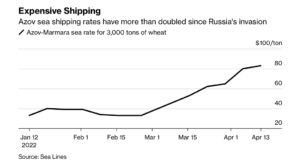

Yesterday’s article added that, “Shipping costs from the Black Sea region have also soared, climbing 50% to 80% from last year due to war risks, according to UkrAgroConsult.”

And Dow Jones writer Yusuf Khan reported yesterday that, “Europe’s wheat exports will be lower than expected in the current season, with a lack of exports from Ukraine continuing to cause turbulence within agricultural markets, Strategie Grains said Thursday.

“Strategie Grains revised its European wheat-export forecast for the 2021-22 season down to 31.4 million metric tons from 32.5 million tons, due largely to the disruption caused by the war in Ukraine. Meanwhile, barley and corn export forecasts were revised up slightly to 7.6 million tons and 5.4 million tons, from 7.2 million tons and 4.7 million tons respectively.”

More narrowly with respect to Ukraine, Reuters writers Pavel Polityuk and Jason Hove reported earlier this week that, “Ukraine’s corn exports could fall to 17 million tonnes in 2021/22, a senior agriculture official said on Wednesday, down from 23.1 million tonnes the previous year, reflecting the impact of Russia’s invasion.

“Sunflower oil exports over the same period could drop to 3.4 million tonnes, down from 5.3 million tonnes, Deputy Agriculture Minister Roman Rusakov said at a conference in Prague.”

And yesterday, Reuters writers Gus Trompiz and Sybille de La Hamaide reported that, “Reduced production of crop seeds in Ukraine due to war with Russia could affect the country’s grain production for several years, a French seed industry group said on Thursday.”

Perfectly put description to the short-term market reaction to the supply shock from the Russia-Ukraine Crisis https://t.co/JAEfw1CxvR

— Scott Irwin (@ScottIrwinUI) April 13, 2022

Meanwhile, Bloomberg writer Elizabeth Elkin reported yesterday that,

CF Industries Holdings Inc. said reductions in rail service along Union Pacific Corp. lines will delay fertilizer shipments in parts of the U.S., threatening to reduce supply for farmers during the planting season.

“The world’s biggest nitrogen fertilizer company said in a statement the delays will affect shipments from its complexes in Louisiana and Iowa on Union Pacific rail lines to key farm areas from Iowa to California.

“The delays threaten to further tighten fertilizer supply and drive up prices that have been hitting repeated records over the last few months as Russia’s invasion of Ukraine threatens a massive portion of global supply. Russia is a low-cost exporter of every major kind of crop nutrient. It’s an especially important season for farmers, who need fertilizer as they plant soybeans, corn and wheat in fields across the U.S.”

Reuters writers Rithika Krishna reported yesterday that, “CF Industries ships to customers through Union Pacific rail lines primarily from its Donaldsonville Complex in Louisiana and its Port Neal Complex in Iowa. The company was asked by the railroad operator to reduce its shipments by nearly 20%.

“The fertilizer producer said it may not have available shipping capacity to take new rail orders involving Union Pacific rail lines to meet late season demand for fertilizer.”

The Reuters article noted that, “‘The timing of this action by Union Pacific could not come at a worse time for farmers,’ CF’s Chief Executive Officer Tony Will said on Thursday.

“‘Not only will fertilizer be delayed by these shipping restrictions, but additional fertilizer needed to complete spring applications may be unable to reach farmers at all,’ he added.”