A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

ERS: US Wheat Price Projected at Record High, Major Exporters’ Ending Stocks Lowest Since 2012/13

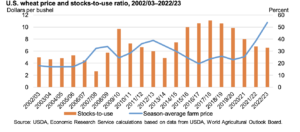

In its monthly Wheat Outlook report on Monday, the USDA’s Economic Research Service (ERS) stated that, “The U.S. season-average farm price (SAFP) for 2022/23 is projected to reach a record $10.75 per bushel, supported by tight domestic stocks.

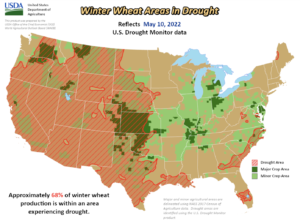

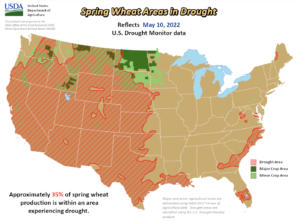

“In 2021/22, stock levels declined due to drought conditions in key Hard Red Spring, Durum, and White wheat production areas, which contributed to the smallest U.S. crop since 2002/03. For 2022/23, slightly larger production is projected compared to the previous year but this would still be the second lowest in the last 20 years based on pervasive drought in major Hard Red Winter growing areas.”

Even with domestic use and exports projected down from the previous year, ending stocks are forecast to decline once again

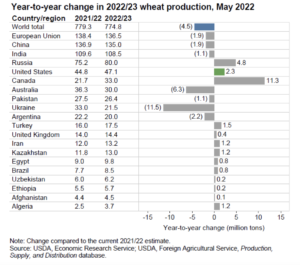

Turning to global production prospects, ERS noted that, “Global wheat production in 2022/23 is projected to be short of the 2021/22 record at 774.8 million metric tons (MT). While Canada and Russia are projected to rebound from their 2021/22 production declines, Ukraine and Australia are forecasted below their record 2021/22 production. The United States is also projected to rebound from last year’s drought-reduced production in spring wheat, but higher expected abandonment for winter wheat this year could limit the expansion.”

With respect to trade, the Outlook explained that, “Despite high wheat prices, high consumption demand leads to higher trade year (July/June) imports in 2022/23 at a record 201.2 million MT, up 3.7 million year-over-year. Trade year exports for 2022/23 are projected at a record 205.3 million MT, up 3.7 million from 2021/22.”

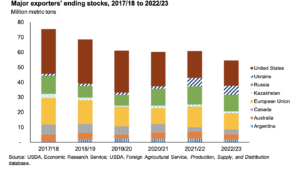

The Outlook added that, “In 2022/23, a draw down in global ending stocks is forecasted (down 5 percent from 2021/22) as consumption exceeds production. Major exporters’ ending stocks are projected 10 percent lower than 2021/22 and would be the lowest since 2012/13 at 54.5 million MT.”

“Ending stocks in Ukraine are projected at 6.0 million MT despite smaller production as exports are expected to be logistically constrained due to the current war with Russia. This is short of Ukraine’s record stock level in 1993/94 at 7.6 million MT,” according to ERS.

Meanwhile, Reuters writer P.J. Huffstutter reported yesterday that, “Chicago wheat futures rallied on Tuesday, even after India said it would allow overseas wheat shipments awaiting customs clearance, as traders focused on an unrelenting question roiling global prices: Where will the world get its grain?”

The Reuters article stated that, “Wheat also received support from a U.S. Department of Agriculture report late Monday, indicating worsening condition of the U.S. winter crop, deepening worries about supply in an already-tight market.

“The USDA rated 27% of the U.S. winter wheat crop in good to excellent condition, down 2 percentage points from the previous week and below analysts’ expectations, while spring wheat was 39% planted, below expectations of 43%.”