A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

WSJ: Countries Scramble to Fill Black Sea Grain Void

Wall Street Journal writers Jesse Newman and Patrick Thomas reported on the front page of today’s paper that, “From India to Ireland, governments are moving to fill a void from the Black Sea region that could total tens of millions of tons of grain. They are paying farmers to sow more crops and are enlisting railcars and additional containers to move wheat.

“Trading giants such as Bunge Ltd. and Archer Daniels Midland Co. are exploring alternate routes to move crops out of Ukraine, where the key port of Odessa is offline and fighting has turned fields into battlegrounds, casting uncertainty over farmers’ ability to plant and harvest their crops. Meanwhile, companies including ADM, Bayer AG and Cargill Inc. are continuing to operate in Russia for now.

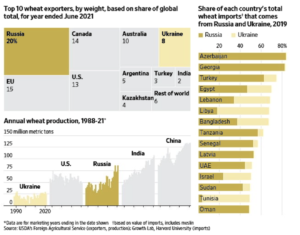

“In the near term, it will be hard for the rest of the world’s farmers to take up the slack, given that Russia and Ukraine combined typically account for more than a quarter of global wheat exports. Since the war began, the U.S. Department of Agriculture has cut its outlook for the world’s wheat trade in the current season by more than 6 million tons, or 3%, as expectations for lower Russian and Ukrainian exports outpace anticipated increases elsewhere.”

Today’s article explained that, “If hostilities continue into the summer, agricultural executives and economists say, crop shortfalls will keep prices high, imperiling food security in places like the Middle East and North Africa, where surging food prices have contributed to political instability in recent decades. Global food prices already have reached record highs, and prices could jump another 22% as war in Ukraine leads to supply gaps, according to the United Nations Food and Agriculture Organization.”

‘It’s not a question of the world running out of grain, it’s a question of how high the price will be that people have to pay for it,’ said Joseph Glauber, former USDA chief economist and senior research fellow at the International Food Policy Research Institute.

Newman and Thomas added that, “In recent years, Ukraine’s sowing of its top six crops covered 59 million acres, roughly the size of planted acreage in Illinois, Indiana and Iowa, three of the U.S.’s biggest farm’s states, according to Scott Irwin, an agricultural economist at the University of Illinois. Russia, the world’s largest exporter of wheat, ships four times the grain grown in Kansas, typically the U.S.’s top wheat-producing state, Mr. Irwin said.

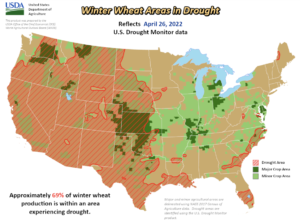

“U.S. farmers aren’t expected to provide much of a buffer. The Northern Hemisphere’s current wheat crop was planted last fall, and is due to be harvested this summer. Drought has taken a toll on the U.S. winter wheat crop, according to the USDA.”

In related news, Reuters writers Neha Arora and Mayank Bhardwaj reported yesterday that, “India’s wheat output looks likely to fall in 2022 after five consecutive years of record harvests, as a sharp, sudden rise in temperatures in mid-March cut crop yields in the world’s second-biggest producer of the grain.

“The drop could curb Indian exports of the staple. Cashing in on a rally in global wheat prices after Russia invaded Ukraine, India exported a record 7.85 million tonnes in the fiscal year to March – up 275% from the previous year.”

The article stated that, “In mid-February, nearly a month before the recent hot spell, the government said India was on course to harvest an all-time high 111.32 million tonnes of the grain, up from the previous year’s 109.59 million tonnes

“The government is yet to formally revise its production estimates, but an official note, seen by Reuters, said the output could fall to 105 million tonnes this year.”

Meanwhile, Reuters writer Pavel Polityuk reported yesterday that, “Ukraine has formally closed its four Black and Azov sea ports, which Russian forces have captured, the Ukrainian agriculture ministry said on Monday.”

And Reuters writer Michael Hogan reported yesterday that, “Russian attacks on Ukraine’s grain infrastructure look like attempts to reduce the competition in Russia’s export markets, German Agriculture Minister Cem Oezdemir was reported as saying on Monday.”

The Reuters article noted that, “‘We are repeatedly receiving reports about targeted Russian attacks on grain silos, fertilizer stores, farming areas and infrastructure,’ Oezdemir was quoted as telling the Redaktionsnetzwerk Deutschland, a cooperation network of German regional newspapers.”

And a separate Reuters article today by Panarat Thepgumpanat reported that, “Thailand’s cabinet on Tuesday approved new measures to boost imports of animal feed for a three-month period to ease a shortage following the disruption caused by Russia’s invasion of Ukraine, a government spokesman told a news briefing.”

Also, Dow Jones writer Stephen Nakrosis reported yesterday that, “Ken Seitz, the interim president and chief executive of Nutrien Ltd., said Monday that global agriculture and crop input markets ‘are being impacted by a number of unprecedented supply disruptions that have contributed to higher commodity prices and escalated concerns for global food security.'”

The Dow Jones article added that, “Potash supplies are being impacted by sanctions placed on Russia and Belarus, two nations that account for about 40% of global potash production and exports, Nutrien’s management said.

“This has led to reduction in management’s projected range of global potash shipments to between 60 million and 65 million tons in 2022.

“Sanctions have also led to tighter global nitrogen supplies due to reduced availability from Russia. The supply is also impacted by China’s restrictions on urea exports, according to management.”