The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

In Southern Odesa, Ukrainian Grain Harvest Begins, While USDA Increases Ukraine’s Corn Production Estimate From Last Month

Reuters writer Pavel Polityuk reported today that, “Farmers of Ukrainian southern Odesa region have started the 2022 grain harvest taking advantage of favourable weather, regional officials said late on Sunday.

“Ukraine has already completed the 2022 grain sowing but the agriculture ministry gave no 2022 grain crop outlook.

“The ministry had said farmers planned to sow 14.2 million hectares of spring grains this year, down from 16.9 million hectares in 2021 due to the Russian invasion.”

The Reuters article noted that, “The Odesa regional administration said local farmers had started winter barley threshing and producers would harvest a total of 1.06 million hectares of early grain crops, including 244,000 hectares of winter barley.

“Farmers also will harvest 551,000 hectares of winter wheat.”

And on Friday, USDA’s Foreign Agricultural Service (FAS) indicated in its monthly World Agricultural Production report that,

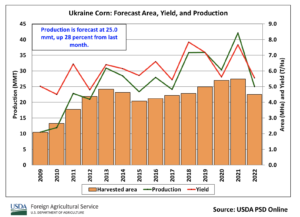

Ukraine corn production for marketing year 2022/23 is forecast at 25.0 million metric tons, up 28 percent from last month, but down 41 percent from last year.

“Yield is forecast at 5.56 tons per hectare, essentially unchanged from last month, and down 28 percent from last year. Harvested area is forecast at 4.5 million hectares (mha), up 29 percent from last month, but down 18 percent from last year.

“According to the Ministry of Agriculture’s planting progress data, planting is almost complete and 4.59 mha have been planted as of June 6th. The USDA assumption is that areas that have been planted are likely to be harvested, therefore, normal abandonment is expected. Abandonment for corn is typically low; it is around 1 percent, based on a 10-year average. Yield is essentially unchanged month-to-month. The critical time for yield development occurs during July and early August, coincident with late reproduction to grain fill. Harvest begins in early September. USDA crop production estimates for Ukraine include estimated output from Crimea.”

FAS also pointed out that, “Ukraine sunflowerseed production for marketing year 2022/23 is forecast at 9.5 million metric tons, down 14 percent from last month and 46 percent from last year. Yield is forecast at 2.07 tons per hectare, down slightly from last month and 16 percent from last year. Harvested area is forecast at 4.6 million hectares (mha), down 13 percent from last month and 35 percent from last year.”

Meanwhile, Bloomberg writer Katarina Hoije reported last week that, “Nine million metric tons of Ukrainian grain didn’t reach markets in March and April as exports from the country were blocked by Russia, James O’Brien, head of the Office of Sanctions at the US State Department, said in an online briefing Thursday.

“‘There’s at least 20 million tons of grain sitting in Ukraine that could be put into the world market,’ O’Brien said. The U.S. is working with its partners to get about 3 million tons of grain — roughly half of what Ukraine exports per month in a ‘normal year’ — to global markets in the coming months, he said.”

On Friday, Reuters writer Marek Strzelecki reported that, “Ukrainian grain exports are rising and nearing 2 million tonnes per month now, European Commissioner for Agriculture Janusz Wojciechowski said on Friday.”

And Reuters writer Kanupriya Kapoor reported yesterday that, “Ukraine has established two routes through Poland and Romania to export grain and avert a global food crisis although bottlenecks have slowed the supply chain, Kyiv’s deputy foreign minister said on Sunday.”

“Ukraine is the world’s fourth-largest grain exporter and it says there are some 30 million tonnes of grain stored in Ukrainian-held territory which it is trying to export via road, river and rail,” the Reuters article said.

Elsewhere, Financial Times writers Emiko Terazono and Camilla Hodgson reported on Saturday that, “Soaring food prices caused by the war in Ukraine have increased the risk of famine, raising pressure on producers of low-carbon fuels derived from crops and sparking a ‘food versus biofuel’ debate.

“Before Russia’s invasion, global biofuel production was at a record high. In the US, the leading biofuels producer, 36 per cent of total corn production went into biofuels last year, while biodiesel accounted for 40 per cent of soyabean oil supplies.

“But some food companies and policymakers are calling for an easing of mandates for blending biofuels into petrol and diesel to increase global grain and vegetable oil supplies.”

Terazono and Hodgson noted that, “In the EU, Belgium and Germany are considering easing biofuel blending mandates to address food security.”