Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Ukrainian Farmers “Feeling the Heat” of Fighting as Harvest Begins

Thomas Grove reported in today’s Wall Street Journal that, “The wheat on Pavlo Sergienko’s 7,400-acre farm is ready to harvest. He has rented the combine and gathered the extra help he will need. His next hurdle: collecting the crops while Russian rockets rain down on his fields nearly every day.

“‘I don’t know how we’ll get everything done,’ Mr. Sergienko said. ‘And how we’re going to transport the wheat from here—that’s another interesting question.’

“Russia’s invasion of Ukraine has hit some of the most productive agricultural land in one of the world’s breadbaskets, disrupting supplies and pushing up food prices. Ukraine’s Black Sea ports have been cut off, grain storage facilities have been targeted, and now as harvest season begins, farmers are feeling the heat of relentless fighting.”

Today’s article stated that, “‘These are the farms that Ukraine depends on to keep its production going,’ said Elena Neroba, a Ukrainian grain broker. ‘For most small farmers, if they lose their crop, it’s death.'”

Grove added that, “Problems don’t end with the harvest. Farmers often must figure out how to transport their crops through dangerous areas. When a buyer purchases grain, the farmer is sometimes responsible for transporting it.”

Newly declassified intelligence sheds light on Russian forces' attacks on Ukrainian grain terminals – including an attack on the Nika-Terra Grain Terminal in Mykolaiv on or around June 4. The world must hold Russia accountable for its actions that undermine global food security. pic.twitter.com/QQ7BH6LLpG

— Ned Price (@StateDeptSpox) June 23, 2022

Meanwhile, Reuters writer Tuvan Gumrukcu reported yesterday that, “Turkish Foreign Minister Mevlut Cavusoglu said on Thursday that Ankara was investigating claims that Ukrainian grain has been stolen by Russia and shipped to countries including Turkey, but added the probes had not found any stolen shipments so far.

“Kyiv’s ambassador to Ankara said in early June that Turkish buyers were among those receiving grain that Russia had stolen from Ukraine, adding he had sought Turkey’s help to identify and capture individuals responsible for the alleged shipments.”

And Reuters writer Kirsti Knolle reported today that, “Setting up reliable transport routes for grain from Ukraine is top priority to prevent a global food crisis and will be a main topic at Friday’s global food conference, German Foreign Minister Annalena Baerbock said.

“Ukraine is being blackmailed by Russian President Vladimir Putin, and therefore it is necessary to develop new transport routes for the long term, said Agricultural Minister Cem Oezdemir at a joint news conference on Friday.”

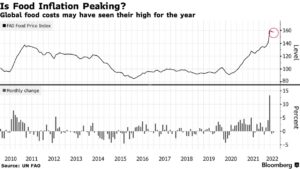

Elsewhere, Bloomberg News reported today that, “Is the global food crisis past its worst? There’s growing talk that grains and cooking oil prices have peaked — and maybe global food costs have too. More supply is on the way, with winter wheat harvests getting under way in the northern hemisphere, and spring wheat, corn and soybeans following later. The focus then turns to production in Australia, Brazil and Argentina. Barring weather woes, output could rise as farmers plant more in response to elevated prices.

“Global stockpiles will remain crimped in the coming season — and millions of tons of grains are stuck in Ukraine — but they may not get substantially tighter. Some Ukrainian cargoes are reaching Europe, while Russia is heading for a bumper crop. Palm oil, the world’s most consumed edible oil, just slumped to its lowest level this year as top producer Indonesia ramps up exports, while wheat, corn and soybeans have tumbled from their highs. Global food costs have already fallen from their all-time peak in March, and more declines could follow.”

Bloomberg writers Tarso Veloso Ribeiro and Tatiana Freitas reported yesterday that, “Corn is stacking up outside of Brazilian silos at the fastest rate in years after the country’s biggest-producing region harvests a bumper crop.

“Warehouses are still full of soybeans, which are reaped only a few months before the corn. In Mato Grosso, soy production was also huge this season and sales have been slower than usual, leaving the warehouses with no room to receive the corn, according to Cleiton Gauer, superintendent at IMEA, Mato Grosso’s rural economy institute.”

The Bloomberg article pointed out that, “The pileup threatens to add further pressure to corn and soy prices that are already slumping in Chicago futures markets amid promising weather in the US growing areas. Corn sank Thursday to the lowest level since before Russia invaded Ukraine, while soybeans touched the lowest level since January with edible oil supply picking up and a broader commodities malaise. The slide in crop futures offers a glimmer of optimism that food inflation may be tempered in coming months, even as prices remain historically high.”