“It was yet another climate-driven shock to a global food system already in upheaval, and a sign of the hunger crisis that looms as the planet warms.

Under Russian Fire, Ukraine Farmers Face Harvest Scramble

Reuters writer Conor Humphries reported today that, “As 10-metre high mounds of sunflower meal smoulder among the blackened ruins of one of Ukraine’s top agricultural terminals, farmers in this front-line region are scrambling to survive a harvest under Russian fire.

“They see Russia’s shelling of the Nika-Tera port facility in the southern city of Mykolaiv on June 4 as just the most dramatic example of a wider assault on a pillar of Ukraine’s economy – and the world’s.

‘Agriculture is one of the few business sectors that is working… Of course they want to destroy it. They want to end this stream of income into the country,’ farmer Volodymyr Onyschuk said near a pile of Russian shell casings on his 2,000 hectare wheat and sunflower holding near Mykolaiv.

Humphries noted that, “Crops will be vulnerable to fire caused by shelling, he said, and that could be ‘hell’ for farmers when the harvest season begins in coming weeks.”

Today’s article added that, “Few in the region hold out hope that diplomatic efforts will unblock the Black Sea. They said a few convoys of ships would not even dent the volumes that need to be exported, and it is not economical to send the same grain by road.”

And Reuters writer Pavel Polityuk reported yesterday that, “A senior government official said on Monday Ukraine’s grain harvest was likely to drop to around 48.5 million tonnes this year from 86 million tonnes last year following Russia’s invasion.”

Polityuk pointed out that, “Efforts led by Turkey to negotiate safe passage for grain stuck in Ukraine’s Black Sea ports has not produced a breakthrough. Kyiv has said Moscow is setting unreasonable conditions and the Kremlin has said free shipment depends on an end to the international sanctions against Russia.”

Spoke to @SecBlinken. We agreed that Russia must release those subjected to abhorrent show trials & end their blockade on grain exports.

— Liz Truss (@trussliz) June 13, 2022

Also discussed our Northern Ireland Protocol Bill. pic.twitter.com/WQDEsqcGTd

Meanwhile, Bloomberg writers Elizabeth Elkin, Daniel Flatley, and Jennifer Jacob reported yesterday that, “The US government is quietly encouraging agricultural and shipping companies to buy and carry more Russian fertilizer, according to people familiar with the efforts, as sanctions fears have led to a sharp drop in supplies, fueling spiraling global food costs.

“The effort is part of complex and difficult negotiations underway involving the United Nations to boost deliveries of fertilizer, grain and other farm products from Russia and Ukraine that have been disrupted by President Vladimir Putin’s invasion of his southern neighbor.”

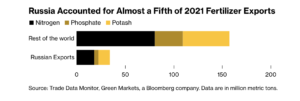

The Bloomberg writers explained that, “The EU and the US have built exemptions into their restrictions on doing business with Russia to allow trade in fertilizer, of which Moscow is a key global supplier. But many shippers, banks and insurers have been staying away from the trade out of fear they could inadvertently fall afoul of the rules. Russian fertilizer exports are down 24% this year. US officials, surprised by the extent of the caution, are in the seemingly paradoxical position of looking for ways to boost them.”

“The US push underlines the challenge facing Washington and its allies as they seek to increase pressure on Putin over his invasion but also limit the collateral damage to a global economy which is heavily dependent on commodity supplies from Russia ranging from natural gas and oil to fertilizer and grains,” the Bloomberg article said.

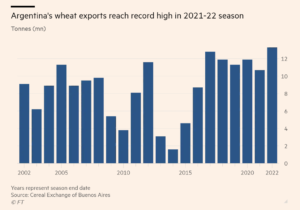

With respect to production and policy responses to the Russian invasion, earlier this week Financial Times writer Lucinda Elliott reported that, “Argentina produced a record 21.8mn tonnes of wheat last year, compared with 25mn tonnes grown in Ukraine. But despite a pledge by President Alberto Fernández last month that the country would seize the ‘formidable’ opportunity to meet demand, its farmers say they are facing a series of deterrents as the May to August planting season is under way.

“Chief among them is a strict export quota that Fernández’s leftwing Peronist administration further reduced in March to shore up domestic supplies — a move farmers say runs counter to his pronouncement last month. ‘Instead of our government stimulating production to make things easier for us, they intervene,’ said Hugo Ghio, who farms wheat near the city of Córdoba.

“The cost of inputs such as fuel and fertiliser has also risen steeply as the war hits supplies and inflation soars in Argentina’s stuttering economy. Meanwhile, the government recently indicated it was considering increasing the 12 per cent tax levied on wheat exports and potentially introducing a new ‘unexpected profit’ tax on companies that analysts say would hit commodity exporters such as farmers.”

And Washington Post writer Sarah Kaplan reported on the front page of today’s paper that, “When Russia invaded earlier this year, threatening Ukraine’s exports of grains, crop-rich India was seen as a global buffer, making up for the shortfall. But this spring’s erratic rains and scorching heat killed crops and made it dangerous for farmworkers to harvest, devastating India’s production. In response, India announced in May it would shut down all grain exports, staving off famine in the country but threatening starvation abroad.

“As of last week, about 750,000 people around the world were facing a food security ‘catastrophe’ — at which ‘starvation, death, destitution and extremely critical acute malnutrition levels are evident’ — according to the Food and Agriculture Organization, the U.N. agency tasked with fighting global hunger.”

Today’s article stated that, “But while the Ukraine war and the pandemic might fade with time, experts say, climate change has become a persistent threat to food security, making it more difficult to respond to unforeseen shocks.”

Elsewhere, Kirk Maltais reported in today’s Wall Street Journal that, “Soybean prices have soared some 30% this year to a record, a surge that promises further pain for consumers facing the most severe bout of food inflation in a decade.

“The continuous contract for soybeans on the Chicago Board of Trade ended trading Thursday at $17.69 a bushel, topping the previous high of $17.68, set in September 2012 when drought scorched the U.S. crop. The price fell to $17.08 Monday, as traders pulled back from many markets following another red-hot U.S. inflation reading that intensified fears of sharper Federal Reserve interest-rate increases.”