Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China Food Security Goals Prompt Effort to Cut Soy Use in Livestock Rations, as Argentina Farmers May Plant More Soybeans

Bloomberg News reported yesterday that, “China is redoubling its efforts to bolster food security by trying to cut the amount of soybeans that get turned into animal feed.

“In a notice this week, the farm ministry identified feed grains as the most pressing problem for food supplies. It urged the feed sector to learn from some of the top producers that have successfully reduced the amount of soybean meal — derived from crushing soybeans — used in livestock rations as their main source of protein.

“China is by far the world’s biggest importer of soybeans, which account for the bulk of its consumption. Last year, the import bill was over $50 billion, not counting smaller quantities of meal, shipped by far-flung suppliers in South America and the US. Those costs have risen further in recent months as food inflation has gripped the world in the wake of Russia’s war in Ukraine.”

The Bloomberg article explained that, “So, even modest shifts in soy consumption would be helpful in controlling both import costs and inflation — and represent a worry for the legions of overseas farmers that rely on Chinese demand.

The soy ratio in animal feed nationwide dropped last year to 15.3%, from 17.8% in 2017, the ministry said on Tuesday. That’s a cumulative saving of 11 million tons of meal, or 14 million tons of beans.

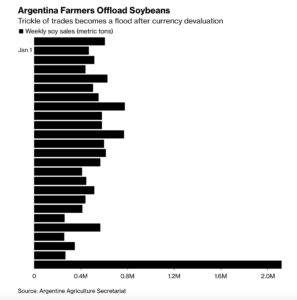

The Bloomberg article added that, “China has massively increased its purchases from Argentina after the South American country devalued its currency for farmers, sparking a deluge of sales.”

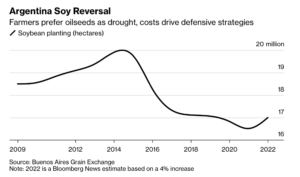

Also yesterday, Bloomberg writer Jonathan Gilbert reported that, “Farmers in Argentina are grappling with a third straight year of withering drought ahead of the growing season, but this year they have a new strategy to beat it: plant soybeans.

“For the first time since 2015, growers on the Pampas crop belt are set to expand the area planted with soybeans as they try to shield their businesses from the dryness. This is an unexpected move because corn has been preferred over soybeans in past seasons to get the most out of droughts. This year, however, corn is the bigger risk. The yellow grain uses far more fertilizer, whose costs soared amid Russia’s invasion of Ukraine. Farmers are loath to throw too much money at a season portending low yields on parched fields, so soybeans, which are cheaper to plant, are making a comeback.

“Traders watch Argentina closely because it’s the world’s biggest exporter of soy meal used in raising animals for meat, as well as soy oil for cooking and biofuels.”

Also with respect to Argentina production variables, Reuters writer Maximilian Heath reported this week that, “In fields near Argentine farm town Pergamino, spiky green shoots of wheat stretch in neat rows to the horizon, a crop developers hope will boost yields of the grain thanks to a single gene borrowed from sunflowers helping it better tolerate drought.

“Reached along a dusty farm track, the field is one of dozens of sites growing a genetically modified (GM) wheat strain called HB4, developed by local firm Bioceres and state scientists. Argentina, the world’s No. 6 wheat exporter, gave commercial planting approval to HB4 in 2020. It was the first GM wheat strain in the world to receive such approval.

“Its backers say HB4, also modified to tolerate the herbicide glufosinate-ammonium, could help ward off food shortages at a time when climate change has led to severe droughts in China, North America and Europe, and a war between major growers Russia and Ukraine has snarled food supply chains.”

In other wheat production news, Reuters writer Ana Mano reported yesterday that, “Brazilian wheat production should total 10.935 million tonnes in 2022 as four states are likely to increase output in what will be a record season for local farmers, according to agribusiness consultancy Safras & Mercado on Wednesday.”

Meanwhile, Reuters writer Julie Ingwersen reported yesterday that, “U.S. wheat futures hit their highest in more than two months on Wednesday on fears of an escalation in the Ukraine war that has disrupted crucial Black Sea grain exports, but pared gains as worries about the health of the global economy pressured the wider commodities sector.”

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Heightened turmoil surrounding the Russia-Ukraine war pushed CBOT wheat up past the $9 per bushel mark today, this after rising yesterday by 7.6%.”

Elsewhere, Laurence Norman reported in today’s Wall Street Journal that, “The European Union reversed guidance on how to apply its economic sanctions against Russia in a bid to sidestep Moscow’s allegations that the bloc’s measures are leading to a food security crisis in developing countries.

“The EU’s executive body, the European Commission, circulated new guidance to member states on Monday that made it clear that fertilizers, coal and some other products from Russia can be transferred to the rest of the world via the bloc, and insurance and other services can be provided on that transport.

“The move comes as Western countries and Russia battle to win over countries in the developing world to their narrative over the global food and energy crisis.”

The Journal article reminded readers that, “Russian officials have accused the West of not upholding its end of an agreement to free up Russian exports. Those exports were subject to a U.N.-backed agreement signed in July as a part of a broader agreement to unblock Ukrainian grain exports frozen by the Russian invasion.”

“Western officials are using this week’s meeting of the United Nations General Assembly in New York to counter Russian claims. On Tuesday, at a special meeting on the food situation, leaders called for donating more money to fight hunger and lift barriers to food supplies. On Wednesday, President Biden said the U.S. would give an additional $2.9 billion in aid to strengthen global food security,” the Journal article said.