As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Russia Wheat Harvest Could Reach Record, but Exports Stymied- as Ukraine Begins Corn Harvest

Bloomberg writer Aine Quinn reported today that, “Russia’s wheat harvest could reach a historic 100 million tons, according to consultant SovEcon, with the commodity piling up at home as the nation struggles to export large volumes.

“Farmers across the country are finishing up the bountiful harvest after good growing conditions throughout the summer. The huge supply in the world’s top shipper would usually help to bring down world prices.

But so far this season, government export taxes and logistical issues from its war in Ukraine are keeping more grain than usual at home.

Quinn explained that, “Russian wheat export prices have recently turned more competitive against other origins like France and the US, meaning that shipments could increase. Higher prices and issues with shipping Russian cargoes — some insurers and banks shunned Russian commodities after its invasion of Ukraine in February — slowed exports earlier in the season. Food exports are not targeted by sanctions, but some institutions are wary of doing business with Russia as a result of those measures.”

Meanwhile, Reuters writer Nigel Hunt reported yesterday that, “The International Grains Council (IGC) on Thursday raised its forecast for 2022/23 global wheat production, partly reflecting an upward revision for the crop in Russia.

“In its monthly update, the inter-governmental body saw global wheat production rising to 792 million tonnes in 2022/23, up from a previous projection of 778 million and now above the prior season’s 782 million tonnes.

“The main revision was for Russia which was now expected to produce 93.4 million tonnes, up from a previous forecast of 87.6 million.”

Main exporters' #wheat stocks in 22/23 are seen at an above-average level. While inventories in the Black Sea suppliers may reach a new high amid a steep accumulation in Russia, combined carryovers at other key origins may be the smallest in 15 years. pic.twitter.com/MUoSyFUm2R

— International Grains Council (@IGCgrains) September 22, 2022

The Reuters article added that, “Russia’s wheat exports in the 2022/23 season were still seen at 36.5 million tonnes, despite the higher production forecast, leading to an expected build-up in stocks in the country.”

And Dow Jones writer Yusuf Khan reported yesterday that, “Higher volumes of Russian, Canadian and Australian wheat this year is likely to help mitigate losses in corn output from the U.S. and raise closing grain stocks for 2022-23, according to a new report.

“The International Grains Council said Thursday that it had raised its closing stocks by 10 million metric tons from the previous estimate in August to 587 million tons of grain overall at the end of 2022-23 agricultural year, mainly because of increases in wheat production.”

#Maize (#corn) supply in the EU is set to be markedly reduced in 22/23 following a sub-par harvest, with consumption also set to fall as feed producers switch to alternatives, including feed #wheat and #barley. pic.twitter.com/JviSbUlGsh

— International Grains Council (@IGCgrains) September 22, 2022

The article noted that, “Corn production is likely to be lower this year, falling by 51 million tons because of the poor growing conditions seen in the U.S. and Europe to 1.168 billion tons in 2022-23. Soybean production is expected to hit a record 387 million tons in 2022-23 led by South American and Black Sea production.”

Amid outlooks for sizeable exportable supplies, 22/23 (Oct/Sep) world trade in #soybeans is expected to rebound solidly. China’s imports may be underpinned by increased hog margins, albeit with downside risk stemming from wider economic worries. pic.twitter.com/2lfNbozCGm

— International Grains Council (@IGCgrains) September 22, 2022

In other developments, Reuters writer Pavel Polityuk reported today that, “Ukrainian farms have started the 2022 corn harvest, threshing 92,200 tonnes of the commodity from 0.5% of the sown area, the agriculture ministry said on Friday.”

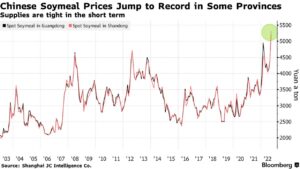

Also today, Bloomberg writer Jinglu Gu reported that, “China is facing a soybean meal shortage, at least in the short term, with prices of the feed ingredient soaring to a record in some provinces.

“Spot prices have jumped as much as 10% this week in the main processing hubs of Guangdong and Shandong, according to data from Shanghai JC Intelligence Co. The rally could drive up feed costs for hog farmers and spur a further run-up in pork prices that Beijing is trying to cool amid inflation risks.

“Traders are scrambling for the feed ingredient, with some saying there’s no guarantee that those who have placed orders can secure supplies. The main reason for the shortage is weak imports of soybeans as demand languished. China’s soybean imports fell 9% in the first eight months from last year.”

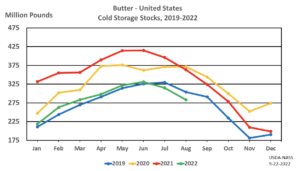

And in a closer look at food costs, Wall Street Journal writer Jesse Newman reported in today’s paper that, “All the world’s inflation woes are melting into a stick of butter.

“Lower milk production on U.S. dairy farms and labor shortages for processing plants have weighed on butter output for months, leaving the amount of butter in U.S. cold storage facilities at the end of July the lowest since 2017, according to the Agriculture Department.

“Tight supplies have sent butter prices soaring at U.S. supermarkets, surpassing most other foods in the past year. U.S. grocery prices in August rose 13.5% during the past 12 months, the largest annual increase since 1979, according to the Labor Department. Butter outstripped those gains, rising 24.6% over the same period.”