Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Drought Closes Portion of Mississippi River- Soybean, Corn Exports Lagging, While Black Sea Export Discussions Continue

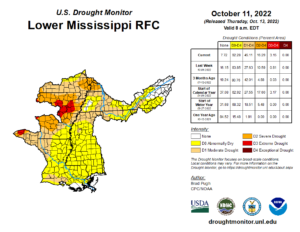

Bloomberg writers Michael Hirtzer and Diego Lasarte reported yesterday that, “Drought has again closed a portion of the Mississippi River — and this time shrunk a part of the major US waterway in Memphis to its lowest level ever.

“Waters in Memphis fell to a reading of negative-10.77 feet, narrowly lower than the previous low of negative-10.70 set in 1988, according to National Weather Service data.”

The Mississippi River is the lowest it has been since records started in 1954. Current stage sits at -10.79 feet. #tnwx #mswx #mowx #arwx #midsouthwx pic.twitter.com/lgZW5enYq0

— NWS Memphis (@NWSMemphis) October 18, 2022

Hirtzer and Lasarte explained that, “The river was closed Monday about 125 miles (201 kilometers) northeast of Memphis, near Hickman, Kentucky, for dredging to remove debris from the river bottom. There were three vessels and 51 barges waiting in the queue at Hickman, according to the US Coast Guard. It was closed earlier this month near Stack Island, Mississippi.

The Mississippi River is seeing some of the lowest water levels since 2012.

— WeatherNation (@WeatherNation) October 17, 2022

While normal for this time of the year, here's a look at how the dry conditions are impacting our nation's waterways. #MississippiRiver pic.twitter.com/KTwIa6hngv

“‘We are seeing some signs of a little bit of rainfall with the cold fronts working their way through, but nothing that will get us out of the low-water situation,’ said Jeff Graschel, a hydrologist at the Lower Mississippi River Forecast Center.”

With river stages around the area being so low, a few gages have been reporting negative values. Negative values do not mean the river has run dry. Rather, the water level has fallen below the 'zero' reference point for the river gage, which is above the river channel bottom. pic.twitter.com/blPAYjgyQx

— NWS Paducah, KY (@NWSPaducah) October 17, 2022

Also yesterday, Reuters writer Karl Plume reported that, “U.S. soybean exports are trailing their normal autumn pace despite rising supplies from an accelerating harvest, as low river levels have slowed the flow of grain barges to export terminals, according to U.S. Department of Agriculture (USDA) data issued on Monday.

“Corn exports are also lagging their typical harvest-time rate, weekly USDA export inspections data showed.

“Low water on the Mississippi River and its tributaries has slowed the delivery of grain barges to export terminals along the Gulf Coast, where some 60% of U.S. crop exports exit the country.”

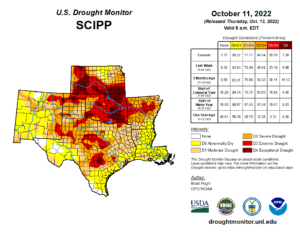

In other drought related developments, Reuters writer Julie Ingwersen reported yesterday that, “With planting roughly halfway complete, the 2023 U.S. hard red winter wheat crop is already being hobbled by drought in the heart of the southern Plains, wheat experts said.

“Planting plans may be scaled back in the U.S. breadbasket despite historically high prices for this time of year, reflecting rising global demand and thin world wheat supplies projected to end the 2022/23 marketing year at a six-year low. The tight supplies have been exacerbated as the conflict in Ukraine has disrupted grain exports from the Black Sea region.

“The drought threatens Kansas, the top winter wheat growing state, and Oklahoma in two ways: discouraging farmers who have not yet planted from trying, while threatening crops already in the ground from developing properly.”

More broadly with respect to wheat production, Bloomberg writer Sybilla Gross reported yesterday that, “Australian wheat farmers are preparing to gather a third straight bumper crop, but with plenty of heavy rain expected in the east of the country, growers there are bracing for a grueling and muddy harvest.

“Wet conditions had earlier buoyed the outlook for wheat production in the nation, one of the world’s top exporters, with the government expecting more than 32 million tons this year after a record 36.3 million tons last season.”

Elsewhere, Reuters writer Maximilian Heath reported yesterday that, “Scarce and patchy rain forecast for Argentina’s main breadbasket regions will likely compound a difficult start to the season for key crops including wheat and corn, a farm weather expert said on Monday, as drought conditions mostly prevail.”

The Reuters article noted that, “A senior analyst at the key Rosario grains exchange told Reuters the 2022/23 wheat harvest would likely come in at 16 million tonnes, a 500,000-tonne cut from the entity’s previous formal forecast.”

Meanwhile, regarding the Black Sea grain export deal, Reuters News reported yesterday that, “Russia on Monday told a top United Nations representative that the extension of a landmark Black Sea grain deal was dependent on the West easing Russia’s own agricultural and fertiliser exports, the defence ministry said in a statement.”

A separate Reuters article yesterday, by Daphne Psaledakis, Katharine Jackson and Michelle Nichols, indicted that, “Discussions will continue on extending and expanding a U.N.-brokered deal allowing Ukrainian Black Sea grain exports, U.N. spokesman Stephane Dujarric said on Monday, after U.N. officials held ‘positive and constructive‘ discussions in Moscow on the deal.

“The July deal has allowed more than 6 million tonnes of grains and other foods to be exported and could expire next month.”

“Russia has criticized the deal, complaining that its exports were still hindered. Moscow could object to extending the pact allowing Ukraine’s exports beyond late November,” the Reuters article said.

51 400 tons of 🇺🇦 wheat carried by Super Henry is being unloaded in Mombasa port. Meanwhile today the third vessel loaded wheat for Kenya has departed from 🇺🇦 ports. We continue to provide African countries with ukrainian grain. More than 1,1M tons has been exported for today pic.twitter.com/GklEOzW09d

— Oleksandr Kubrakov (@OlKubrakov) October 17, 2022

Also yesterday, Reuters writer Pavel Polityuk reported that, “Ukrainian grain exports in the first 17 days of October were just 2.4% lower than in the same period of 2021 despite the closure of several seaports and the Russian invasion, agriculture ministry data showed on Monday.”

Polityuk added that, “The ministry’s data showed that Ukraine has exported 2.12 million tonnes of grain, mostly corn and wheat, so far in October, versus 2.17 million tonnes in the same period of October, 2021.

“The data also showed that Ukraine has exported a total of 10.8 million tonnes of grain so far in the 2022/23 July-June season compared with 16.5 million in the same period of 2021/22.”