As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

IMF- Food Insecurity Rising Since 2018, War in Ukraine Push Food and Fertilizer Prices Higher, as Mississippi Barge Rates Hit Record High

Wall Street Journal writer Yuka Hayashi reported late last week that, “Sharp rises in food and fertilizer prices caused by the war in Ukraine are creating the worst global food crisis since at least 2008, putting the lives and livelihood of 345 million people in immediate danger, the International Monetary Fund said Friday.

“While the food shock is touching nations in various parts of the world, the worst impact is felt by 48 mostly low-income countries, many of which depend on imports from Ukraine and Russia. About half of these countries, such as Somalia, South Sudan and Yemen, are especially vulnerable due to existing severe economic challenges and weak institutions, IMF economists said in a new report.

“Food insecurity has been rising since 2018 as severe weather events, regional conflicts and the Covid-19 pandemic disrupted food production and distribution and boosted their prices.”

The Journal article noted that, “The situation deteriorated sharply following Russia’s invasion of Ukraine. Exports of food and fertilizer from the two nations plummeted, prompting some other countries to impose export restrictions. Together, the two countries account for 30% of globally traded wheat, 20% of corn and 75% of sunflower oil.”

Also last week, Reuters writer David Lawder reported that, “The [IMF] also called for eliminating food export bans and other protectionist measures, citing World Bank research that these account for as much as 9% of the world wheat price increase.”

Lawder added that, “Ukraine was among the top five grain exporters before the war, accounting for some 15% of global corn exports and 12% of wheat exports, and a resumption of shipments from Black Sea ports under a deal with Russia has only partly eased shortages. But the conflict is reducing Ukraine’s future crop production.”

Meanwhile, Reuters writer Pavel Polityuk reported on Saturday that, “Ukraine’s grain exports fell by 23.6% year on year in September to 4.278 million tonnes, but reached the highest level since the Russian invasion, agriculture ministry data showed.

“The country’s grain exports have slumped since February as the invasion closed off Ukraine’s Black Sea ports, driving up global food prices and prompting fears of shortages in Africa and the Middle East.”

And yesterday, in a separate Reuters article, Pavel Polityuk reported that, “A fifth vessel chartered by the United Nations World Food Programme (WFP), NEW ISLAND, has arrived at Ukraine’s Black Sea port of Chornomorsk and will deliver Ukrainian wheat to Somalia, Ukraine’s infrastructure ministry said on Sunday.

“Ukraine has already shipped wheat to Ethiopia, Yemen and Afghanistan under the programme.”

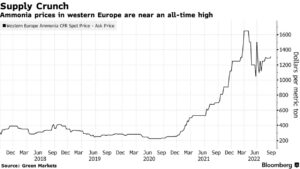

In more detailed reported on fertilizer issues, Bloomberg writers Megan Durisin and Elina Anya Ganatra reported this week that, “Ditching oilseed crops for peas, preparing to cut herds and splashing out on tractor gadgets. That’s what European farmers are doing to try to cope with a worsening fertilizer crisis.

“The lengths they’re going to in order to apply less of the nutrients vital for growing staples like wheat and rapeseed highlights the continued threat the crunch poses to food output.

Many of Europe’s fertilizer plants have closed as Russia’s war in Ukraine squeezes supplies of gas that nitrogen fertilizer is derived from.

The Bloomberg writers pointed out that, “The European Union’s grain output shrank 9% this year as a drought ravaged corn fields. While it’s too early to know how plantings for next year’s harvest will fare, farmers will likely shift some land to crops that need less fertilizer, Strategie Grains analyst Vincent Braak said.”

Last week, Bloomberg writer Jen Skerritt reported that, “The world’s top fertilizer maker says Russia’s war in Ukraine is driving supply disruptions in nitrogen and potash markets and exacerbating concerns of global food shortages.

“Challenges of shipping food and fertilizer from Russia are expected to persist, Nutrien Ltd. Chief Executive Officer Ken Seitz said in an interview for the Bloomberg Canadian Finance Conference. He said at least 25% of Russian potash shipments are constrained, along with vital food staples from the region, including wheat and barley.”

Elsewhere, Bloomberg writers Katia Dmitrieva, Augusta Saraiva, and Michael Sasso reported yesterday that, “Hurricane Ian has left a path of destruction behind, destroying countless homes, ruining citrus crops and risking fragile supply chains, but the storm’s skirting of a key US fertilizer-production area in Florida means the broader US economy was spared from the worst.”

“But a more lasting hit to inflation was likely avoided as the storm spared a critical production center for fertilizer used by farmers in the US and around the world,” the Bloomberg article said.

In other developments, Reuters writer Gus Trompiz reported last week that, “The European Commission on Friday cut its forecast for this year’s maize harvest in the European Union to 55.5 million tonnes from 59.3 million in late August, joining other forecasters in projecting a 15-year low for the drought-hit crop.

“The 6.4% decrease marked the third sharp reduction in a row to the Commission’s monthly forecast for the maize harvest.”

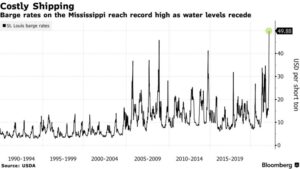

Also last week, Bloomberg writers Kim Chipman, Dominic Carey, and Michael Hirtzer reported that, “American farmers face yet another supply-chain headache just as harvest season moves into high gear: Not enough barges on a shrinking Mississippi River.

“Drought is drying up the crucial US water artery. That means less room for vessels shipping out corn and soybeans, the biggest US crops. Barge rates reached $49.88 per ton on Tuesday, the highest on record and up nearly 50% from a year ago, according to a government report released Thursday.”

The Bloomberg article added that, “The Mississippi River is by far the largest US export channel for corn and soybeans, accounting for more than half of the shipments bound for the world market. The barge woes are hitting at harvest time when supplies will be the biggest, and follow a harrowing season of weather setbacks and soaring inflation for farm necessities like fuel and fertilizer.”