A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

China Protests Contribute to Global Demand Fears

Lingling Wei, Brian Spegele and Wenxin Fan reported on the front page of today’s Wall Street Journal that, “Protests are erupting in major cities in China over President Xi Jinping‘s zero-tolerance approach to Covid-19, an unusual show of defiance in the country as the economic and social costs from snap lockdowns and other strict restrictions escalate.”

The Journal writers noted that, “Open displays of anger are rare in China, where crackdowns on dissent have intensified over the past decade,” while adding that, “The weekend protests were remarkable considering the sheer size of China’s surveillance state and the consequences that dissidents can face in China, including lengthy prison terms.”

Washington Post writer Lily Kuo reported on the front page of today’s paper that, “Protests erupted in cities and on campuses across China this weekend as frustrated and outraged citizens took to the streets in a stunning wave of demonstrations against the government’s ‘zero covid’ policy and the leaders enforcing it.”

The Post article explained that, “The immediate trigger for the demonstrations, which were also seen at universities in Beijing, Xi’an and Nanjing on Saturday, was a deadly fire in Urumqi, the capital of Xinjiang, in China’s far northwest on Thursday. Ten people, including three children, died after emergency fire services could not get close enough to an apartment building engulfed in flames. Residents blamed lockdown-related measures for hampering rescue efforts.”

And Associated Press writers Huizhong Wu and Dale Kong reported on the front page of today’s Los Angeles Times that, “Party leaders promised last month to make restrictions less disruptive by easing quarantine and other rules but said they were sticking to ‘zero-COVID.’ Meanwhile, an upsurge in infections that pushed daily cases above 30,000 for the first time has led local authorities to impose restrictions that residents complain exceed what is allowed by the central government.”

Financial Times writers Hudson Lockett and George Steer reported today that, “Global stocks and oil prices slipped on Monday after protests in China against the government’s Covid-19 policies weighed on market sentiment and added to uncertainty about the outlook of the world’s second-largest economy.”

Also today, Bloomberg News reported that, “A turbulent year for commodities is heading for a volatile finish, with China’s Covid-19 turmoil adding to global demand fears that look set to buffet markets from oil to copper and crops through December.

“Crude opened Monday by slumping to its lowest level this year — while metals and grains also fell — after weekend protests over pandemic policies swept major Chinese cities.”

The Bloomberg article indicated that,

November began with some investor optimism for China’s exit from strict virus controls. It ends with fear that a fresh wave of restrictions will once again pummel commodity demand.

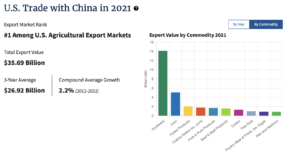

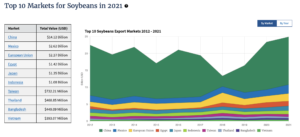

A separate Bloomberg News article from today reported that, “A return to stricter lockdowns would further squeeze demand for a number of key commodities. China is the largest importer of everything from oil to iron ore and soybeans, and purchases have already slowed this year as the economy has stumbled.”

Yesterday, Bloomberg writers Jinglu Gu and Alfred Cang reported that, “China’s strict Covid controls are leaving farmers with no option other than to destroy crops they can no longer sell, triggering concerns about food shortages and stirring outrage on social media.

“Videos circulating online show farmers dumping healthy crops because they’re struggling to sell their harvest. Local and state media also reported that fields of vegetables are being destroyed in major producing regions such as Shandong and Henan provinces to make way for the sowing of the next crop.

“The destruction of fresh food is happening at a time when many Chinese are under lockdown and bracing for food shortages and other supply disruptions. It threatens to drive up food costs which are already elevated, and undercut Beijing’s push to safeguard food supply and eliminate waste.”

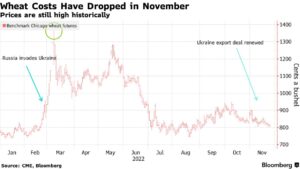

Meanwhile, Reuters News reported late last week that, “Ukrainian President Volodymyr Zelenskiy hosted a summit in Kyiv with allied nations on Saturday to launch a plan to export $150 million worth of grain to countries most vulnerable to famine and drought.

“The ‘Grain from Ukraine’ initiative demonstrated global food security was ‘not just empty words’ for Kyiv, he said.

“The Kremlin says food exported from Ukraine’s Black Sea ports under a U.N.-brokered plan has not been reaching the most vulnerable countries.

“Zelenskiy said Kyiv had raised $150 million from more than 20 countries and the European Union to export grain to countries including Ethiopia, Sudan, South Sudan, Somalia and Yemen.”

Elsewhere, Alistair MacDonald reported in today’s Wall Street Journal that, “For decades, globalization has increased the variety and reduced the cost of food. Now the pandemic, war in Ukraine and other global disruptions have shown how that complex supply chain can also result in more turbulent prices.

“Food-price inflation hit multidecade highs this year in the U.S. and elsewhere, outpacing overall consumer prices. While food inflation has cooled in recent weeks, food prices globally are still 25% higher than before Covid-19 struck in early 2020, according to the United Nations Food Price Index.

“Among the factors pushing up prices, food-industry executives and economists say, have been manufacturing and transport disruptions stemming from the pandemic and the impact of the war in Ukraine on energy and grain prices. While those issues may recede, and some suppliers say they will try to source from closer to home, analysts expect price swings to be more frequent.”

MacDonald pointed out that, “Food and drink, like many manufactured goods from cars to iPhones, often include components from around the world. American pizzas can be topped with ham from Spain and Mexican sauce. Scotch whisky is sometimes made with Ukrainian barley. Overall, almost a quarter of global food exports now have a foreign component, according to data from the World Trade Organization.

“‘When people think of globalized trade, they don’t think that one of the major components of globalization was the food chain,’ said Susan Wachter, a professor at the Wharton School of the University of Pennsylvania, who studies inflation. ‘The increased complexity of that food chain makes food supply extremely vulnerable to supply shocks,’ she added.”