As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Drought Impact on Mississippi May Persist, China Soybean Imports Down From Last Year, as U.S. Sets Fiscal Year Agricultural Trade Record

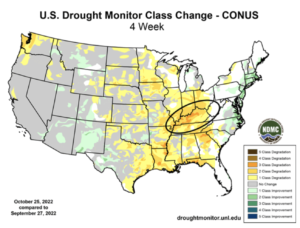

Ag Meteorologist Bryce Anderson reported on Friday at DTN that, “October was dry in many primary U.S. crop areas, including the Eastern Midwest and specifically the Ohio River valley. Precipitation totals in the Ohio Valley were no more than half the normal totals. This lack of moisture was a big contributor to low water levels on the Mississippi River system.

“Precipitation for October at four major weather recording sites on the Ohio River — Cincinnati, Ohio; Louisville, Kentucky; Evansville, Indiana; and Paducah, Kentucky — shows amounts which are less than half the normal totals.

“Cincinnati recorded 0.99 inches in October, only 30% of the normal 3.35 inches. Louisville’s 1.54 inches was just 42% of the normal 3.72 inches. Evansville logged 1.37 inches in October, a mere 40% of the average 3.39 inches. And Paducah’s October precipitation at 1.90 inches was 48% of the normal 3.99 inches.

Ohio River at Cairo. pic.twitter.com/5DUhlj1vOZ

— FarmPolicy (@FarmPolicy) November 6, 2022

“A storm system during the final days of October brought the majority of precipitation; otherwise, October 2022 could possibly have entered history as the driest October on record.”

Rainfall for this year has been much below normal for the Mississippi River basin especially in the Arkansas River drainage where 5 to 15 inches below normal are common. pic.twitter.com/Q1PbykkPYf

— NWSABRFC (@NWSABRFC) November 4, 2022

Anderson explained that, “Going into November, the weather pattern is not offering much in the way of significant precipitation to boost the Ohio River volume. Late-week forecast precipitation suggests no more than one-half inch over the Ohio Valley, and indications are that precipitation totals during the first half of November will be near to below normal.

The number of grain barges unloaded in New Orleans fell 30 percent from last week to 598, 25 percent lower than last year during the same week and 16 percent lower than the 3-year average, https://t.co/aLuXCbKlyX @USDA_AMS pic.twitter.com/tDswLGWGVf

— FarmPolicy (@FarmPolicy) November 4, 2022

“Such a trend indicates that the low-volume contribution from the Mississippi system’s largest provider will continue to lag during the balance of this year and into early 2023.”

For the week of November 1, the St. Louis barge spot rate (GTR table 9) fell 9 percent from last week to $80.12 per ton, 24 percent lower than its peak the week of October 11, but 397 percent higher than last year, https://t.co/aLuXCbKlyX @USDA_AMS pic.twitter.com/53HIY8e07Y

— FarmPolicy (@FarmPolicy) November 4, 2022

Meanwhile, Bloomberg News reported today that, “China’s exports and imports both unexpectedly fell for the first time in more than two years, with rising risks of a recession causing overseas consumers to buy less and domestic problems such as Covid Zero controls and a housing slump hitting demand at home.”

“The decline in imports was widespread, with Chinese purchases from Australia, the US, Japan, South Korea and Taiwan all down. China’s commodities imports broadly weakened in October as a slowing economy constrained shipments of items from natural gas to copper and soybeans.”

The Bloomberg article added that, “Covid outbreaks and stringent control measures at home are another major source of concern. Mobility restrictions aside, the nation’s unswerving commitment to the Covid Zero strategy is dashing hopes of any quick improvement in the economic situation, promoting Chinese households to save at a record pace and cut back on spending.”

And Reuters writer Naveen Thukral reported today that, “Chicago soybeans futures slid on Monday, dropping from previous session’s six-week high, after China denied it was considering easing its zero-COVID policy amid declining purchases by the world’s top importer.”

Thukral pointed out that, “China’s soybean imports in October fell 19% to 4.14 million tonnes from a year earlier, according to Reuters calculations based on customs data released on Monday, as it curbed purchases amid high global prices and poor crush margins.

“Soybean imports by the world’s top buyer of the oilseed for the first 10 months of the year were at 73.18 million tonnes, down 7.4% compared with last year, data from the General Administration of Customs showed.

“Soybean planting in Argentina’s core farm belt region is far behind last year’s pace due to a lack of rain, the Rosario grains exchange said in a report on Friday, a concern for farmers in the world’s top exporter of soy oil and meal.”

Nonetheless, U.S. agricultural exports in Fiscal Year 2022 set a new record of $196.4 billion, up $24.7 billion, or 14%, from the previous record in Fiscal Year 2021 (related tweets below):

"It's Official. Fiscal Year 2022 Ag. Exports Were Record High," https://t.co/V3fcQT4AwS (MP3- 1 minute). @USDA Radio. pic.twitter.com/t5AdANfEDv

— FarmPolicy (@FarmPolicy) November 6, 2022