The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

Farmland Values, Production Costs in Focus, No Agreement on Black Sea Export Deal, While Biden and Xi Meet

Linda Qiu reported in today’s New York Times that, “Joel Gindo thought he could finally own and operate the farm of his dreams when a neighbor put up 160 acres of cropland for sale in Brookings County, S.D., two years ago. Five thousand or six thousand dollars an acre should do the trick, Mr. Gindo estimated.

“But at auction, Mr. Gindo watched helplessly as the price continued to climb until it hit $11,000 an acre, double what he had budgeted for.”

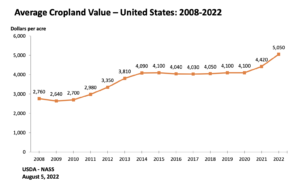

The Times article noted that, “What is happening in South Dakota is playing out in farming communities across the nation as the value of farmland soars, hitting record highs this year and often pricing out small or beginning farmers. In the state, farmland values surged by 18.7 percent from 2021 to 2022, one of the highest increases in the country, according to the most recent figures from the Agriculture Department. Nationwide, values increased by 12.4 percent and reached $3,800 an acre, the highest on record since 1970, with cropland at $5,050 an acre and pastureland at $1,650 an acre.”

Qiu pointed out that, “A series of economic forces — high prices for commodity crops like corn, soybeans and wheat; a robust housing market; low interest rates until recently; and an abundance of government subsidies — have converged to create a ‘perfect storm’ for farmland values, said Jason Henderson, a dean at the College of Agriculture at Purdue University and a former official at the Federal Reserve Bank of Kansas City.

“As a result, small farmers like Mr. Gindo are now going up against deep-pocketed investors, including private equity firms and real estate developers, prompting some experts to warn of far-reaching consequences for the farming sector.”

The Times article added that, “Economists and lenders said farmland values appeared to have plateaued in recent months, as the Federal Reserve raised interest rates and the cost of fertilizer and diesel soared. But with high commodity prices forecast for next year, some believe values will remain high.”

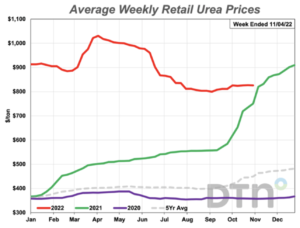

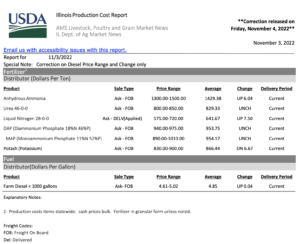

With respect to fertilizer prices, DTN writer Russ Quinn reported last week that, “The average retail price of most fertilizers continues to trend downward, according to retail fertilizer prices tracked by DTN for the end of October and early November 2022.”

However, University of Illinois agricultural economist Gary Schnitkey noted last week that, “Continued volatile prices should be expected.”

And regarding diesel prices, Clifford Krauss reported in Friday’s New York Times that, “Gasoline prices have dropped as much as a dollar a gallon since early summer, easing a financial strain on many people. But the price of diesel, the fuel that moves trucks, trains, barges, tractors and construction equipment, has remained stubbornly high, helping to prop up the prices of many goods and services.

“On Thursday, a gallon of diesel fuel in the United States cost $5.362 on average, according to AAA. That was down from a record of $5.816 in June but well above the $3.642 it cost a year ago. (A gallon of regular gasoline now averages $3.803.)”

Krauss explained that, “Diesel inventories are always a bit low in the spring and fall, during agricultural planting and harvesting seasons, but this fall supplies are at their lowest level since 1982, when the government began reporting data on the fuel.”

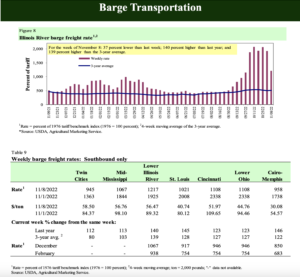

And in a closer look at barge transportation costs, Thursday’s weekly Grain Transportation report from the USDA’s Agricultural Marketing Service indicated that, “For the week of November 8, the St. Louis spot rate fell 49 percent from last week to $40.74 per ton. This is the lowest rate since the week of September 20 (when the rate was $38.10 per ton) and 62 percent lower than the all-time record high of $105.85 per ton the week of October 11. The rate is still 145 percent higher than the same week last year and 128 percent higher than the 3-year average.”

“The St. Louis 1-month rate fell 12 percent from last week to $36.58, its lowest since September 13. The St. Louis 3-month rate held steady from last week at $30.09 per ton. Although closures and dredging operations still disrupt the Mississippi River System (MRS) daily, recent rainfall has helped stabilize portions of the system. The improved conditions have allowed empty barges to move a little more freely. Forecast models indicate rain that will help the MRS water levels rise near Cairo, IL, and Memphis, TN, in the next few weeks, which will further stabilize the MRS.”

Elsewhere, Reuters News reported late last week that, “Russia said on Saturday there was no agreement yet to extend a deal allowing Ukraine to export grain via the Black Sea, repeating its insistence on unhindered access to world markets for its own food and fertiliser exports.

“Deputy Foreign Minster Sergei Vershinin was quoted by state news agency TASS as saying talks with U.N. officials in Geneva on Friday had been useful and detailed but the issue of renewing the deal – which expires in one week – had yet to be resolved.”

Meanwhile, Reuters writers Nandita Bose and Stanley Widianto reported today that, “Chinese leader Xi Jinping and U.S. President Joe Biden met on Monday for long-awaited talks that come as relations between their countries are at their lowest in decades, marred by disagreements over a host of issues from Taiwan to trade.

“The two, holding their first in-person talks since Biden became president, met on the Indonesian island of Bali ahead of a Group of 20 (G20) summit on Tuesday that is set to be fraught with tension over Russia’s invasion of Ukraine.”

Bloomberg writers Josh Wingrove and Justin Sink reported today that, “‘We share responsibility in my view to show that China and the United States can manage our differences, prevent competition from becoming anything ever near a conflict, and to find ways to work together on urgent global issues that require our mutual cooperation,’ Biden said at the start of the meeting.

“‘The world expects, I believe, China and the United States to play key roles in addressing global challenges, from climate changes to food insecurity, and for us to be able to work together,’ Biden added.“

BREAKING: Joe Biden and Xi Jinping meet ahead of the G-20 summit in Bali, the first in-person talks between the leaders of the US and China since before the Covid-19 pandemic https://t.co/5LMD7NXTK1 pic.twitter.com/6pgU5rKXHY

— Bloomberg Asia (@BloombergAsia) November 14, 2022

Bloomberg News reported yesterday that, “Agriculture and the industries it feeds have seen some of the wildest impacts from China’s virus restrictions.

“Edible oil imports have halved from a year ago as demand from restaurants and caterers has collapsed. Cotton purchases are down by about a fifth as Covid Zero hammers textile makers and the government is expecting a further reduction in demand.”

Reuters writer Dominique Patton reported today that, “China is set to increase pork imports in the coming months, industry participants said, after losses for farmers last year in the world’s top pork producer caused a reduction in hog output that appears larger than official data suggests.”