As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

USDA Sees More Corn, Wheat Acres and Less Soybeans in 2023/24 Crop Year

Earlier this week, Reuters writer Julie Ingwersen reported that, “The USDA on Monday released unofficial annual ‘baseline’ forecasts projecting that U.S. farmers are likely to expand plantings of corn and wheat for the upcoming 2023/24 marketing year, while reducing seedings of soybeans.”

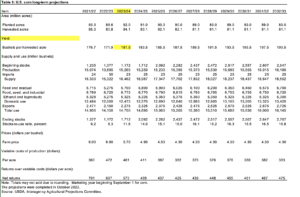

Dow Jones writer Kirk Maltais reported yesterday that, “Early indicators of what next year’s crop may look like are already giving traders the sense that U.S. crop sizes may bounce back next year, with the USDA’s Early Baseline’s report released late Monday showing 2023 corn acreage at 92 million acres with a yield of 181.5 bushels per acre, and soybean acreage at 87 million acres at 52 bushels per acre.”

And Reuters columnist Karen Braun indicated today that, “While analysts await the U.S. Department of Agriculture’s updated view on the 2022 corn and soybean crops, the 2023 discussion can already begin as the agency this week also offered its first glimpse into next season.

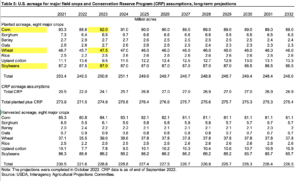

“USDA will publish its monthly supply and demand reports on Wednesday at noon EST (1700 GMT). Tables from its annual long-term baseline projections, including the first unofficial crack at 2023-24, were released on Monday.”

Braun noted that, “USDA set 2023 U.S. corn plantings at 92 million acres, soybeans at 87 million and wheat at 47.5 million, compared with 88.6 million, 87.5 million and 45.7 million, respectively, in 2022.”

Braun added that, “Focus will soon shift to 2023, and USDA’s corn trend yield of 181.5 bpa could already be labeled as controversial. Last year, the agency’s 2022 trend started at an unprecedented 181, but it was amended to 177 by the first official outlook in May because planting was slow.

“The record yield is 176.7 from 2021, so yet again, yield north of 180 remains questionable for a trend.

“USDA’s trend yields are based on a model, so the methodology is consistent year to year. Final corn yield has not beat USDA’s initial trend since 2018, and although there have been obvious weather problems ever since, it is fair to wonder whether the model’s parameters are still reasonable.”

A news release from USDA explained that, “These projections use the October 12, 2022, World Agricultural Supply and Demand Estimates (WASDE) report as the starting point.”

The release added that, “These projections, commonly referred to as the ‘USDA Baseline,’ assume that current laws affecting federal spending and revenues remain in place throughout the projection period, and do not attempt to predict global policy or political outcomes, abnormal weather events, or other external shocks that could affect market outcomes. Instead, they reflect USDA’s assessment of how markets would evolve under current conditions, existing laws, and normal weather patterns. Rather than serving as a prediction of the future, they are intended to serve as a neutral benchmark for measuring the effects of proposed legislation or external developments that could have enduring effects on agricultural markets.”