As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

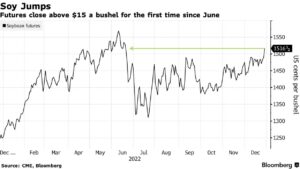

China Demand, Argentina Weather Impacting Soybean Prices, Recent Cold Spell Causes Winter-Kill Worries in Wheat

Bloomberg writers Tatiana Freitas and Megan Durisin reported yesterday that, “Soybean futures jumped to the highest in six months on expectations for greater demand from China and as dry conditions in parts of South America threaten supply. Winter wheat extended gains amid concerns of potential crop damage caused by freezing weather in the US.

“China, the world’s largest soybean buyer, is moving to unwind coronavirus measures on travelers from early January, putting it on track to emerge from three years of self-imposed global isolation. That’s set to buoy demand for crops.

“Meanwhile, increasing drought stress is rebuilding across most of Argentina’s corn and soy growing areas. Only limited rainfall is expected this week, according to a Maxar Technologies report.”

Freitas and Durisin added that, “While the severe US cold is easing, with above normal temperatures expected in the next 15 days, recent winter-kill caused ‘significant damage‘ to wheat across the central Plains and west central Midwest, said Donald Keeney, senior meteorologist at Maxar.”

Also yesterday, Dow Jones writer Dan Molinski reported that, “Wheat Wrecked: ‘The cold weather could have produced some Winterkill in US production areas to make a small crop even smaller. Temperatures were very cold and blizzard conditions were reported farther north due to high winds blowing the snow and probably the ground into the atmosphere,’ said Jack Scoville at Price Futures.”

Temperature Anomaly, Dec. 18th to Dec. 24th, https://t.co/vsAMXrnTEe pic.twitter.com/67hW7QL7Da

— FarmPolicy (@FarmPolicy) December 28, 2022

The Dow Jones article added that, “Jumping Soybeans: ‘Beans were up from the get-go, supported by talk of lower Argentine crop estimates that pushed meal values up,’ said Marex Capital in a note.”

Meanwhile, Reuters News reported today that, “Soybean futures continue to find support from South American weather with a lack of rainfall in key growing areas of Argentina threatening the crop.”

The Reuters article pointed out that, “The relaxing of health restrictions in China has extended to food imports, as checks have been lifted on imported chilled and frozen foods, beginning Jan. 8.

“However, there is caution in global markets about the short-term impact of China’s COVID policy shift, with a surge in infections straining hospitals and prompting some countries to consider new rules for Chinese visitors.

“Wheat has rallied in recent sessions as extreme cold weather gripped the United States, threatening to hurt winter wheat crops already weakened by drought.”

In more detailed reporting regarding China, Christian Shepherd, Samuel Oakford, Stefanie Le and Vic Chiang reported on the front page of today’s Washington Post that, “Emergency departments are overflowing, with patients sleeping in hallways until they can be evaluated or taken to a hospital room. In at least one hospital, half of doctors and nurses were absent because they had tested positive for covid.

“These and other alarming scenes in China’s medical facilities have been captured in videos and photographs posted to social media during the past two weeks. They offer a glimpse of the toll a huge coronavirus wave is wreaking — and undercut Beijing’s claim that the government is in control.

“The full extent of the outbreak is unclear. The government’s sudden easing of coronavirus restrictions in early December came as infections were already surging. Officials soon stopped reporting asymptomatic cases, leaving the public to rely on social media to understand what was happening.”

The Post article added that, “Given China’s strict censorship, the content is only a snapshot of what’s happening nationwide. But it shows that many communities are struggling to cope with the massive number of patients infected with covid.”

Elsewhere, a FarmPolicyNews update yesterday took a closer look at U.S. production costs, with a focus on fertilizer and fuel prices.