The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

WSJ: U.S. Farm Belt Booming; Farmland Values Climb

Jesse Newman and Jacob Bunge reported in today’s Wall Street Journal that, “High prices for crops and livestock are fueling a boom in the U.S. Farm Belt, making farmers, ranchers and agricultural companies rare winners as the broader American economy softens.

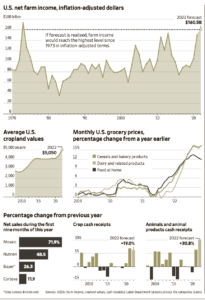

“U.S. net farm income is expected to surge to $160.5 billion this year, boosted by increased prices for farm goods ranging from wheat to milk, according to a key U.S. Department of Agriculture forecast in December.

If realized, farm income would reach the highest level since 1973 in inflation-adjusted dollars, marking a sharp recovery from an agricultural recession that battered farmers and their suppliers during the past decade.

“U.S. grain producers have benefited this year as prices for crops including corn and wheat soared following Russia’s February invasion of Ukraine, a major breadbasket nation. Poor weather in some growing areas also helped lift crop markets, and cattle ranchers have commanded higher prices for their animals as the U.S. herd shrank due to rising costs for feed and other goods.”

Newman and Bunge pointed out that, “Broader economic struggles could eventually ripple out to farmers, if demand for agricultural commodities falters as farmers’ expenses rise. Climbing interest rates also make borrowing for purchases such as land and equipment more costly, potentially constraining future buying.

“Higher incomes for U.S. farmers have prompted a windfall for agricultural companies selling seeds, fertilizer and equipment, and have helped push land prices to new heights.”

Today’s article added that, “Farmers have plowed some of their proceeds into land. Average U.S. cropland values rose to a record $5,050 an acre this year, according to USDA data, a 14% increase from 2021. Farmland values in Iowa, a key agricultural state, hit more than $11,400 an acre, an all-time high, according to Iowa State University.

“Farmers have grappled with higher costs for fertilizer, pesticides and machinery, as agribusiness giants have cited their own growing expenses as a reason to raise prices. Production expenses from feed to fuel are expected to rise 19% this year, the USDA said.”

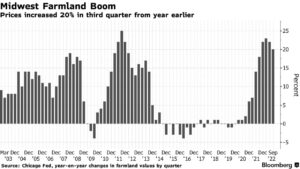

And yesterday, Bloomberg writer Michael Hirtzer reported that, “Farmland prices in the Midwest, the nation’s breadbasket, jumped 20% just in the third quarter from a year earlier — bucking a downturn in the residential real estate market, according to data from the Federal Reserve Bank of Chicago and the National Association of Realtors. That was the eleventh consecutive quarter of gains, the longest streak since 2014.”

Hirtzer explained that, “More demand for farmland coincides with pandemic-induced shifts in population. The number of people living in non-metro counties rose 0.3% in the 12 months ended in July 2021, the first time the growth in rural population outpaced that of urban areas since the mid-1990s, according to USDA.”

The Bloomberg article cautioned that, “To be sure, rising rates and a potential US recession next year could still hit the farmland market. Prices for grade-A plots in Illinois could decline between 2% and 5% next year, according to Luke Worrell, a farmland broker in the state’s town of Jacksonville.

“‘Between decreasing returns and higher interest rates, you’re hitting your top two buyers of farmland. It’s a one-two punch,’ Worrell said in an interview. ‘We’ve had a wild ride, but we’d be naive to think it will last forever. We have to prepare for a little softening.'”

Hirtzer added that, “Interest from outside investors is also on the rise. Farmland is considered a great hedge against inflation because the commodities it produces usually gain in value when overall prices rise.

“‘Land is a real asset,’ Gary Schnitkey, professor at the University of Illinois, said at a conference in Champaign. ‘Do you want to own a piece of dirt or cryptocurrency? It’s a good way to diversify your asset pool.'”