As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

ERS: “Wholesale Table-Egg Prices Peaked in December”

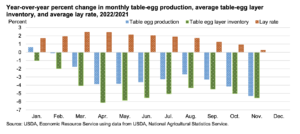

In its monthly Livestock, Dairy, and Poultry Outlook report yesterday, the USDA’s Economic Research Service (ERS) indicated that, “Table-egg production was estimated at 635.0 million dozen in November. This represents a 5.3- percent decrease from last November. The average size of the table-egg flock supporting this production was estimated at 308.8 million layers, down 5.5 percent from last year.”

ERS noted that, “The December 1 table-egg layer flock was estimated at 308.3 million layers. This is only 0.8 million layers lower than the November 1 estimate, despite 2.72 million layers being lost to HPAI [Highly Pathogenic Avian Influenza] during November, implying that producers are working on building back their egg-laying flocks. However, another 3.9 million layers were lost to the same disease through December. The total number of table-egg layers lost to HPAI in 2022 increased to 43.3 million birds.”

ERS explained that,

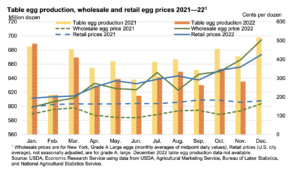

December wholesale egg prices (large, grade A, New York) were the highest ever recorded.

“December prices averaged 503.0 cents per dozen, more than 207-percent higher than December 2021. The daily average prices peaked at 540 cents per dozen during the week leading to Christmas. Since then, following the post-holiday expectations, prices have been declining. As of January 11, at 412 cents per dozen, daily average price was more than one dollar lower than the highest daily price in late December.

“Wholesale egg prices (large, grade A, New York) averaged 282.4 cents per dozen in 2022, 138.4 percent higher than last year. Although there were some monthly variations in price direction, prices in 2022 generally followed an upward trend. December 2022 wholesale prices were 247 percent higher than January 2022.

“Retail egg prices (grade A, large) averaged 285.7 cents per dozen in 2022, 70.7 percent up from the 2021 average. The December retail egg prices were 425 cents per dozen, 120.3 percent higher than the prices at the beginning of the year. Retail eggs prices are typically less volatile than wholesale prices, but also tend to lag the wholesale prices.”

Yesterday’s ERS report added that, “While the table-egg production was affected by repeated cases of HPAI, the demand for eggs remained strong throughout the year, adding additional pressure to prices. This is partially because eggs are a staple product with few substitutes. Moreover, for much of the year, they represented the lowest cost protein alternative. Per capita egg disappearance for 2022 is forecast at 277.5 eggs per person, 3 eggs fewer than last year.

“While wholesale prices are expected to decline further, they will likely stay elevated as producers rebuild their egg-laying flock capacity. Based on higher-than-expected December average prices and lower production expectations, the quarterly wholesale egg price forecasts for 2023 are increased as follows: first-quarter to 285 cents, second-quarter to 195 cents, third quarter to 165 cents, and fourth quarter to 175 cents per dozen. This brings the 2023 average forecast prices to 205 cents per dozen, almost 30 percent down from the 2022 average price.”