As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

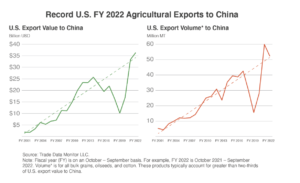

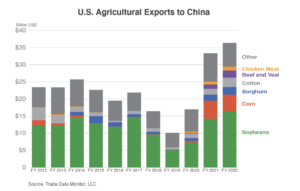

FAS: Record U.S. FY 2022 Agricultural Exports to China

In a report this month from USDA’s Foreign Agricultural Service (FAS), “Record U.S. FY 2022 Agricultural Exports to China,” Graham Soley indicated that, “U.S. agricultural exports to China in fiscal year (FY) 2022 were $36.4 billion and surpassed the previous year’s record with China as the largest export market for the second consecutive year. Significantly higher agricultural prices and resilient demand helped drive exports above the previous year’s record despite lower volumes for most products.

“Robust shipments follow a precipitous drop in U.S. exports to China and the conclusion of the Phase One Agreement. U.S. exports have returned to trend growth experienced since the People’s Republic of China’s (PRC) accession to the World Trade Organization (WTO) and in the last 2 years the United States has witnessed record export values to China for soybeans, corn, beef, chicken meat, tree nuts, and sorghum. Cotton exports to China have also rebounded, propelled by strong demand. All these products are major contributors to the U.S. farm economy.”

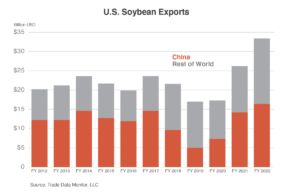

FAS stated that, “Soybeans accounted for nearly one-half of U.S. agricultural exports to China at a record $16.4 billion, surpassing the previous year’s record by more than $2.2 billion. China is the world’s largest soybean importer, accounting for nearly 60 percent of global trade and half of U.S. soybean export value.

“Greater export value is attributable to higher prices. Average unit values climbed 24 percent this year to $622/ton, driven by a severe drought in South America, war in Ukraine, and a palm oil export ban in Indonesia. China is the largest processor of soybeans to feed its domestic livestock industries. The country’s livestock industries are supported by the world’s largest population, second-largest economy, and a rising middle class, all driving greater demand for meat.”

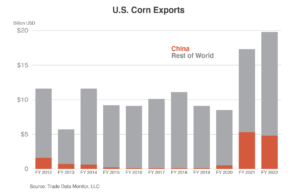

The report also noted that, “China has boosted its corn supplies with imports mostly from the United States. China is also a major buyer of other U.S. feedstuffs including sorghum and alfalfa hay.

“Like demand for soybeans, robust demand from pork and poultry sectors propelled higher volumes of feed grain imports.”

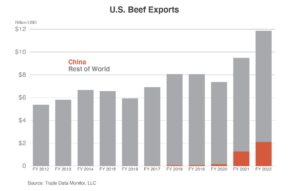

More narrowly regarding livestock, FAS pointed out that, “Beef and beef product export value was a record $2.1 billion, $800 million higher year-on-year. Beef consumption and import demand has exploded in China in the past decade, as total imports have grown from $155 million in FY 2012 to $17 billion in FY 2022. The implementation of the Phase One Agreement greatly expanded U.S. beef access in China, leading to explosive growth in shipments during the past 2 years.”

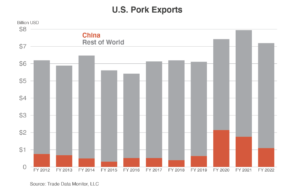

“U.S. pork and pork product exports to China reached $1.1 billion in FY 2022, down from the previous year but significantly above levels witnessed for the past decade. Export volumes fell in FY 2022 as China’s pork imports plunged due to recovery in domestic production from African swine fever.”

FAS added that, “China’s importance to U.S. farms and their profitability cannot be ignored. Despite major challenges including the COVID-19 pandemic and logistical disruptions to U.S. agricultural supply chains, the United States witnessed its second-consecutive record exports to China in FY 2022.

“China is forecast as the largest U.S. export market in FY 2023 for the third consecutive year at $34.0 billion.”