Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

FAS Report Highlights China’s Corn Imports From Brazil; While Rice Prices Climb

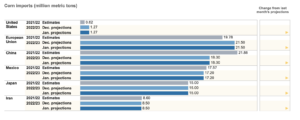

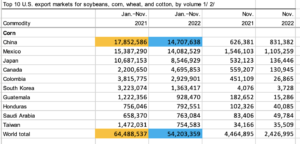

The USDA’s Foreign Agricultural Service (FAS) indicated in a report this week, “China: Grain and Feed Update,” that, “Post forecasts MY2022/23 corn imports at 18 MMT, the same as USDA’s official estimate.

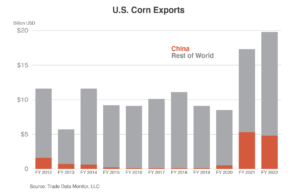

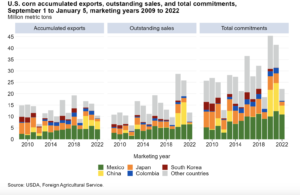

“China currently holds contracts for 3.7 MMT of U.S. corn for delivery in MY2022/23, 70 percent less than the same time last year. Customs data shows 600,000 MT of U.S. corn exported to China each month in both October and November, the lowest monthly volume in two years.”

FAS explained that,

With the arrival of the first vessel of Brazilian corn in early January 2023, China will likely turn to Brazil for a substantial amount of its corn imports.

“Brazil is projected to have 40-50 MMT corn export capacity in MY2022/23. China agreed to temporarily waive a key clause in the phytosanitary protocol re-signed with Brazil in May 2022, in part to reduce dependence on the United States and replace supplies cut off from Ukraine owing to Putin’s brutal war of aggression and the volatility surrounding the Black Sea Grain Initiative (BSGI). In October, China approved over 130 Brazilian facilities for export. Industry sources reported close to 2 MMT of Brazilian corn was planned to sail to China from November 4 2022. According to industry contacts, over 900,000 MT was loaded by mid-December and was en route with additional shipments expected in the first few months of 2023.

“Southern American corn is relatively lower priced compared with U.S. corn. New crop Brazilian corn is reportedly quoted at U.S.$400 (RMB 2,800) per MT after tariff (i.e., delivered duties paid or DDP) for January delivery and U.S.$371 (RMB 2,600) per MT for 3rd quarter 2023. While January 2023 arrival U.S. corn is quoted at U.S. $423 (RMB2,960) per MT DDP at Guangdong ports and U.S.$400 (RMB2,800) per MT DDP for June delivery.

“The war in Ukraine continues to disrupt trade from China’s other leading supplier, but the current resumption of the BSGI deal allowed China to continue to import Ukrainian corn, which is reportedly quoted at U.S.$379 (RMB 2,650) per MT for June delivery. Corn prices in southern Guangdong province for domestic corn shipped form the Northeast averaged U.S. $427 (RMB 2,990) per MT at the end of 2022.”

More broadly with respect to China, Financial Times writer Eleanor Olcott reported yesterday that, “The fight to get Chinese youngsters married and producing babies is moving from the family home into the political arena as the world’s most populous country enters a long-term and irreversible population decline.

“Last week, Chinese authorities announced that a long-anticipated turning point had finally been reached: the population officially shrank in 2022 for the first time in 60 years, losing 850,000 people as deaths outstripped births.”

The FT article noted that, “Rising youth unemployment, soaring prices for housing and education in major cities and the looming healthcare costs of caring for the ageing relatives who outnumber them have created a powerful disincentive for young Chinese to start families.”

Elsewhere, Reuters writer Gus Trompiz reported yesterday that, “Ukraine’s corn and wheat production is set to fall for a second year in 2023, with corn output not expected to exceed 18 million tonnes and wheat production 16 million tonnes as farmers reduce planting due to the war, a grain sector group said on Thursday.”

Ukraine’s agriculture minister said last month that 2022 corn production could fall to 22 million-23 million tonnes from 41.9 million in 2021.

In other developments, Bloomberg writer Patpicha Tanakasempipat reported yesterday that, “Rice prices are climbing, a sign that the food inflation shock that threw millions into poverty is still reverberating, even as the cost of wheat and other farm commodities has declined.”

And Bloomberg writer Eric Martin reported yesterday that, “The top senators on the committee that deals with trade urged President Joe Biden to pursue enforcement action against Canada and Mexico in areas where the nations aren’t complying with rules in their free-trade agreement especially around energy and agriculture policies.

“‘The Office of the United States Trade Representative must continue to pursue full implementation and, where necessary, robust enforcement’ of the US-Mexico-Canada Agreement, Ron Wyden and Mike Crapo, the leading Democrat and Republican on the Senate Finance Committee, wrote in a letter to the USTR Thursday seen by Bloomberg News. The pact’s ‘full potential remains unrealized,’ they said.”

Martin pointed out that, “On the long-running dairy issue with Canada, the US in December requested dispute-settlement consultations for a third time over Ottawa’s quotas that many American producers say shuts them out of the Canadian market, saying it has found more areas of “deep concern” and that the nation’s measures are inconsistent with its obligations under the trade pact. ”

“The senators also pushed the USTR for resolution on Mexico’s imposition of export tariffs on white corn, environmental, and digital-trade issues,” the Bloomberg article said.