As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

DTN: Nitrogen Fertilizer Prices Lower; Bloomberg: Relying on International Fertilizer Supplies, a Growing Concern

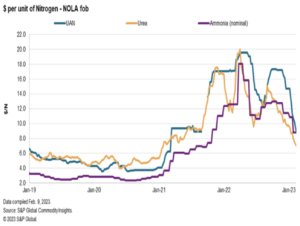

Logan Garcia, Market Reporter — at Fertecon, S and P Global Commodity Insights, reported last week at DTN that, “January began a reset across the nitrogen complex with anhydrous ammonia, urea and UAN fertilizer prices falling sharply to open 2023, a fall attributed mostly to a lack of demand across all products as well as further reductions in European natural gas prices last month.”

Anhydrous Ammonia and Henry Hub Natural Gas Price

— FarmPolicy (@FarmPolicy) February 16, 2023

from Thursday's farmdoc webinar. pic.twitter.com/kIg0g9pZjH

#Fertilizer Prices per Ton in #Illinois.

— FarmPolicy (@FarmPolicy) February 16, 2023

from Thursday's farmdoc webinar. pic.twitter.com/g1uPMl1M6Z

In related news, Financial Times writer David Sheppard reported last week that, “The price of European natural gas has fallen to its lowest level since the build-up to Russia’s full-scale invasion of Ukraine, boosting the EU and UK economies and delivering a blow to President Vladimir Putin’s war effort.”

“Helped by mild weather, ample storage and efforts to source alternative supplies, European gas prices have tumbled by as much as 85 per cent since August 2022, when big cuts in Russian supplies led to alarm about possible blackouts,” the FT article said.

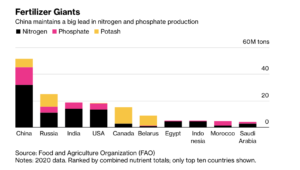

More broadly on the issue of fertilizer supply dependency, Bloomberg writers Alan Crawford, Frank Jomo, Elizabeth Elkin and Matthew Bristow reported yesterday that, “Yet alongside humanitarian considerations, it’s the realization that much of the world relies on just a few nations for most of its fertilizers — notably Russia, its ally Belarus and China — that’s ringing alarm bells in global capitals.

Just as semiconductors have become a lightning rod for geopolitical friction, so the race for fertilizers has alerted the US and its allies to a strategic dependency for an agricultural input that is a key determinant of food security.

The Bloomberg article added that, “That’s pushed fertilizers — and who controls them — to the forefront of the political agenda around the world: The US State Department is beefing up its expertise on fertilizers, presidents are tweeting about them, they’re featuring in election campaigns, and becoming the focus of tensions between countries as well as an unlikely currency of diplomacy. They’re also being pulled into the contest of narratives over who’s to blame for the fallout from Russia’s war on Ukraine.

“‘The role of fertilizer is as important as the role of seed in the country’s food security,’ said Udai Shanker Awasthi, managing director and chief executive officer of the Indian Farmers Fertiliser Cooperative, the country’s largest producer. ‘If your stomach is full then you can defend your house, you can defend your borders, you can defend your economy.'”

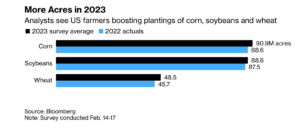

And with respect to planted acreage prospects, Bloomberg writer Sophie Caronello reported yesterday that, “The Russia-Ukraine conflict continues to shake grain and other crop markets globally. As such, traders will be focused on the US Department of Agriculture’s annual outlook forum, which starts Thursday.

“The USDA is expected to unveil fresh forecasts for the 2023-24 growing season, including for acreage. A Bloomberg survey shows analysts expect farmers to plant more corn, soybeans and wheat this year from a year ago.

“Even so, the agency earlier this month forecast that overall farm income would fall by 16% in 2023 after two consecutive years of record profits as inflation for many foods has moderated. Wheat futures in Chicago in particular have retreated after a turbulent year, despite lingering concerns that Russia will intensify its war.”