Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

FAS Reports Highlight Brazil and Argentina Crop Production and Exports

The USDA’s Foreign Agricultural Service (FAS) indicated in a report this week, “Brazil: Grain and Feed Update,” that, “Brazilian agricultural production is expected to continue growing in 2023, maintaining the trend of producing another record-breaking grain harvest. The beginning of the year brings the sowing of second and third season crops and beginning in April, the planting of winter crops in Brazil. Currently, farmers are focused on the weather behaviors and how they may affect the productivity of the summer crops, whose sowing was mostly completed in December and now await maturity.”

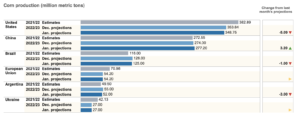

With respect to corn production, FAS noted that, “Post slightly adjusts its production forecast down for MY 2022/2023 to 125.5 MMT from its previous 126 MMT based on adverse weather conditions that may affect the sowing of second-season corn crops in the south of Brazil, with regions in the south of the country experiencing droughts, while others in the southeast, up to Mato Grosso suffered with excess water. Post maintained its corn production estimate for MY 2021/2022 at 116 MMT from the previous forecast, in line with the expected record growth experienced by the country in recent years.”

In a closer look at corn exports, the FAS report stated that, “Post maintains its forecast for corn exports for MY 2022/2023 (March 2023 – February 2024) to 47 MMT, based on the continued interest in corn in international markets. Post increased its estimate for corn exports for MY 2021/2022 from 44.5 MMT to 46.5 MMT, based on the rise in Brazilian production and the heated international demand, which has seen exports of Brazilian corn to different markets, including China.

“After signing an export protocol in the middle of 2022, the Asian country started Importing Brazilian corn only in November, but at a sufficient rate to make it the eleventh importer.

Some analysts believe that China can reach 18 million tons of corn imported from Brazil in 2023, which would severely impact trade with the United States.

“According to the National Association of Grain Exporters (ANEC), Brazil exported a record 44.7 MT of corn in 2022, against 20.6 MT in 2021. Furthermore, the Brazilian National Foreign Trade Secretariat (SECEX) forecasts that the country has lined-up 5.4 million tons of exports for January 2023. This represents a 143 percent increase from the previous year.”

With respect to wheat exports, the FAS report stated that, “With a projected record harvest, added to favorable prices in international markets, Brazil is expected to increase its exports. As such, Post raises its forecast for wheat export in MY 2022/2023 to 3.5 MMT on a wheat grain equivalent basis (WGE), up 6 percent from its previous estimate.”

And in a separate report this week, “Argentina: Oilseeds and Products Update,” FAS indicated that, “Dry weather and high temperatures in the last months of 2022 have damaged the Marketing Year (MY) 2022/23 Argentine soybean crop, particularly affecting first crop soybeans within a 125 kilometer radius of Rosario, Santa Fe Province. Recent rains will buy time for second crop soybeans, but better-than- average weather through February is needed for a substantial recovery. Post lowers its MY 2022/23 estimated production to 36 million metric tons (MMT), 9.5 MMT below the official USDA estimate.”

FAS added that, “Argentina exports (in processed and raw form) the vast majority of the oilseed crops it produces. Reductions in production will translate to lower export volumes.”

Meanwhile, Reuters writer Eliana Raszewski reported this week that, “Argentina will launch measures to help producers hit by a historic drought over its main agricultural region, Economy Minister Sergio Massa said on Tuesday, including a relief fund to tackle considerable losses to the country’s grains harvests.”

Elsewhere, Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s grain harvest may decrease again in 2023 to 49.5 million tonnes from around 51 million tonnes expected in 2022, Interfax Ukraine news agency quoted deputy economy minister Denys Kudyn as saying on Wednesday.”

In news highlighting U.S. production variables, Reuters writer Julie Ingwersen reported today that, “U.S. farmers expanded plantings of winter wheat by 11% from a year ago to an eight-year peak, encouraged by high prices tied to concerns over food supplies following Russia’s invasion of major wheat producer Ukraine, as well as relatively low input costs and expanded crop insurance programs.

“But even with the added acres, a multi-year drought that has gripped the key Plains wheat belt puts harvest prospects in doubt, especially in states like top producer Kansas and Oklahoma, the No. 3 winter wheat producer last year. An uptick in precipitation in recent days is helpful but won’t be enough to revive the crop, experts say.”

In more detailed reporting on China, Reuters writer Roberto Samora reported yesterday that, “Demand for beef in China is expected to rise as the country still has relatively low per capita consumption, Gilberto Tomazoni, chief executive of JBS SA , said on Wednesday during a business conference.”

“On Tuesday, the CEO of poultry and pork processor BRF , Miguel Gularte, said he was optimistic about China’s meat demand returning to normalcy after the Chinese New Year celebrations,” the Reuters article said.

And Chris Buckley and Amy Chang Chien reported on the front page of yesterday’s New York Times that, “When China abruptly abandoned ‘zero Covid,’ accelerating an onslaught of infections and deaths, many feared a prolonged tide rippling from cities into villages. Now, two months later, the worst seems to have passed, and the government is eager to shift attention to economic recovery.”

Nonetheless, the article pointed out that, “Even as Chinese medical officials signaled that infections have been falling, they have also warned that the country remains vulnerable to fresh outbreaks, especially in rural areas where medical services are much scarcer than in cities.”