President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Argentina Soybean, Corn Production Estimates Lowered, as “Country’s Key Agricultural Region Battles Ongoing Drought”

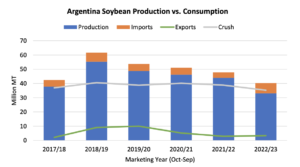

In its monthly Oilseeds: World Markets and Trade report yesterday, the USDA’s Foreign Agricultural Service (FAS) indicated that, “For the third straight month, 2022/23 Argentina soybean production is lowered as hot and dry weather continues to strain the crop in key growing regions.

“This month, production is down 8.0 million tons to a 14-year low of 33.0 million. Likewise, crush is forecast at the lowest level in over a decade.

Plummeting Argentina supplies and crush will have implications on global trade of soybeans, protein meal, and vegetable oils over the coming months.

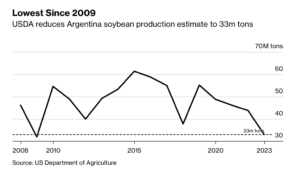

Also yesterday, Reuters writer Maximilian Heath reported that, “Argentina’s Rosario grains exchange sharply cut its forecast for the country’s 2022/23 soybean harvest on Wednesday, dropping it to the lowest estimated this century and warning of future cuts as the country’s key agricultural region battles an ongoing drought.

“The new estimates put the current cycle’s soy crop at 27 million tonnes, below the 34.5 million tonnes seen in last month’s forecast and under the 27.5 million tonnes harvested in the 2000/2001 season, when a separate exchange, the Buenos Aires grains exchange, began keeping records.”

And Bloomberg writer Michael Hirtzer reported yesterday that, “Argentina, the world’s top shipper of soymeal and soyoil, will harvest 33 million tons of the beans this year, the USDA said in its monthly supply and demand report Wednesday. That’s a decline of 20% from its February estimate and the smallest crop since 2009.”

World #Soybean Production pic.twitter.com/fJZasPmuUb

— FarmPolicy (@FarmPolicy) March 8, 2023

U.S. #Soybeans Supply and Demand pic.twitter.com/J6sCQHPAr2

— FarmPolicy (@FarmPolicy) March 8, 2023

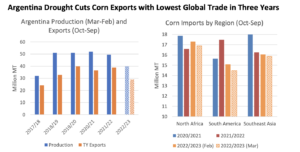

And with respect to corn, in its Grain: World Markets and Trade report yesterday, FAS stated that, “Argentina corn exports (Oct 2022 – Sep 2023) are forecast at 29.0 million tons, the lowest since 2017/18. This year’s production, like 2017/18, has been heavily impacted by drought, which is expected to reduce supplies available for export.

The cut comes at a difficult time for global corn supplies.

“At the start of the 2022/23 marketing year, U.S. exports were constrained by logistical problems and relatively uncompetitive prices. Since mid-January, U.S. price competitiveness has improved but export sales have been slow to respond. At the same time, export inspection data for January and February combined is about half of the average shipped during the same period in 2020/21 and 2021/22. As a result, the U.S. export forecast is trimmed by another 2.0 million tons this month. The renewal of the Black Sea Grain Initiative has yet to be renegotiated from its current March 18 expiration, leaving some uncertainty in the future of Ukraine’s grain exports.

“In stark contrast, Brazil is forecast to harvest a record crop of 125.0 million tons and export a record 52.0 million tons (Oct 2022 – Sep 2023). Though Brazil is expected to export large volumes between July and September after its safrinha harvest, ultimately, 2022/23 global trade is forecast down 2.6 million tons this month.”

World #Corn Production pic.twitter.com/rFh1NNcFtx

— FarmPolicy (@FarmPolicy) March 8, 2023

Reuters News reported yesterday that, “U.S. corn supplies will be bigger than previously thought as the country’s export program faces stiff competition from a massive crop in Brazil, the government said on Wednesday.

“Domestic end stocks of corn for the 2022/23 marketing year were pegged at 1.342 billion bushels, the U.S. Agriculture Department said in its monthly World Agricultural Supply and Demand Estimates report.

U.S. #Corn Supply and Demand pic.twitter.com/9K8kxv9CL4

— FarmPolicy (@FarmPolicy) March 8, 2023

“That compares with the government’s February outlook for 1.267 billion bushels.”