As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

FAPRI Baseline Update- Corn, Soybean Variables in Focus

The Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri released its latest baseline update for U.S. agricultural markets yesterday.

In part, the baseline update stated that, “Unfavorable weather, the Russian invasion of Ukraine, avian influenza and a host of other factors resulted in high commodity prices, high farm production costs and high consumer food price inflation in 2022. An assumed return to more normal conditions results in projected declines in commodity prices, farm income and food price inflation.”

“If weather conditions allow crop yields to return to trend-line levels in 2023, prices for corn, soybeans, wheat, cotton and many other crops are likely to fall. Over the next 10 years, average nominal prices are much lower than they have been in 2022/23, but they remain above the average of 2017/18 to 2021/22.”

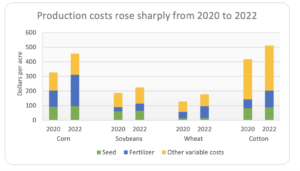

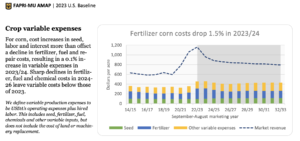

“Higher fertilizer, fuel and feed costs contributed to a very sharp increase in farm production expenses in 2022.

“A smaller increase is projected in 2023, and lower prices for some inputs result in a reduction in production costs in 2024 and 2025,” the report said.

With respect to corn acreage, the baseline pointed out that, “Corn area in 2023 is projected to increase to 92.2 million acres in response to projected favorable expected net returns relative to other crops despite many input prices remaining at elevated levels.”

As part of a larger discussion on soybean variables, the FAPRI update explained that, “U.S. soybean prices exceed $14 in 2022/23 as a result of drought- weakened U.S. production. Increased production contributes to lower prices in 2023/24. The futures markets in March are consistent with these projections. Reduced Argentina production in 2023 would tend to increase prices, but other factors have countered this effect.”

In a closer look at farm income, yesterday’s report indicated that, “Net cash income for the farm sector increased in 2022, despite a decline in government payments as both crop receipts and livestock receipts increased.

“Net cash income declines in 2023, as the reduction in government payments and the increase in production expenses combine with a decrease in cash receipts.”