The U.S. ag economy enters 2026 in a clear crop-sector recession, but the deeper crisis is one of confidence. High input costs, weak prices, policy uncertainty and eroding trust in…

“Weaker” Economic Rebound in China, as Brazil Looks to China for Farm Infrastructure Investment, U.S. Winter Wheat Conditions Updated

Financial Times writer Joe Leahy reported earlier this week that, “China’s economic rebound is weaker than expected as consumers emerge ‘stunned‘ from pandemic-led disruptions and a real estate meltdown last year, according to the head of AP Møller-Maersk.

“Vincent Clerc, the new chief executive of the world’s second-largest container shipping group, said, however, that trading volumes associated with the Chinese economy remained resilient with little sign of negative impact from US-led efforts to ‘decouple’ from China.

‘When we started the year, there was this hope that as China reopens after Covid we would see a really strong rebound,’ Clerc said in an interview in Beijing. ‘I think we’ve not seen it yet . . . The Chinese consumer is a bit more stunned by what’s happened and is not in a splurging mood right now.’

The FT article added that, “Profits at Chinese industrial groups slumped 22.9 per cent in January-February, official statistics showed on Monday, further underscoring concerns about the economy’s rebound from pandemic restrictions.”

Meanwhile, Reuters writer Dominique Patton reported yesterday that, “Brazil is courting fresh investment from top Chinese grains trader COFCO, as the company plays a growing role in the South American nation’s booming farm exports, Agriculture Minister Carlos Favaro told Reuters on Monday.

“Favaro proposed investing in Brazilian railways and waterways to COFCO’s board during a meeting in Beijing last week, he said, as well as financing the restoration of farmland.”

Patton explained that, “But Brazil is also a new supplier of corn to China. COFCO was a key player in opening up the market late last year to Brazilian supplies, said Favaro, and behind the purchase of all 1.5 million tonnes of corn shipped to China so far.”

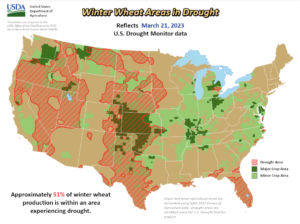

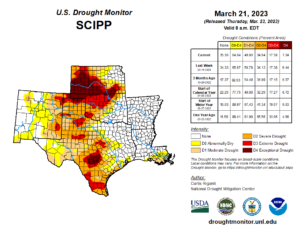

Elsewhere, Reuters writer Julie Ingwersen reported yesterday that, “The U.S. Department of Agriculture’s (USDA) National Agricultural Statistics Service in a weekly crop report on Monday rated 19% of the winter wheat in top producer Kansas in ‘good-to-excellent’ condition, steady with the previous week.

“U.S. farmers planted 36.950 million acres (14.953 million hectares) of winter wheat for 2023, the most in eight years, the USDA said on Jan. 12. But dry conditions have threatened crop prospects in portions of the southern Plains.

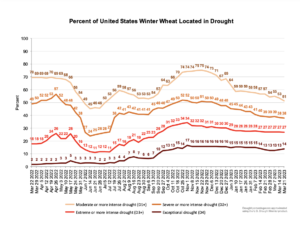

“Approximately 51% of U.S. winter wheat is produced in an area currently experiencing drought, the USDA said last week, a reduction from 53% a week earlier and down from 69% as the year began.”

The Reuters article noted that, “For Oklahoma, the USDA rated 34% of the winter wheat crop in ‘good-to-excellent’ condition, up from 29% a week ago.

“For Texas, the USDA on Monday rated 18% of the crop as ‘good-to-excellent,’ a drop from 23% the previous week, while 48% was rated as poor to very poor, compared with 44% previously.”

“For Colorado, the USDA rated 28% of the winter wheat as ‘good-to-excellent,’ down from 36% the previous week.”

Reuters writer Mei Mei Chu reported today that, “Continued uncertainties on the fate of the Black Sea corridor for grain shipments, along with a somewhat dry outlook for Kansas, helped support wheat prices, [commodities research firm] Hightower said.”