As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Fertilizer Prices “Well Below Year-Ago Levels”

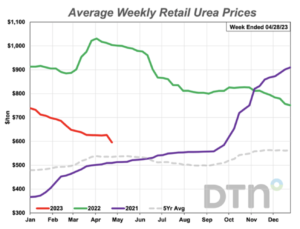

DTN writer Russ Quinn reported last week that, “Most average retail fertilizer prices continued to be down from the previous month in the fourth week of April 2023, according to sellers surveyed by DTN.

“Prices for seven of the eight major fertilizers were lower compared to last month. DTN designates a significant move as anything 5% or more.

“After a week off, anhydrous returned to lead fertilizer prices lower. The nitrogen fertilizer was 10% lower compared to last month and had an average price of $928 per ton.”

Quinn noted that, “Urea was 5% less expensive compared to last month…[and]…one fertilizer, meanwhile, was slightly higher compared to last month. DAP had an average price of $827/ton.”

The DTN article added that, “All fertilizers are now lower by double digits compared to one year ago. 10-34-0 is 18% less expensive, DAP is 21% lower, MAP is 26% less expensive, potash is 29% lower, UAN32 is 31% less expensive, UAN28 is 33% lower, anhydrous is 40% less expensive and urea is 41% lower compared to a year prior.”

#Illinois Production Cost Report pic.twitter.com/KPkiw3LRal

— FarmPolicy (@FarmPolicy) May 6, 2023

#Iowa Production Cost Summary pic.twitter.com/jOo7tmK79M

— FarmPolicy (@FarmPolicy) May 6, 2023

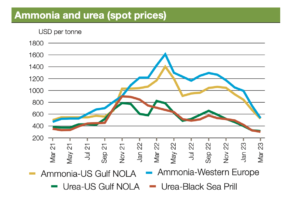

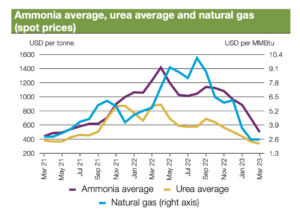

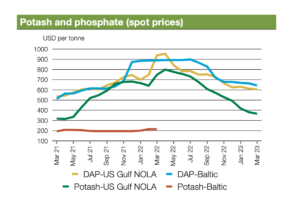

Meanwhile, in its May Market Monitor report, the Agricultural Market Information System (AMIS) indicated that, “Price trends of main fertilizer products varied across regions in April. Strong demand in the northern hemisphere earlier in the month put an upward pressure on prices, particularly in the United States, while prices softened in other parts of the world. International markets remain generally well-supplied, helping keep prices well below year-ago levels.”

The Monitor indicated that, “Natural gas prices decreased in April due to reduced demand following the end of the heating season in the Northern Hemisphere and ample supplies. Inventories are well- stocked.

“Ammonia prices dropped substantially again in April across major markets due generally to low demand in world markets and lower energy prices. It remains uncertain how much further prices will fall, leading buyers to delay purchases. The storage facilities of producers in the Middle East are gradually filling as movement of product remains slow.”

“DAP prices increased in April in the United States while they generally decreased in other markets,” the Monitor said.

Elsewhere, in its weekly Grain Transportation Report on Thursday, the USDA’s Agricultural Marketing Service pointed out that, “For the week ending May 1, the U.S. average diesel fuel price decreased 5.9 cents from the previous week to $4.018 per gallon, 149.1 cents below the same week last year.”

Weekly #diesel fuel⛽️ prices, U.S. average, https://t.co/BDQGREvd3S pic.twitter.com/K1Cj9nL3zt

— FarmPolicy (@FarmPolicy) May 4, 2023

And Financial Times writer Myles McCormick reported last week that, “As growth slows in the US economy, warning signs in the energy markets are adding to investor fears that a recession is looming over the world’s biggest fuel guzzler.

“Demand for diesel, the lifeblood of the industrial economy, has fallen sharply in recent months as freight markets cool. And there are indications that petrol demand may be beginning to wane as motorists look to dial back spending.”

The FT article pointed out that, “Demand for distillates including diesel, which is used to power the trucks and trains that transport goods around the country, was about 6 per cent lower in the first quarter of 2023 compared with the same period last year as a trade slowdown bites, according to government data crunched by S&P Global Commodity Insights.”