President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

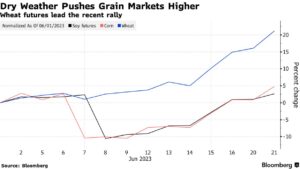

Corn “Has Risen More Than 10% in the Last Four Trading Days,” Declining Crop Condition Ratings- Dry Weather

Bloomberg writer Tarso Veloso Ribeiro reported yesterday that, “Corn prices are surging as persistent dry weather in the US, the world’s biggest producer, has dragged crop conditions to the worst levels in three decades.

Futures in Chicago have jumped more than 12% over four sessions, the biggest such gain since early March 2022, when the outbreak of the war in Ukraine rattled grain markets.

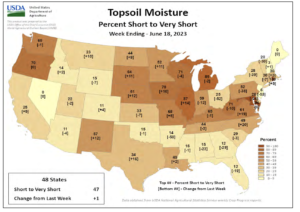

“Heat and drought have shriveled the potential for yields in critical growing areas of the Midwest. The portion of the US corn crop rated good to excellent has dropped to 55%, the lowest for this time of year since 1992.”

“Conditions have been particularly poor in Illinois, the No. 2 US producer. Only 36% of the state’s crop was rated good to excellent for the week ending June 18, down 12 percentage points from a week earlier,” the Bloomberg article said.

#Illinois #Corn Condition pic.twitter.com/kSIcsgIR1M

— FarmPolicy (@FarmPolicy) June 20, 2023

Ribeiro added that, “There’s little sign of relief for crops in the forecast.

“Dryness and stress will remain significant across southern, central and northeastern areas of the Midwest corn and soybean belt, forecaster Maxar Technologies Inc. said in a report dated June 20.”

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Grain futures reacted to the USDA reporting big drops in the amount of planted corn, soybeans, and wheat in good or excellent condition.”

“The size of the drops surprised traders,” Maltais said.

The Dow Jones article added that, “With drought conditions all over the U.S. Corn Belt, grain traders are piling in risk premium – with concerns that the dry conditions will adversely impact crop yields.”

Reuters writer Matthew Chye reported today that, “Chicago corn futures edged lower on Thursday, as traders locked in profits after a recent rally over concerns about dry weather conditions in key areas of the U.S. Midwest.”

Elsewhere, Reuters writer Rajendra Jadhav reported yesterday that, “India’s wheat harvest in 2023 is at least 10% lower than the government’s estimate, a leading trade body told Reuters on Wednesday, amid a sharp rise in local prices during the past two months.

“Lower wheat production for a second straight year could complicate New Delhi’s efforts to keep a lid on prices of the staple and overall food inflation, a major concern amid forecasts of an El Nino weather pattern.”

And Bloomberg writer Michael Hirtzer reported yesterday that, “American pig farmers are losing so much money that some may soon start selling the corn they would normally use to feed animals, according to the world’s largest hog producer.

“It’s a sign that producers will soon take steps to shrink their herds, with growers losing as much as $80 a head, said Shane Smith, chief executive officer of Smithfield Foods. Demand from top buyer China is waning at a time the cost to feed animals is surging.

“A drought in the Midwest has deteriorated crops, with corn at its worst conditions for this time of year since 1992. That’s squeezing profits and making it more appealing for growers to sell the grain, which has risen more than 10% in the last four trading days.”