As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

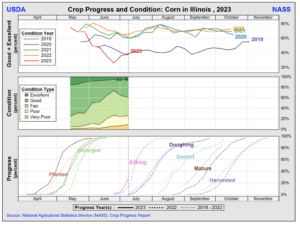

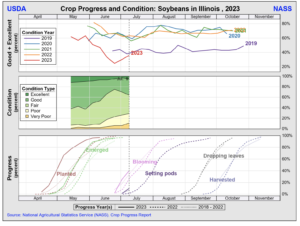

Corn, Soybean Conditions Improve, But “Still the Lowest for this Time of Year Since 2012”

DTN Managing Editor Anthony Greder reported yesterday that, “Another week of widespread rains and cooler weather boosted the national corn condition rating for the second week in a row, and soybean condition also improved slightly following several weeks of declines, according to USDA NASS’ weekly Crop Progress report released Monday.”

Greder explained that, “Nationally, corn was rated 55% good to excellent, up 4 percentage points from 51% the previous week but down from 64% a year ago at this time. This year’s current rating is still the lowest for this time of year since 2012.

7- Day Observed Precipitation pic.twitter.com/Dm8QrJCCtg

— FarmPolicy (@FarmPolicy) July 10, 2023

“‘Nebraska’s corn crop showed the largest jump in the good-to-excellent rating, climbing 13 percentage points to 62%,’ noted DTN Lead Analyst Todd Hultman.”

The DTN article added that, “Soybeans were rated 51% good to excellent as of Sunday, up 1 percentage point from 50% last week but down from 62% a year ago at this time. Like corn, soybean’s current rating is still the lowest since 2012.

‘As with corn, Nebraska had the largest rating jump for soybeans last week, going from 43% to 55%,’ Hultman said.”

Reuters writer Naveen Thukral reported today that, “Chicago corn futures lost ground on Tuesday after a weekly U.S. government report showed improvement in crop condition following rains in the Midwest grain belt, while soybeans ticked higher.”

The Reuters article noted that, “‘U.S. weather over the next few weeks is key to determining soybean and corn yields and can improve production prospects,’ said Pranav Bajoria, a director at Singapore-based brokerage Comglobal.”

7-Day Total Precipitation Outlook, July 11th to 18th. pic.twitter.com/0LY1uxWC4F

— FarmPolicy (@FarmPolicy) July 10, 2023

Thurkral pointed out that, “Brazilian farmers have harvested through last Thursday 27% of the area planted for their second corn crop, agribusiness consultancy AgRural said on Monday, up 10 percentage points from the previous week but still lagging 2022 levels.

“At the same time last year, 41% of the corn fields in Brazil’s center-south region had been reaped, the consultancy said.”

#Illinois Topsoil Moisture pic.twitter.com/gSGCcgfCX9

— FarmPolicy (@FarmPolicy) July 10, 2023

Earlier this week, Bloomberg writer Sophie Caronello reported that, “Erratic weather in the US and ongoing uncertainty over the deal that allows Ukraine to safely ship grain from Black Sea ports could contribute to further price instability. The USDA’s World Agricultural Supply & Demand Estimates on Wednesday will provide additional insight into production forecasts, and possibly an update on crop yields.”

"New USDA Supply/Demand Forecasts Coming Soon," https://t.co/2131815AtL (MP3- 1 minute). @USDA Radio.

— FarmPolicy (@FarmPolicy) July 10, 2023

* Remarks from Outlook Board Chair, Mark Jekanowski. pic.twitter.com/qMr6RjtM5n

Elsewhere, Dow Jones writer Kirk Maltais reported yesterday that, “Inspections of U.S. corn exports declined in the U.S. Department of Agriculture’s latest report – with marketing year inspections remaining well behind last year’s pace.

“In its latest grain export inspections report for the week ended July 6, the USDA said corn export inspections totaled 341,024 metric tons. That’s down nearly 50% from last week’s report.

“For the current marketing year, corn export inspections have totaled 33.5 million tons. That’s down 32% from last year’s total of over 49 million tons.”

Also with respect to trade, the USDA’s Economic Research Service (ERS) yesterday released its monthly U.S. Agricultural Trade Data Update; the following charts from the ERS data set highlight corn, soybean and wheat trade variables:

Top 10 U.S. export markets for #corn by volumehttps://t.co/uLkBR0QRB2 pic.twitter.com/7iw9SAa3zs

— FarmPolicy (@FarmPolicy) July 10, 2023

Top 10 U.S. export markets for #soybeans, by volume, https://t.co/uLkBR0QRB2 pic.twitter.com/VTO2905F8z

— FarmPolicy (@FarmPolicy) July 10, 2023

Top 10 U.S. export markets for #wheat by volume https://t.co/SUHC9SFY5e pic.twitter.com/F5JXSlgQHR

— FarmPolicy (@FarmPolicy) July 10, 2023

U.S. #agricultural exports, year-to-date and current months, https://t.co/uLkBR0QRB2

— FarmPolicy (@FarmPolicy) July 10, 2023

* by VOLUME#wheat, #corn, #soybeans pic.twitter.com/Ua8STQGOxa

U.S. agricultural exports, year-to-date and current months, https://t.co/uLkBR0QRB2

— FarmPolicy (@FarmPolicy) July 10, 2023

* VALUES#wheat, #corn, #soybeans pic.twitter.com/i8RH62c8Wj