As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve: Observations on the Ag Economy- June 2023

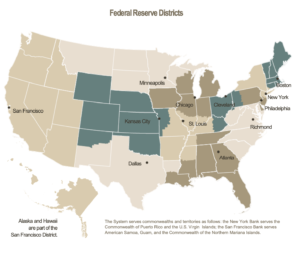

On Wednesday, the Federal Reserve Board released its June 2023 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

* Sixth District- Atlanta– “Agricultural conditions were soft over the reporting period. Oversupplies of cheese kept demand for milk low. With fewer avian flu outbreaks, chicken exports increased somewhat, but overall demand for chicken remained down. Citrus growers experienced good returns on sales but weak profits because of low yields. Row crops were generally healthy, although severe storms damaged crops in some parts of Mississippi and Alabama. Demand for cotton continued to fall. The cattle market remained strong as demand for beef remained high amid low supply.”

* Seventh District- Chicago– “Expectations for Seventh District farm incomes for 2023 deteriorated some as drought expanded throughout the District. One contact said, ‘It is time to be concerned, but too soon to panic.’ Crops were behind normal growing progress. Expectations for this year’s corn crop worsened more than for soybeans because corn is more sensitive to drought at this growth stage. Crop prices were volatile during the reporting period; while corn prices ended down, soybean prices were up, and wheat prices were about the same. Some input costs were lower. Prices for milk were down once again, extending losses for dairy farms. Although hog prices moved up some, producers continued to struggle to turn a profit. Egg prices edged up. Cattle prices made further gains, as drought limited water and forage availability, forcing farmers to trim their herd sizes.”

* Eighth District- St. Louis– “District agriculture conditions declined moderately relative to the previous reporting period. Between the end of May and end of June, the percentages of corn, cotton, rice, and soybeans rated fair or better saw slight to moderate decreases across the board. Compared with this time last year, overall crop conditions have declined moderately. Crop conditions both began lower and decreased more over the period when compared with this time last year. With the exception of cotton, which increased modestly, all other individual crop conditions were worse compared with last year. Contacts in the Little Rock region reported some anxiety about the expiring farm bill later this year.

While commodity prices remain high generally, some have begun retreating while input and fuel costs remain high, leading to profitability concerns as we enter the second half of the year.

* Ninth District- Minneapolis– “District agricultural conditions weakened slightly since the last report. Most of the District’s corn and soybean crop was reportedly in good or excellent condition; however, wheat crops were in worse shape as the harvest approached. Persistent drought conditions in the eastern portion of the District, particularly in South Dakota, improved slightly with recent precipitation.”

* Tenth District- Kansas City– “Agricultural economic conditions in the Tenth District were steady through June. The price of most major commodities increased moderately from the previous month as drought intensified in many major crop production areas across the nation. Expectations for dry conditions to reduce yields pushed prices higher, but lower production could limit revenues for some producers. Through mid-June, an average of about 15% of corn and soybean acres and nearly 30% of winter wheat acres were in poor or very poor condition across all District states. Dry weather also continued to limit grass and feed supplies, resulting in higher costs for many cattle producers.

Despite concerns about the potential for reduced profitability ahead, agricultural lenders continued to report strong credit conditions.

* Eleventh District- Dallas– “Drought conditions eased substantially over the past six weeks, with now less than a quarter of the district in drought. Increased soil moisture broadly improved crop and pasture conditions, though heavy rains caused significant disruption to cotton planting in the Texas High Plains. A sizeable portion of cotton acreage in that area may not be harvestable this year, either because of prevented planting or crop flooding. Row crop prices generally moved up over the reporting period, and cattle prices increased dramatically, driven by steady demand for meat but reduced supplies of both cattle and beef.”

* Twelfth District- San Francisco– “Conditions in agriculture and resource-related sectors were mixed. Expanded ocean freight capacity and lower shipping costs supported exports, but lingering backlogs, the war in Ukraine, and a strong dollar limited access to some international markets. Domestic retail demand for agricultural products softened and demand from the food services sector plateaued. Demand for timber rose. Produce yields across the District were broadly up, recovering from the wet winter and spring. However, inventories of some foods such as raisins and nuts declined. Major seafood stocks edged up.

Rising labor and insurance costs put upward pressure on production expenses, while past rains somewhat offset irrigation costs.

“One contact noted that ongoing capital investments helped boost productivity and curtail labor costs in the agriculture sector.”