Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Midwest Drought “Eases Its Grip”

Bloomberg’s Brian K Sullivan reported yesterday that, “The Midwest ‘flash drought’ that gripped the region through the spring and early summer has shown a glimmer of relaxing with dry areas dropping for the first time since May.

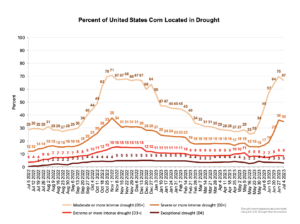

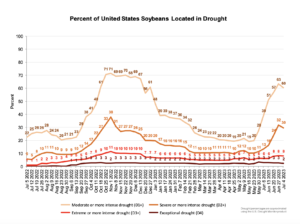

“Drought across the Midwest fell to 63.54% from 64.71% a week ago, according to the US Drought Monitor. The area of extreme and exceptional drought rose however from 3.52% to 4.27% for the week ending July 4.

#Drought Monitor, Corn Belt pic.twitter.com/hu58uECadv

— FarmPolicy (@FarmPolicy) July 6, 2023

“Three months ago only 5.46% of the Midwest was in drought.”

Sullivan noted that, “Through spring and early summer a resilient block of high pressure parked across northern North America, which was responsible for Canada’s record wildfire season, as well as leaving the Midwest parched, said Brad Rippey, a meteorologist with the US Department of Agriculture.

“‘What transpired in the Midwest this spring and early summer is a classic flash drought, despite the absence of sustained heat,’ Rippey said in an email interview. ‘In other words, drought has developed quickly, in spite of relative cool conditions.’

“The recent rains have contributed to a drop in corn futures through Wednesday. The crop saw its biggest drop since early 2021 as larger acreage and improving crop conditions signaled better supplies.”

The Bloomberg article added that, “‘The big question for agriculture is how much damage has been done, now that some rain is starting to fall again,’ Rippey said. ‘Chances are we’ve already trimmed some corn yield potential, but soybeans in most areas can still fully recover.'”

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Recent rainfall has eased some fears that dry soil in crop-growing areas will stifle yields, but traders continue to have concerns that the soil moisture isn’t enough, particularly for corn.”

Maltais pointed out that, “Drought conditions in the Eastern Corn Belt improved for the week ended July 4 in Illinois and Indiana, according to the U.S. Drought Monitor. However, high temperatures and drought will likely continue to be a pressure point for grains going forward.”

Corn Belt #Drought, One-Week Change pic.twitter.com/CXjTyuccQ3

— FarmPolicy (@FarmPolicy) July 6, 2023

And today, Reuters writer Naveen Thukral reported that, “Chicago corn futures were largely unchanged on Friday, with the market poised for its first weekly gain in five weeks on concerns over dry weather reducing yields in the U.S. grain belt, although expectations of rains in some rains limited the upside in prices.”

7-Day Total Precipitation Outlook, July 7th to 14th pic.twitter.com/JTyubbSbxS

— FarmPolicy (@FarmPolicy) July 7, 2023

The Reuters article added that, “‘Rains have improved soil moisture levels in the U.S. Midwest but we think more precipitation is needed,’ a Singapore-based grains trader said.”

Thukral also noted that, “Further showers and mild temperatures are expected in the central and southern Midwest over the next two weeks, aiding corn that is entering its crucial pollination phase. However, Northern crop areas may remain stressed amid forecasts for below-normal precipitation.

“Weekly U.S. Drought Monitor data showed marginal improvement in parts of the corn belt and further deterioration in others. As of July 4, 60% of soybeans and 67% of corn remain affected by drought, down 3 points from a week earlier.”

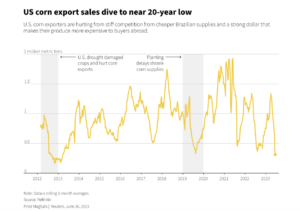

Elsewhere, Reuters writer Karl Plume reported today that, “U.S. corn export dominance is fading in an increasingly competitive global marketplace as Brazil, aided by a new supply agreement with China, is set to out-ship the U.S. for just the second time ever this season.

“Meanwhile, Mexico, America’s other top market, is preparing to limit imports of genetically modified corn that comprises more than 90% of every U.S. harvest.

“The eroding export market share spells trouble for the $90 billion U.S. corn industry as domestic demand for feeding livestock and producing ethanol has also cooled. Plantings of America’s most widely grown crop are likely to decline and farm incomes could suffer in the years ahead as a result, analysts said.”

The article added that, “Illinois farmer Richard Guebert is concerned. ‘We need a good export market for our corn. The seed technology in Brazil is getting better and better each and every year. They’re not going away,’ he said.”