A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

U.S. Crop Conditions – – Corn Up One Point, Soybeans Down One

DTN Managing Editor Anthony Greder reported on Monday that, “After falling for three weeks in a row, corn condition improved last week, but just by 1 percentage point, according to USDA NASS’ weekly Crop Progress report released Monday. Soybean condition, on the other hand, logged its fourth weekly decline during the week ended July 2.

“More widespread rain and cooler weather is in the forecast for the coming week, which should be beneficial for crops in many areas of the country, according to DTN forecasts.”

7-Day Total Precipitation Outlook, July 5th - 12th pic.twitter.com/Wls1Dyh4Cr

— FarmPolicy (@FarmPolicy) July 4, 2023

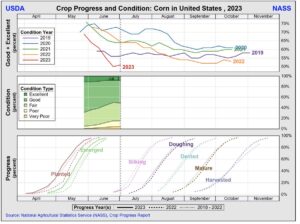

The DTN article indicated that, “Nationally, corn was rated 51% good to excellent, up just 1 percentage point from 50% the previous week and down from 64% a year ago at this time.

This year’s current rating is now the lowest for the crop for this time of year since 2012.

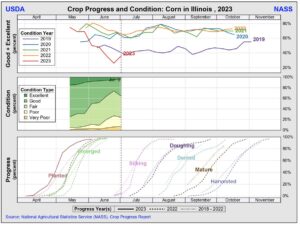

“‘Illinois corn was rated 36% good to excellent, Missouri just 23% and Michigan just 33% good to excellent,’ said DTN Senior Analyst Dana Mantini.”

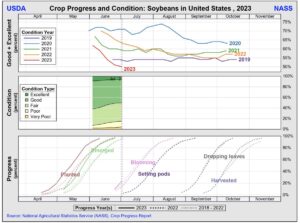

Greder added that, “Soybeans were rated 50% good to excellent as of Sunday, down 1 percentage point from 51% last week and down from 63% a year ago at this time.

“Like corn, soybean’s current rating is the lowest since 2012. ‘Illinois soybeans improved to 30% good to excellent, but still 26% poor to very poor,’ Mantini said. ‘Missouri and Michigan were a poor 24% and 30% good to excellent, respectively.'”

#Illinois Topsoil Moisture pic.twitter.com/W80QTJI7d1

— FarmPolicy (@FarmPolicy) July 3, 2023

Donnelle Eller reported on the front page of Monday’s Des Moines Register that, “Across Iowa, drought conditions are nearing a third year, the longest stretch since the U.S. Drought Monitor began 23 years ago, said Justin Glisan, the state climatologist. Some portion of Iowa has experienced drought conditions over the past 155 weeks, beating the 2011-12 drought that lasted 151 weeks, Glisan said.”

The Register article noted that, “Even with recent showers, and scattered storms over the July 4th weekend, the state is unlikely to escape the drought anytime soon, Glisan said.

“Recent rain — and signals that Iowa farmers will see more precipitation in July — will help, Glisan said. But ‘we will need several months, if not more than a year, to really get enough precipitation to chip away at the long-term deficit‘ in Iowa, he said.

“Glisan said May and June are typically Iowa’s wettest months of the year, but the months as of last week had received only 62% of the normal rainfall, Glisan said. Southeastern Iowa has received less than half its normal rainfall, he said.”

Eller also pointed out that, “July is a critical time for the state’s corn crop, which will begin tasseling, part of the pollination process that’s a big factor in determining yields.

“‘We need a lot of rain in July to keep us going,’ said Aaron Saeugling, an Iowa State University Extension agronomist in southwest Iowa.

“‘Soybeans appreciate a good drink, too, but August is much more critical for soybeans, reproduction-wise,’ Saeugling said.”

Also Monday, Dow Jones writer Yusuf Khan reported that, “Grain and oilseed prices are starting to soften, but remain volatile, as wet weather in the U.S. corn belt helps to mitigate concerns about production.

“Wheat futures are down 12% from a week ago while corn is down 14.9% in Chicago, having rallied through much of June over production worries.”

And Dow Jones writer Kirk Maltais reported earlier this week that, “Inspections of U.S. grain exports have turned higher in the U.S. Department of Agriculture’s latest report, although levels remain generally low.

“In its grain export inspections report for the week ended June 29, the USDA said corn export inspections totaled 642,900 metric tons, soybean inspections totaled 250,055 tons and wheat inspections totaled 336,349 tons. Brazil was the leading destination for U.S. wheat, while Japan was the leading destination for corn and Indonesia was the leading destination for soybeans.”

Also with respect to trade, Bloomberg writers Alberto Nardelli and Daryna Krasnolutska reported on Monday that, “European Union and United Nations officials are discussing creating a new unit within a sanctioned Russian bank in a bid to salvage Ukraine’s grain export deal.

“A new entity of Russian Agricultural Bank — which was cut off from the SWIFT international payments system following the invasion of Ukraine — would be allowed to undertake transactions related to grain trading, according to people familiar with the talks. The Kremlin has been pushing to reconnect the bank to the network as a condition of renewing the Black Sea deal that offers a safe corridor for Ukraine grain shipments.”

Reuters News reported on Monday that, “Russia is pessimistic about the prospects of renewing the Black Sea grain deal because no progress has been made in implementing accompanying agreements that pertain to Russian exports, the Kremlin said on Monday.”