As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Bird Flu Detected on U.S. Commercial Poultry Farm

Late last week, Reuters writer Tom Polansek reported that, “The U.S. has detected its first case of avian flu on a commercial poultry farm since April, in a flock of 47,300 turkeys in Jerauld County, South Dakota, the U.S. Department of Agriculture (USDA) said.

“Infected flocks are culled to prevent the spread of the virus, potentially tightening the poultry meat and egg supply if more cases occur.

“Since 2022, 58.8 million U.S. chickens, turkeys and other birds have been wiped out by the disease, officially known as highly pathogenic avian influenza (HPAI), according to the USDA. The losses drove prices for turkey meat and eggs to record highs last year, raising costs for inflation-hit consumers.”

The Reuters article noted that, “Cal-Maine Foods, the biggest U.S. egg producer, said this week that the average price of conventional eggs dropped 48% from last year to $1.24 per dozen in a quarter that ended on Sept. 2. The company’s total net sales fell 30% to $459.3 million in the quarter.”

Polansek added that, “Prior to this week’s outbreak, U.S. infections were limited to live bird markets and ‘non-poultry’ birds since April, USDA records show. The last commercial farms infected in April raised turkeys in South Dakota and North Dakota, records show.”

Emma Bubola reported in Friday’s New York Times that, “In recent years the disease, known as Highly Pathogenic Avian Influenza, or HPAI, has spread through poultry farms across the globe, causing the deaths of nearly 60 million farmed birds in the United States alone.”

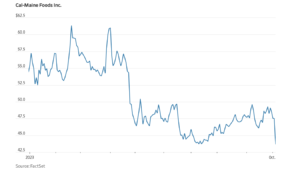

Meanwhile, Wall Street Journal writer Aaron Back reported last week that, “Cal-Maine reported [earlier this month] that egg production has recovered from the avian flu outbreak of 2022, which caused the deaths of nearly 58 million poultry in 47 states. Egg prices have collapsed as a result. Cal-Maine said its average selling price for eggs fell to $1.59 a dozen in its fiscal first quarter, compared to $2.28 a year earlier.

“The company’s revenue in the quarter fell 30% from a year earlier. At the same time, though, labor and other costs have remained elevated, including expenses incurred to guard against future avian flu outbreaks. As a result, it posted an operating loss of $6.76 million, compared with an operating profit of $163.9 million a year earlier.

“Its shares were down around 8% Wednesday morning [Oct 4th], and are down around 20% so far this year, having given up nearly all their gains since the outbreak started in March of 2022.”

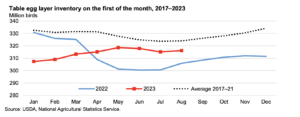

In its most recent Livestock, Dairy, and Poultry Outlook last month, the USDA’s Economic Research Service (ERS) indicated that, “The table egg layer inventory on the first of August was estimated at 316.2 million hens. This is a slight increase month over month, continuing the slow recovery of the national flock from last year’s outbreaks of Highly Pathogenic Avian Influenza (HPAI).”

The ERS update added that, “Based on somewhat stagnant flock growth, third- and fourth-quarter table egg production projections are adjusted down to 2.0 billion dozen and 2.035 billion dozen, respectively. This would make the 2023 total 7.885 billion dozen table eggs, down 48 million from last month’s projection. This is still an increase of 1.3 percent from 2022.”

Elsewhere, Dow Jones writer Kirk Maltais reported yesterday that, “Thursday’s WASDE report is expected to show the USDA revising its production outlooks to the downside, albeit slightly.

“U.S. corn production is expected to drop 34 million bushels to 15.1 billion bushels, while soybean production is expected to decline 14 million bushels to 4.13 billion bushels, according to analysts surveyed by The Wall Street Journal.

“Analysts expect the report to point toward a solid finish for U.S. crops.”

And Reuters writer Peter Hobson reported today that, “The U.S. Department of Agriculture will on Thursday release a monthly grain supply and demand report, with analysts expecting small downgrades to U.S. corn and soybean harvest estimates.

“Commodity brokerage StoneX, however, raised its estimate of U.S. 2023 corn production to 15.282 billion bushels from 15.102 billion and lifted its forecast for U.S. soybean production to 4.175 billion bushels from 4.144 billion.

“CBOT corn is up around 4% from a 33-month low of $4.67-3/4 last month and soybeans are near their lowest since December 2021.”

Also today, Reuters writer Dan Peleschuk reported that, “Ukrainian President Volodymyr Zelenskiy said on Tuesday he had arrived in Bucharest for talks with Romanian President Klaus Iohannis on security cooperation in the Black Sea region.

I started my talks with @KlausIohannis.

— Volodymyr Zelenskyy / Володимир Зеленський (@ZelenskyyUa) October 10, 2023

Defense cooperation, Black Sea security, and economic cooperation are on the agenda, with a focus on developing infrastructure and creating jobs in both nations.

Ukraine-Romania partnership is a factor of stability for Europe and beyond.

“Kyiv is fighting a full-scale Russian invasion that has involved frequent air strikes on Ukrainian grain and port infrastructure, including along the Romanian border.”

The article pointed out that, “Romania’s Black Sea port of Constanta has been Kyiv’s main alternative export route for grain since Russia quit a deal allowing safe Ukrainian shipments via the Black Sea in mid-July.”