As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Low Mississippi Levels “Disrupt U.S. Corn Trade,” and “Could Add Pressure on Local Storage Systems”

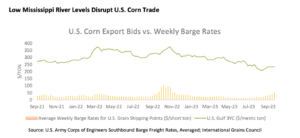

In its monthly Grain: World Markets and Trade report on Thursday, the USDA’s Foreign Agricultural Service (FAS) indicated that, “Since June 2023, hot and dry conditions along the Mississippi River valley caused river levels to dip well below historical averages.”

FAS explained that, “When river levels decline, barge operators must both reduce the load of each barge and lower the number of barges pulled together.

These operating restrictions mean that more boats and barges are required to move smaller amounts of grain, straining both capacity and efficiency.

“Pressure on capacity is already triggering a spike in barge freight costs.”

.@usda_oce Wx: On October 11, the #Mississippi River at Memphis, Tennessee, dipped to a record-low stage of -11.52 feet, eclipsing the low-water mark set on October 21, 2022, by 0.71 foot, or about 81⁄2 inches.

— FarmPolicy (@FarmPolicy) October 13, 2023

“As transport costs to export positions in the U.S. Gulf increase, cash prices in upstream river terminals decline while cash prices in the Gulf rise to compensate for increasing costs,” the report said.

The Grain report noted that, “The net effect of smaller Gulf-bound supplies and higher transit costs is reduced competitiveness for U.S. corn, supporting weaker export demand for U.S. corn. Despite U.S. production being forecast at second from record, as of the week ending September 28, U.S. export sales data indicates accumulated sales and shipments of U.S. corn were 28 percent below the 5-year average for the same week.”

Barge movements on the #Mississippi River (Locks 27-Granite City, IL)

— FarmPolicy (@FarmPolicy) October 12, 2023

For the week ending October 7:

55 percent lower than last year and 47 percent lower than the 3-year average.https://t.co/nPPx2GpD0Y pic.twitter.com/MYcFr2OFo9

With respect to corn prices, the FAS report pointed out that, “Since the September WASDE, U.S. and Brazilian bids have moderated, while Argentine bids have soared. As of October 10, U.S. bids were $229/ton, down $6 from last month. Early-season demand for U.S. corn remains soft likely due to poor Mississippi River system logistics and competition from other exporters including Brazil. Brazilian bids were $221/ton, down $3 from last month. Record exportable supplies and competition with U.S. new crop supplies are supporting downward pressure on bids.”

Elsewhere, in its weekly Grain Transportation Report on Thursday, USDA’s Agricultural Marketing Service (AMS) pointed out that, “Grain storage is an essential tool to efficiently market grain throughout the year. It can also relieve strains on grain transportation— whether from natural disasters, labor disputes, or market volatility—and keep transportation costs down. By allowing shipments to be deferred until conditions improve, available storage can mitigate transportation bottlenecks, especially during harvest time.”

AMS noted that, “As the 2023 corn and soybean harvests gain momentum, concerns surround water levels in the Mississippi River System (MRS) and whether barge supply will suffice to meet the needs of U.S. grain exports. The MRS’s low water levels reduce barge capacity and the number of barges in tow. River disruptions could add pressure on local storage systems, as farmers hold crop to sell later.”

The Transportation report stated that, “Heading into harvest, grain stocks (as of September 1) were below average. However, mainly because a large corn harvest is anticipated, total fall grain supplies are projected to be about average. Combined with the grain storage capacity added in recent years, the roughly average fall grain supplies suggest storage will be less constrained than in many years (though not as available as last year). If storage is sufficient as expected, then the harvest will not unduly stress the transportation system across most of the Nation this fall.

#Drought Monitor - River Basins pic.twitter.com/GbAGwJKneN

— FarmPolicy (@FarmPolicy) October 12, 2023

“In forecasting storage availability and transportation demand, one wildcard is whether low water levels in the MRS—like those which stymied barge traffic last year— will continue. Storage availability could be an issue in States such as Ohio and Indiana that rely heavily on the MRS and also face above-average storage deficits. Grain rail performance is so far reliable, but shippers and other stakeholders are watchful for signs of deteriorated service that persisted through last year’s harvest. Likewise, another factor of unknown effect—the high-interest- rate environment—could either stimulate transportation or quell it, depending on how the contradictory effects of high interest rates play out.”