A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

2023 Farm Sector Income Forecast, November

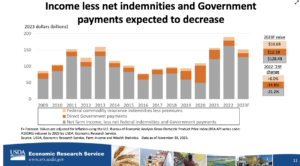

The USDA’s Economic Research Service (ERS) indicated on Thursday that, “Farm sector income is forecast to fall in 2023 after reaching record highs in 2022. Net farm income, a broad measure of profits, reached $182.8 billion in calendar year 2022, increasing $42.4 billion (30.2 percent) from 2021 in nominal dollars.”

“In inflation-adjusted 2023 dollars, net farm income is forecast to decrease by $37.9 billion (20.0 percent) in 2023, and net cash farm income is forecast to decrease by $49.2 billion (23.8 percent) compared with the previous year.

If realized, both income measures would remain above their 2003–22 averages (in inflation-adjusted dollars).

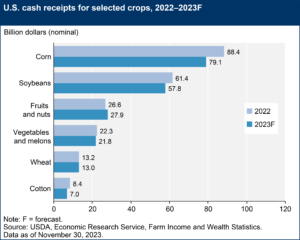

ERS pointed out that, “Overall, farm cash receipts are forecast to decrease by $25.2 billion (4.7 percent) from 2022 to $509.6 billion in 2023 in nominal dollars,” and, “Total production expenses, including those associated with operator dwellings, are forecast to increase by $14.9 billion (3.5 percent) in 2023 to $443.4 billion.”

Thursday’s update stated that, “Corn receipts are expected to fall by $9.4 billion (10.6 percent), because of lower expected prices in 2023. Soybean receipts are forecast to decrease by $3.6 billion (5.9 percent) in 2023, caused by lower expected prices and quantities.”

ERS stated that, “After reaching a record high of $45.6 billion in calendar year 2020, direct Government farm program payments decreased to $26.0 billion in 2021 and to $15.6 billion in 2022. They are forecast to fall further to $12.1 billion in 2023. The overall decrease from 2020 in direct Government farm program payments primarily reflects lower payments from supplemental and ad hoc disaster assistance, including lower Coronavirus (COVID-19) pandemic assistance.”

“Conservation payments from the financial assistance programs of USDA’s Farm Service Agency (FSA) and Natural Resources Conservation Service (NRCS) are expected to be $3.7 billion in 2023, an increase of $148.5 million (or 4.2 percent) from the 2022 estimate.”

ERS also explained that, “Farm bill commodity payments under the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs are forecast to decline by $28.8 million (7.7 percent) in 2023 to $343.7 million compared with $372.5 million in 2022.”

With respect to production expenses, ERS noted that, “When adjusted for inflation, production expenses are forecast to remain comparable to the 2022 level, increasing by only 0.1 percent from 2022 to 2023, and remaining below the record-high level of 2014.”

More narrowly, ERS pointed out that, “Interest expenses (including expense for operator dwellings) are forecast to have the most significant increase in nominal terms at $10.3 billion (42.9 percent above the 2022 value) to $34.4 billion in 2023. This reflects expectations that both total debt levels and interest rates will rise in 2023. While in nominal terms this level is forecast to be the highest to date, in inflation-adjusted dollars, interest expenses were at least 50 percent higher in early 1980s.”

“Fertilizer expenses (including lime and soil conditioner expenses) are projected to have the most significant decline in nominal terms from 2022, falling $5.2 billion (14.1 percent) to $31.7 billion in 2023. The projected drop is driven by reductions in fertilizer prices.”