As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Farm Loan Interest Rates Climb, as Ag Real Estate Values “Held Firm”

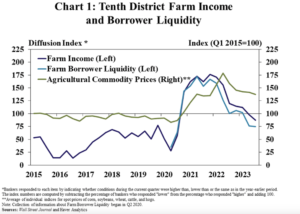

Nate Kauffman and Ty Kreitman, writing in last week’s Ag Credit Survey from the Kansas City Fed, noted that, “Farm income and producer liquidity cooled in recent months alongside lower commodity prices. Nearly half of respondents in the third quarter survey reported that farm income and borrower liquidity were less than a year ago, the highest share since 2020. Farm financial conditions have softened from considerably strong levels as prices of key commodities have moderated.”

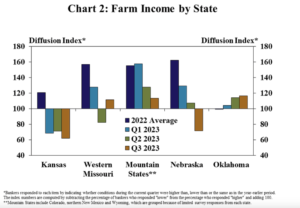

The Ag Credit Survey indicated that, “Prospects for income were comparably worse in some states, depending on their industry concentration. Farm income was higher than a year ago in states more dependent on cattle production such as Oklahoma and the Mountain States. In contrast, conditions deteriorated at a moderate pace in Kansas and Nebraska which have many areas dependent on revenue from corn, soybeans, and wheat.”

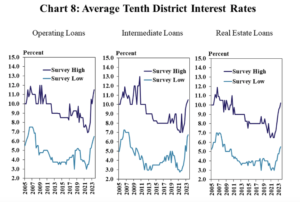

With respect to interest rates, the Kansas City Fed pointed out that, “The moderation in agricultural credit conditions has coincided with a rapid rise in farm loan interest rates.

“The lowest average rates offered on non-real estate and real estate farm loans has increased about 400 and 300 basis points, respectively over the past two years.”

The highest average rates have grown by a similar amount with many borrowers paying a rate of interest on farm debt above 10%.

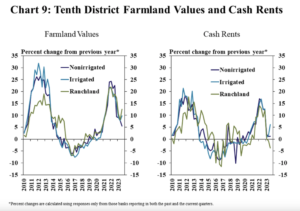

The Survey added that, “Despite the rapid rise in interest rates and a recent moderation in the farm economy, agricultural real estate values held firm. The value of nonirrigated cropland was about 5% higher than a year ago and cash rents on those acres increased by about 2%.

“Irrigated and ranchland values grew by about 10% and, while cash rents on irrigated acres increased, rent charges on ranchland were lower than a year ago.”

Recall that earlier this month, the Chicago Fed indicated that third quarter farmland values increased 5% year-over-year.