As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

NYT: “Carriers Want to Replace Jet Fuel with Ethanol to Fight Global Warming”- Water Use Concerns

New York Times writers Max Bearak, Dionne Searcey and Mira Rojanasakul reported yesterday that, “Vast stretches of America are dominated by corn, nearly 100 million acres of it, stretching from Ohio to the Dakotas. What once was forest or open prairie today produces the corn that feeds people, cattle and, when made into ethanol, cars.

Now, the nation’s airlines want to power their planes with corn, too.

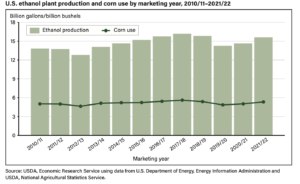

“Their ambitious goals would likely require nearly doubling ethanol production, which airlines say would slash their greenhouse gas emissions. If they succeed it could transform America’s Corn Belt yet again, boosting farmers and ethanol producers alike, but also potentially further damaging one of the nation’s most important resources: groundwater.”

The article noted that, “Corn is a water-intensive crop and it can take hundreds of gallons to produce a single gallon of ethanol. But as airlines embrace the idea of ethanol, prompting lobbyists for agribusiness and ethanol makers to push for clean-energy tax credits in Washington, the threat to groundwater is largely missing from the discussion.”

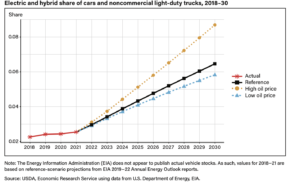

Bearak, Searcey and Rojanasakul explained that, “United Airlines this year signed a deal with a Nebraska ethanol company to buy enough sustainable aviation fuel, as the biofuel is known, to power 50,000 flights a year. In August, Delta announced a plan to create a sustainable fuel hub in Minnesota, a major corn state. The Biden administration could decide on its tax incentives for the industry as soon as December.

“‘Mark my words, the next 20 years, farmers are going to provide 95 percent of all the sustainable airline fuel,’ President Biden said in July.

“This year a New York Times data investigation found that groundwater is being dangerously depleted nationwide, largely by agricultural overuse. As climate change makes rainfall less reliable and intensifies droughts, rising demand for ethanol could put even more pressure on America’s fragile aquifers to be used for irrigation.”

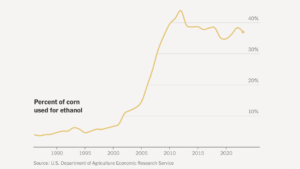

Yesterday’s article pointed out that, “Today, nearly 40 percent of America’s corn crop is turned into ethanol, up from around 10 percent in the mid-2000s. This was largely because of government mandates that began in 2005 requiring gasoline to be mixed with minimum amounts of renewable fuel.

“After that mandate, groundwater use jumped in some places as corn prices skyrocketed. Farmers added millions of new acres by switching to corn or rotating it into their crops year-to-year.”

The Times article added that, “But there are few options for powering aircraft without fossil fuels. Ethanol, advocates say, is the best solution to reduce greenhouse gas emissions from aviation. Farmers argue that agriculture has become much more efficient — and will continue to do so — and will not necessarily require huge amounts of additional water. Ethanol makers also say the industry has gotten cleaner over the years, and that government incentives would further help.

“The airlines say the renewable fuel options that exist for powering planes today are too expensive and would force them to raise ticket prices if mandated. Adding ethanol into the mix, they argue, would significantly reduce those costs and allow them to more quickly start blending renewables into jet fuel.

“‘Sustainable aviation fuel is the best tool we have to decarbonize airplanes,’ said Lauren Riley, United’s chief sustainability officer. Her counterpart at Delta Air Lines, Amelia DeLuca, called for federal support ‘like the incentives that already exist in the automotive industry.'”

Meanwhile, Reuters writer Peter Hobson reported today that, “Chicago wheat futures rose for a third day on Thursday and were poised for their biggest monthly gain since June as traders covered short positions ahead of weekly U.S. export sales data.

“Soybean and corn futures also climbed, with beans set to end the month slightly higher and corn lower.”

Today’s article noted that, “In soybeans, traders were looking at the effect of arid conditions in key cropping areas in top producer Brazil.

“‘Moisture stress is expected to expand to nearly 50% of Brazil’s soybean belt in the days ahead, combined with above normal summer heat to add to crop stress,’ StoneX analyst Arlan Suderman wrote in a note.

“Analysts, however, say even if Brazil suffers significant crop losses its harvest will be larger than last year.”

Elsewhere, Reuters writers Andrea Shalal and Leah Douglas reported yesterday that, “U.S. Agriculture Secretary Tom Vilsack on Wednesday said China took advantage of lower prices for corn in Brazil, leading to a nearly 20% drop in U.S. exports to China, but he expected the numbers to rise again over time.

“At the same time, he told Reuters in an interview, the U.S. government was working hard to reduce American exporters’ over-reliance on China and other big markets and encourage greater diversification.”

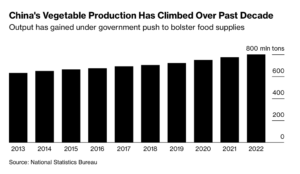

And Bloomberg writer Hallie Gu reported today that, “Chinese farmers in some provinces are being forced to let fresh vegetables rot in their fields due to weak demand and ample supply, according to a local news report and videos posted on social media.”

The Bloomberg article stated that, “China is grappling with a gloomy jobs market and an ailing property sector, which is a key threat to growth, and data released Thursday showed economic activity shrank in November. Restaurants and supermarkets have slowed buying of vegetables amid a sluggish economy, according to Jiemian.”

The article added that, “Chinese farmers have boosted vegetable production over the past decade under a government push to bolster food supplies. Output in 2022 was around 800 million tons, up 26% since 2013, according to official data.”