As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

U.S. Share of China Soybean Imports Falls

Reuters writers Mei Mei Chu and Amy Lv reported Monday that “China’s soybean imports from Brazil in 2023 jumped 29% from the prior year, customs data showed on Saturday, expanding the South American grower’s dominance in the world’s largest soybean market and eating into the U.S. market share.”

China’s total soybean imports in 2023, Reuters’ Karen Braun reports, were 99.41 million metric tons. Brazil accounted for 70% (69.95 mmt) of the total imports, while the U.S. accounted for just 24% (24.17 mmt) — down 13% from 2022.

🇨🇳#China‘s 2023 imports of #soybeans totaled 99.41 mmt. Breakdown by source:

🇧🇷69.95 mmt from #Brazil, up 29% from 2022 and accounting for 70% of China’s 2023 haul

🇺🇸24.17 mmt from USA, down 13% from 2022 and accounting for 24% of China’s 2023 haul

— Karen Braun (@kannbwx) January 21, 2024

“In December, soybean arrivals from Brazil were 94% higher than a year earlier at 4.98 million tons while arrivals from the United States were 31% lower at 3.85 million tons,” Chu and Lv wrote.

The 13% year-over-year decline of the U.S. share of China’s soybean imports is slightly more than the United States Department of Agriculture had predicted in Nov. 2023, according to reporting from Business Insider’s Phil Rosen, which said that the USDA had forecast “a 12% year-over-year decline for US sales to China of the commodity,” at that time.

It was likely that same month — November — however, that saved the U.S. from having an even larger decline in its share of China’s soybean imports. In mid-November, China “purchased more than 3 million metric tons of American soy, good for the biggest single-day purchase in at least three months,” Rosen reported.

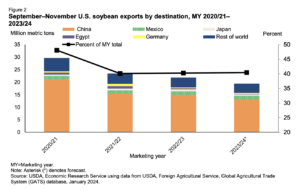

Although the U.S. had a smaller share of China’s soybean imports in 2023, China has remained the No. 1 destination for U.S. soybean exports throughout the year by a rather wide margin. In the period from September to November, for example, China accounted “for 67 percent of the shipments and China’s share is down only 1 percent compared with the same period last year,” according to the USDA’s Oil Crops Outlook: January 2024 report.

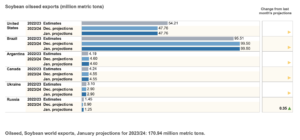

Looking ahead to 2024, Chu and Lv report that there may be “further competition to U.S. soybeans,” particularly through exports from the world’s third-largest soybean grower, Argentina, which has exports that “are expected to surge in 2024 amid forecasts for a rebound in its soybean crop from drought.”