Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Soybean Futures Continue Falling

Bloomberg’s Gerson Freitas Jr reported that last week, “soybeans capped an eighth straight week of losses, the longest stretch of declines since 2006, on an outlook for record global stockpiles and sluggish appetite for US exports.”

“The losing streak underscores how soybean traders have lacked any incentive to buy futures of the commodity used in everything from animal feed to truck diesel,’ Freitas Jr. reported. “Most-active futures settled at the lowest level since December 2020 on the Chicago Board of Trade.”

Decrease Led by Increasing Stocks

Freitas Jr. reported that one of the main drivers behind the soybean price decrease is that “global supplies are expected to be abundant in the current season even after extreme weather conditions hurt crops in Brazil.”

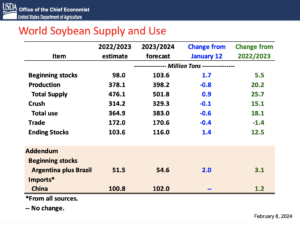

Progressive Farmer reported Friday that in the United States Department of Agriculture’s World Agricultural Supply and Demand Estimates report released this past week, global soybean “ending stocks climbed to 116.03 million metric tons, up 1.63 mmt from last month. The change was largely a result of higher beginning stocks, as USDA revised Brazil’s 2022-23 production up 2 mmt to 162 mmt on higher yield and acreage. For the 2023-24 crop, which is currently being harvested, Brazil’s estimate was lowered to 156 mmt, 1 mmt lower than last month.”

In addition, farmdoc daily‘s Joe Janzen reported at the beginning of February that soybean export bids in Brazil have been “moving well below US prices, making Brazilian exports much more competitive.”

“If the global market thought that Brazil wouldn’t have much of a soybean crop, that the worst sort of fears about Brazilian soybean production were being realized, I don’t think we would have seen this sort of divergence,” Janzen said.

The low prices in Brazil — $11.05 at the port of Paranagua compared to $13.03 in New Orleans — have even led to “at least three cargoes of Brazilian soybeans” being shipped to “a U.S. East Coast crusher, which is not typical for this time of year,” according to reporting from Pro Farmer Editors.

Janzen reported that “these prices have dropped enough that there is a spacial arbitrage trade moving soybeans from Brazilian ports into markets on the US East Coast. It’s actually cheaper to get the beans there than to get them from the Midwest by truck or rail because of these lower export prices coming out of Brazil.”

US Exports Contributing, Too

Freitas Jr. reported that “the USDA also said the US will export less (soybeans) than previously expected in the current season, citing a slow pace in sales and increased competition from Brazil. ‘The numbers remain largely bearish,’ said Vinicius Ito, a director at futures and options brokerage Marex.”

“Limiting the downside, farmers in the US have been reluctant to sell at current prices, and there is speculation that the USDA’s latest forecast on Brazil output still doesn’t fully reflect the yield losses seen in the nation because of drought, according to Ito,” Freitas Jr. reported. “Brazil’s state-run forecaster Conab said on Thursday that the country should produce about 149 million metric tons this year, less than expected by the USDA.”