Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

U.S. Cotton Mills Rapidly Closing

Bloomberg’s Ilena Peng reported Saturday that cotton’s “demand from US manufacturers is on an unrelenting — and accelerating — decline. There were nearly 900 US cotton mills operating around the time of the Chicago expo (in 1893). That number is today around 100, the National Cotton Council estimates, after eight closed in the last five months of 2023 alone.”

“With domestic textile manufacturing nearly gone, cotton farmers who are this month starting to sow millions of acres from California to the Carolinas are less likely than ever to find a buyer for their next harvest at home,” Peng reported.

Why Demand is Low and Mills are Closing

Farm Progress’ John McCurry reported in early March that “changing trade deals, particularly NAFTA, wreaked havoc on the industry.”

“Manufacturing leaders are blaming the recent precipitous closings of several mills on de minimis, a term which by definition means insignificant or negligible, but in this case means anything but,” McCurry wrote. “It refers to a trade policy loophole that keeps imports under $800 free from taxes. The National Council of Textile Organizations says with the proliferation of ecommerce, ‘the de minimis mechanism is now being aggressively used allowing millions of products in the U.S. market duty free that otherwise would be subject to tariffs.'”

“The NCTO blames de minimis on the loss of eight plants over the past three months,” McCurry reported. “Prominent shutterings include 1888 Mills in Georgia, a National Spinning plant in North Carolina, a Gildan yarn plant in North Carolina and a Hanesbrands hosiery plant in Clarksville, Ark.”

In addition, Peng reported that, “in other sectors, a recent push for re-shoring has brought a new wave of manufacturing back to the US, especially when it can help relieve shipping snags and geopolitical tensions — think semiconductors or industrial metals important for developing a domestic electric-vehicle supply chain. But textiles aren’t seen as having ‘the same criticalness as a chip or certain minerals,’ said Erin McLaughlin, a senior economist at the Conference Board, a nonprofit think tank — even if the urgent need for protective equipment like masks during the pandemic highlighted the importance of a US industry.”

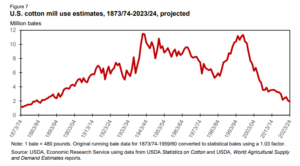

Cotton Mill Use Lowest Since 1885

The United States Department of Agriculture Economic Research Service reported that “U.S. cotton mill use—the volume of raw cotton processed into textiles—is estimated at 1.9 million bales for the 2023/24 marketing year (August–July). If realized, cotton used by U.S. textile mills would fall to its lowest level in more than 100 years—since the 1884/85 marketing year, when approximately 1.7 million bales were used.”

“U.S. cotton mill use rose, peaking again in the mid-1990s, before the World Trade Organization (WTO) Agreement on Textiles and Clothing began phasing out quotas on developed countries’ textile and apparel product imports,” the USDA ERS wrote. “By the early 2000s, cotton mill use in several countries—particularly China—expanded to take advantage of the phased-out quotas on cotton product exports to the United States. Although U.S. raw cotton exports benefited from increased foreign mill demand, U.S. cotton mill use weakened, and the downward trend led to the near historically low 2023/24 U.S. cotton mill use projection.”

Peng reported that “more than three-fourths of US cotton supply this year will be exported, government data show, the highest share on record. That outsized reliance on export demand leaves farmers more susceptible to geopolitics and other disruptions, said Gary Adams, CEO of the National Cotton Council.”