USDA is asking farmers and other stakeholders to help examine how USDA can improve its data collection and analysis. The department is issuing a Request for Information (RFI) to examine…

Farmers Still Holding Corn & Soybeans Amid Low Prices

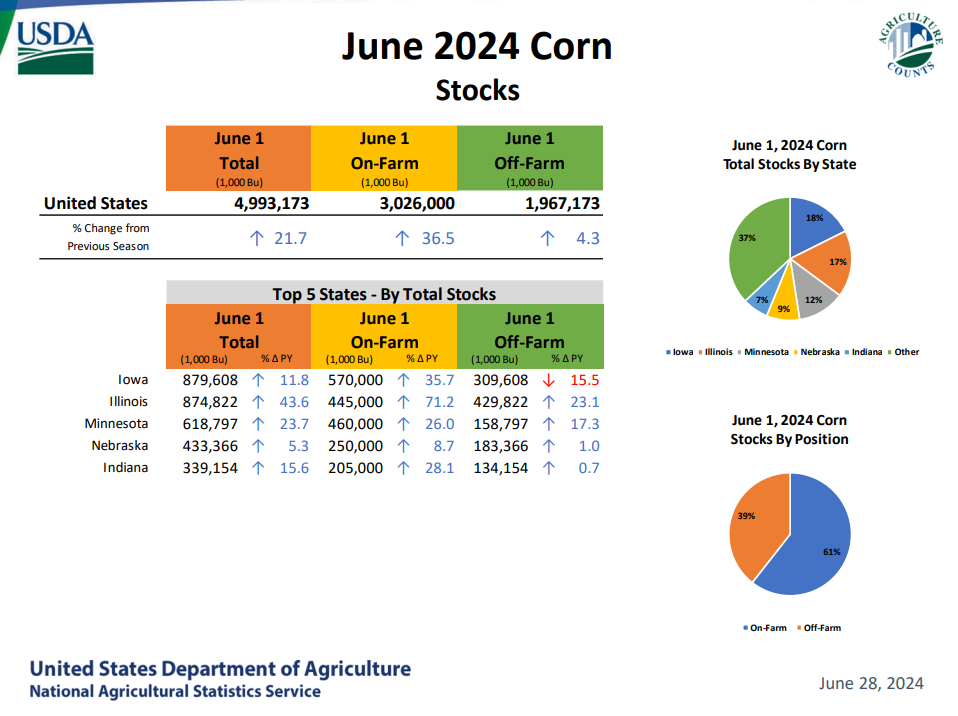

Reuters’ Karen Braun reported Tuesday that “survey work published by the U.S. Department of Agriculture on Friday showed June 1 U.S. corn stocks at 4.99 billion bushels, a four-year high, up 22% from a year earlier and up 7% from the 10-year average for June 1. But 61% of those corn supplies was held on farms, the largest June 1 share since 1999 and well above the decade average of 52%.”

“Similarly, some 48% of June 1 soybean stocks was held on farms, the largest percentage for that date since 2006 and above the 10-year average of 35%,” Braun reported. “Total June 1 soy stocks also landed 22% above the year-ago levels and reached four-year highs, but the 970 million bushels were about 1% lower than the decade mean.”

Low Prices Largely Driving Stockpiles

Braun reported that “U.S. corn and soybean prices have tumbled to four-year lows and producers’ disappointment with the situation is reflected in their unusually massive stockpiles.”

Progressive Farmer’s Katie Micik Dehlinger reported Tuesday that “‘We did have an opportunity for higher prices in May, but we didn’t ring the $5 bell,’ DTN Lead Analyst Todd Hultman said. The July corn futures contract hit a high of $4.755, while the national average cash price only got to $4.49 during May, which is historically when a seasonal peak occurs.”

“Weather problems this spring may also have encouraged some farmers to hold onto more corn in the hope of bullish price development. Instead, prices slid, with July futures prices trading below $4 per bushel during the day on July 1,” Micik Dehlinger reported.

“‘A year ago, we were still in the ballpark of $6 corn. That’s the other reason farmers are so stubborn right now. They feel like it’s gotten beat down too hard,” Hultman said, adding that many farmers’ breakeven levels are around $5 per bushel,” Micik Dehlinger reported. “‘When you factor in inflation into the production cost mix, this is a very cheap price. Spot corn equates to like $3.10 in pre-COVID terms.'”

Stockpiling Has Been the Trend So Far this Year

Braun reported that “U.S. farmers have held a larger-than-normal portion of corn and soybean stocks throughout this marketing year, but that margin widened in the third quarter between March and May, suggesting farmers have been increasingly stingy sellers.”

“Farms also housed 61% of U.S. corn supplies on March 1, a 19-year high for the date, though the decade average is 56%. For soybeans, some 51% of March 1 supplies was on farms, a 17-year high but also a bit closer than June 1 to its decade average of 42%,” Braun reported. “Things were much less anomalous on Dec. 1, right after the conclusion of last year’s harvest, as corn and soy stocks on farms accounted for 64% and 48% of national stocks, respectively. Decade averages are 62% and 47%.”

Which States Have the Most Stocks?

Braun reported that “relative to normal, Illinois is by far the most stuffed with corn, as 17.5% of national corn stocks was held in the No. 2 producer on June 1 compared with a five-year average of 15.6%.”

“Top corn producer Iowa’s June 1 stocks were 17.6% of total compared with 19.6% on average, and only Nebraska had a larger deficit from average in 2024, down 2.6 percentage points,” Braun reported. “Kansas’ share of June 1 corn stocks was also below average, but shares in Minnesota, Ohio, Missouri and the Dakotas were between 0.5 to 1 percentage point above normal. Minnesota held 11.2% of all June 1 soy stocks, above the 10% average. Only Ohio and South Dakota maintained a higher gap than normal, combining for nearly 15% of June 1 stocks.”