As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

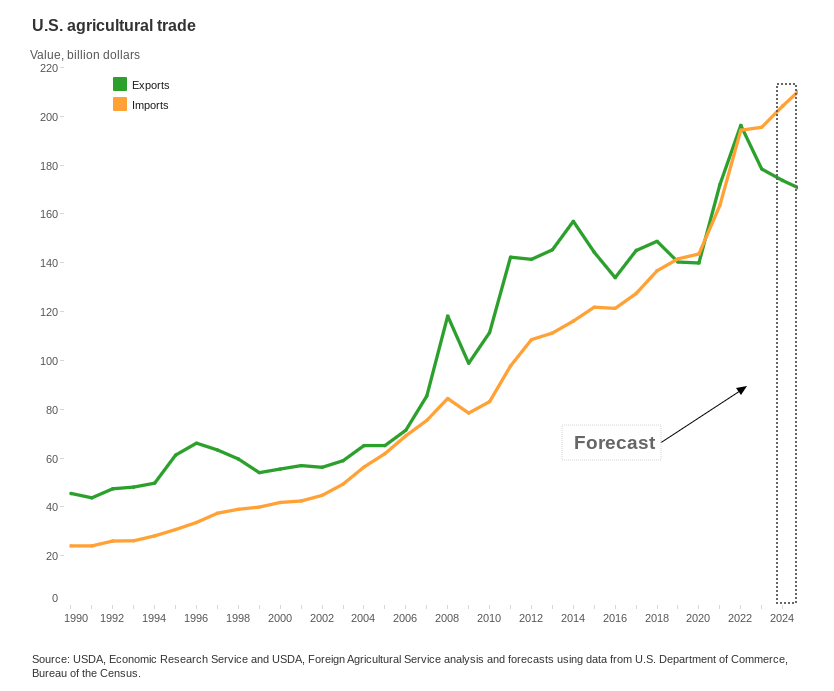

US Ag Trade Deficit Projected to Top $42 Billion

FERN’s Ag Insider reported earlier this week that “the U.S. food and ag trade deficit will soar to a record $42.5 billion in the fiscal year opening on Oct. 1, fueled by steadily growing consumer demand for imported fresh produce, alcohol, coffee, and sugar, said USDA economists on Tuesday. It would be the third year of largest-ever deficits while export sales, hobbled by the strong dollar, retreat from the record set in fiscal 2022.”

Agri-Pulse’s Philip Brasher reported that “U.S. ag exports are estimated to total $169.5 billion in FY25, a drop of $4 billion from FY24, reflecting in part the continued drop in prices for corn, soybeans and other key commodities, according to USDA’s quarterly ag trade outlook, released Tuesday.”

“USDA is forecasting that U.S. ag imports will increase by $8 billion in fiscal 2025 to $212 billion, pushing the projected trade deficit to $42.5 billion, up from a $30.5 billion deficit projected for FY24,” Brasher reported. “The surge in imports reflects consumer appetites for fresh fruits and vegetables as well as coffee, cocoa and other products.”

FERN’s reported that “demand for imported food has rebounded from a pandemic slowdown and was expanding at $8 billion or more per year, said the USDA in its first estimate of ag trade in fiscal 2025.”

Chinese Export Market Shrinking

Brasher reported that “the report a underscores the weakness of the Chinese market for U.S. farmers. Exports to China are projected to drop $3 billion to $24 billion. In 2023, U.S. ag exports to China exceeded $33.6 billion.”

“‘Deceleration in economic growth and weak consumer sentiments reduce China’s overall import demand, particularly for feed stuff,’ the USDA report says,” according to Brasher’s reporting. “‘Soybeans account for the bulk of the year-over-year reduction as U.S. supplies face stiff competition from Brazil. U.S. coarse grain exports are also expected to decline due to lower U.S. sorghum production and China’s sufficient corn supplies (owing to expected imports from Brazil and Ukraine and large domestic production).'”

In addition, Successful Farming’s Chuck Abbott reported earlier in August that “the USDA has forecast that Mexico — and Canada — will push China into third place among export markets this year. Food and ag shipments to Canada totaled $21.5 billion through June. Fiscal years begin each Oct. 1. China, the largest customer in 2023, was buying markedly smaller amounts of U.S. soybeans and corn this year, said USDA analysts in May. The drop-off has continued into early August, according to USDA export sales data.”

Export Details

Brasher reported that “U.S. corn exports are estimated to increase from 57 million to 58 million metric tons in FY25, but the value of those exports is projected to drop from $13.1 billion in FY24 to $12.2 billion.”

“The U.S. is expected to ship 50.4 million metric tons of soybeans, worth $22.9 billion, in FY25, compared to 46.3 million tons, worth $24.4 billion, in the current fiscal year,” Brasher reported. “Wheat exports are expected to rise from 20.6 million metric tons in FY24 to 22.2 million tons in FY25, with the value of those shipments also increasing slightly, $5.9 billion to $6 billion.”

🚨 USDA’s new projections for #agricultural trade signal a growing deficit, up to a new record of -$42.5B in FY25. Below is a 👀 at the trade balance by category. The @SenateAgGOP #FarmBill seeks to boost trade promotion and foreign market development funding. #oatt 🌽🌱🌾 pic.twitter.com/BUGhv1jQo6

— John Newton (@New10_AgEcon) August 28, 2024

“An estimated decline in the volume of beef also is expected to contribute to the deficit. USDA projects sales of U.S. beef to decline from 1 million metric tons worth $9.4 billion in FY24 to 900,000 tons valued at $8.4 billion in FY25,” Brasher reported.

“Specialty crops are one of the bright spots for agriculture. Exports of tree nuts are projected to grow from $9.5 billion to $9.9 billion in FY25. Exports of processed fruits and vegetables are seen growing $300 million to $8.3 billion,” Brasher reported. “Sales of fresh fruits and vegetables ‘are forecast $100 million higher to $7.6 billion due, in part, to rising apple shipments to India following last year’s lifting of retaliatory tariffs that had been in place since 2019,’ USDA says.”

Import Details

Brasher reported that “the agricultural import increase in FY25 reflects increases in a range of products, including fresh fruits and vegetables, sugar, cocoa and coffee. Imports of fresh fruits are estimated to rise $800 million to $20.3 billion, while imports of fresh vegetables are estimated at $13.5 billion in FY25, a $700 million increase over the current fiscal year.”

“Americans are expected to consume $9.3 billion worth of coffee and $6.8 billion in cocoa and related products in FY25, gains of $700 million and $400 million respectively,” Brasher reported. “Imports of sweeteners are projected to rise from $7.5 billion to $7.8 billion. Wine imports are forecast up $100 million to $7.1 billion.”