USDA is asking farmers and other stakeholders to help examine how USDA can improve its data collection and analysis. The department is issuing a Request for Information (RFI) to examine…

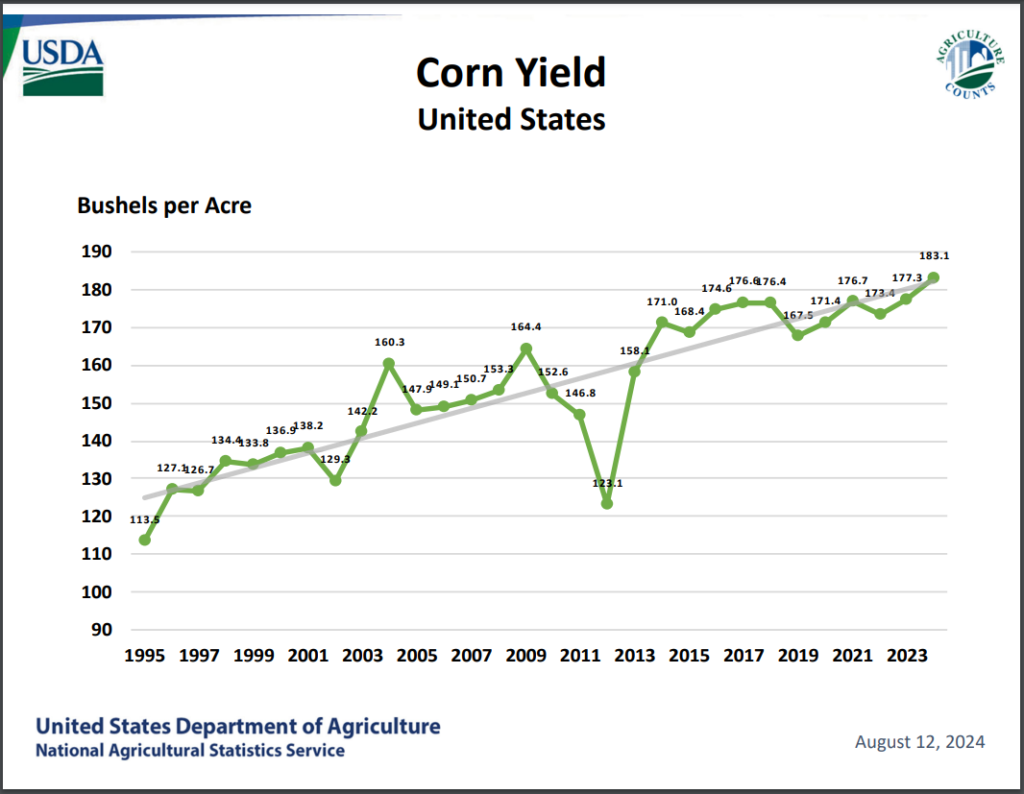

USDA Projects Record Soybean, Corn Yields

The USDA on Monday said that US farmers will grow a record soybean crop in 2024, while national average yields for both corn and soybeans will set record highs.

In its Crop Production Report on Monday, the USDA said that the national average soybean yield is estimated at 53.2 bushels per acre — 1.3 bpa above the previous record in 2016 — which will result in a record soybean crop of 4.589 billion bushels. That national average yield record includes new state yield records in Illinois (66 bpa), Indiana (62 bpa), Ohio (59 bpa), Mississippi (58 bpa) and Arkansas (57 bpa).

The USDA also said that the national average corn yield is estimated at 183.1 bushels per acre — 5.8 bpa above last year’s record — resulting in a corn crop of 15.147 billion bushels, slightly above the estimate from July. The national average yield record includes new state yield records in Illinois (225 bpa), Iowa (209 bpa), Indiana (207 bpa), Wisconsin (183 bpa) and Michigan (177 bpa).

The University of Illinois’ Scott Irwin said on the social media platform X on Monday that “neither one of these yield estimates is a huge surprise,” and that on the corn side, it is reflective of the growing conditions much of the country has seen this summer. He described the conditions in Illinois and Indiana as “ridiculously good,” while saying that conditions in South Dakota, Nebraska, Missouri, Michigan and Wisconsin were “very good.” The only states he labeled as “disappointing,” were Minnesota, Ohio, Kentucky and states further south and southeast.

Corn, Wheat Ending Stocks Lowered

Brownfield Ag News’ John Perkins reported Monday that “the USDA tightened the balance sheets for corn and wheat while raising ending stocks for soybeans.”

“Corn carryout is pegged at 2.073 billion bushels, a cut of 26 million from July, but still potentially 206 million larger than last marketing year, with a higher production estimate and lower food, seed, and industrial use canceled out by an increase for exports,” Perkins reported. “Wheat is seen at 828 million bushels, a decrease of 28 million on the month primarily due to a reduction in production, but that would be 126 million more than the previous marketing year because of a year-to-year jump in crop size.”

“Soybean ending stocks are estimated at 560 million bushels, up 125 million following that increased production guess, which canceled out higher exports, and 215 million larger than the marketing year before because of that larger crop canceling out better projected demand,” Perkins reported.

How the Reports Affected Markets

Progressive Farmer Staff reported Monday that “according to DTN Lead Analyst Todd Hultman, Monday’s new-crop U.S. ending stocks estimates were neutral for corn, bearish for soybeans and neutral to bullish for wheat. Meanwhile, world ending stocks estimates from USDA were neutral for corn and wheat but bearish for soybeans, Hultman said.”

Successful Farming’s Cassidy Walter reported that Karl Setzer, a partner at Consus Ag Consulting, said that “the bigger production number for soybeans is the most negative factor we’re seeing today. That’s why soybeans are posting such big losses. And what’s probably more negative is we’re below $10 a bushel now.”

“Corn on the other hand was actually supported today. USDA cut harvested acres more than expected and overall production was up less than expected,” Setzer said, according to Walter. “Also, demand being increased tells us we don’t have a demand issue, we have a production issue. The issue is we are producing huge crops.”

Reuters’ Heather Schlitz reported Monday that “August is the most important month for soybean crop development, and traders will closely monitor weather in the U.S. Midwest, which is so far expected to be largely beneficial.“