Politico's Paula Andrés reported Wednesday that "business as usual is no longer an option for European farmers and businesses if climate collapse and economic hardship are to be avoided." "That’s…

Black Sea, EU Wheat Facing Weather Challenges

Bloomberg’s Áine Quinn reported Tuesday that “dried out soils in Russia and Ukraine are threatening plantings for next year’s wheat harvest, yet another headache for farmers hit by weather setbacks and the ongoing war.”

“Swaths of land across the nations, which together account for more than a quarter of all wheat exports, are too dry to plant some crops on. While there’s still plenty of time for conditions to improve and farmers to catch up, the challenges risk shortening the sowing window for winter crops that make up the bulk of their annual production,” Quinn reported. “Most of European Russia is experiencing ‘tremendous dryness,’ said Dmitry Rylko, director of Moscow-based consultant IKAR. ‘Farmers were hesitant to sow in the dust.'”

“It’s an early reminder of potential supply risks for next season. While wheat prices are well below a peak set following Moscow’s invasion of Ukraine, they’ve edged up in recent weeks in part due to Black Sea supply concerns,” Quinn reported. “Ukraine’s wheat output is about a third below pre-war levels after it lost land to the invasion. Russia’s latest crop shrank roughly 10% due to unfavorable weather.”

“Rain this week should aid soil moisture slightly for Black Sea wheat, but much more is needed for a significant improvement to ease worries over dryness, forecaster Maxar said. Still, farmers have until around October or November to catch up with plantings, if the weather improves,” Quinn reported. “If the European part of Russia gets good rains before mid-October and the weather remains warm, then ‘it’s not very dangerous yet,’ IKAR’s Rylko said.”

European Production Cut Due to Rains

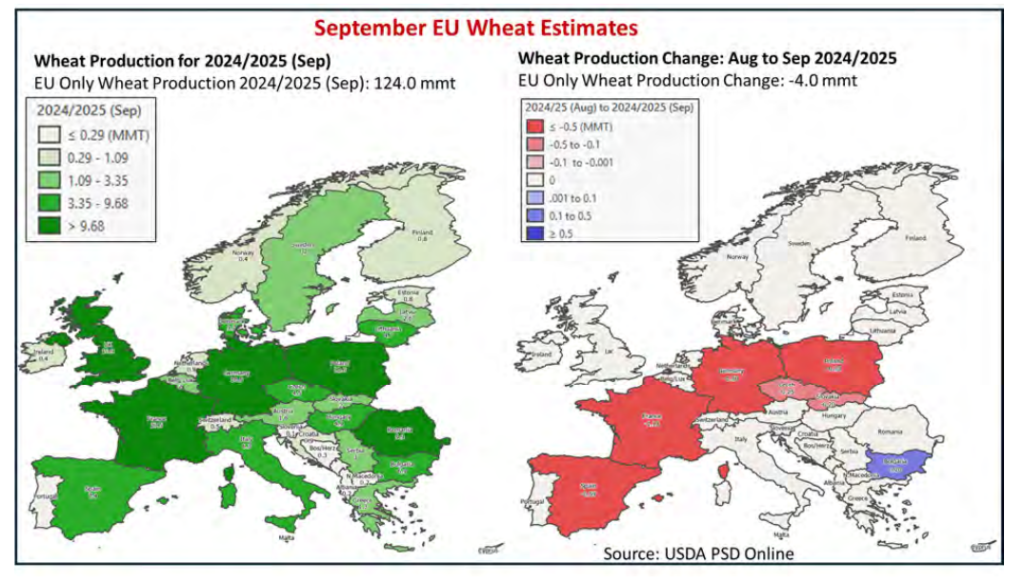

The USDA’s September World Agricultural Production report reported that “wheat harvest is finished in the EU and results are disappointing. Wheat areas have had months of excessive rainfall that saturated fields, hampered farm work, increased diseases, prevented grain development, and delayed harvest in northwest Europe.”

“In particular, Germany’s production is estimated down 1.5 mmt this month to 18.8 mmt (with a revised 0.1 mha drop in harvested area),” the USDA reported. “France, the EU’s largest wheat producer has also battled excessive rainfall the entire season. France’s production is lowered again, with production now at 27.5 mmt, down 1.1 mmt from last month. France’s production is estimated to be lower than the similarly rain-soaked crop of MY 2016/17, and also the lowest production since MY 1987/88.”

Overall, “wheat production in the European Union (EU) for marketing year (MY) 2024/25 is estimated at 124.0 million metric tons (mmt), down 4.0 mmt from last month, 10.9 mmt below last year and 8 percent below the 5-year average,” the USDA reported. “Harvested area is estimated at 23.0 million hectares (mha), down 0.1 mha from last month, down 1.3 mha (5 percent) from last year, and down 4 percent from the 5-year average. Yield is estimated at 5.39 tons per hectare (t/ha), below last month’s 5.54 t/ha, last year’s 5.55 t/ha and 4 percent below the 5-year average.”