USDA is asking farmers and other stakeholders to help examine how USDA can improve its data collection and analysis. The department is issuing a Request for Information (RFI) to examine…

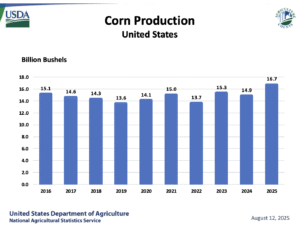

USDA Forecasts Record Corn Yield and Production

Progressive Farmer Staff reported that the “USDA on Tuesday forecast a record corn crop at a whopping 16.7 billion bushels with record yields projected for corn at 188.8 bushels per acre — shattering another record. USDA also bumped up the soybean yield to 53.6 bpa, just below the record, though USDA lowered soybean production 43 million bushels to 4.292 billion bushels.”

“USDA increased the 2025-26 corn production by more than 1 billion bushels (bb) in the report, moving from 15.705 billion bushels to 16.742 bb. For comparison, record production was 15.34 bb in the 2023-24 crop,” Progressive Farmer reported. “Planted acres for corn were also increased 2.1 million acres (ma) to 97.3 ma. Harvested acres are projected at 88.7 ma, up from 86.8 ma in July.”

American Ag Network’s Jesse Allen reported that the USDA “forecasts record high corn yields in Idaho, Illinois, Indiana, Iowa, Minnesota, Missouri, South Carolina, South Dakota, Tennessee, Virginia, and Wisconsin. Also, if realized, the forecasted soybean yields in Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Michigan, Minnesota, Mississippi, Missouri, North Carolina, and Virginia will be record highs.”

Successful Farming’s Cassidy Walter reported that Jeremy McCann, account manager at the Farmer’s Keeper said that “this (report) comes as a shock, not only to the trade but also to farmers, who are facing adverse conditions ranging from a lack of moisture to disease pressure. I can confidently say this is a big crop, but I would be shocked if these numbers are not revised lower by the time we get to our final estimate in January.”

Soybean Production Forecast Decreased

Progressive Farmer reported that “USDA forecast soybean production at 4.29 billion bushels, at the low end of pre-report estimates. The agency forecasts a national average yield of 53.6 bushels per acre, which would be a record high if it comes to fruition. USDA reduced harvested area from 82.5 million acres to 80.1 million.”

The larger-than-average downward revision in harvested area was largely attributed to the fact that “NASS reported they would use the FSA data in August for only the second time (last two years),” USDA’s Chief Economist Seth Meyer said on X. “Comparing acreage revisions now to history is going to mislead, Sept and Oct changes should be on the lower side of historical adjustment as a result.”

🫛USDA projects 2025 US soybean yield at 53.6 bu/acre, well above 2016’s record of 51.9 bu/acre.

Last year finished dry, and soybean yield suffered. Here’s how the 2025 estimates compare with a year ago by state. pic.twitter.com/UUU7Qx73b3

— Karen Braun (@kannbwx) August 12, 2025

“(Soybean) supplies for the 2025-26 marketing year are forecast to decline. Ending stocks, at 290 million bushels, are 20 mb lower than last month’s estimate. Production declined by 43 mb and beginning stocks by 20 mb,” Progressive Farmer reported. “USDA trimmed its export forecast by 40 mb to 1.705 bb and residual by 3 mb. The national average farm gate price was unchanged at $10.10 per bushel.”

USDA Forecast Points to Potentially Increased Commodity Program Payments

Agri-Pulse’s Philip Brasher and Oliver Ward reported that, in addition to forecasting a record corn crop, the USDA also “sharply lowered its forecast for the average corn price, which if realized could trigger significantly higher commodity program payments.”

“The department lowered the estimated season-average price for this year’s crop by 30 cents to $3.90 per bushel. A decrease of that size could increase commodity program payments by as much as $3.6 billion, according to an analysis by ag accountant Paul Neiffer,” Brasher and Ward reported. “Under the budget reconciliation law enacted in July, USDA will pay farmers the higher of the Price Loss Coverage or Agriculture Risk Coverage program this year, regardless of which program they signed up for.”

Crop revenue insurance payments should be boosted if low prices hold through October. Corn put in its low in August last year, reducing potential insurance payments. #oatt

— Arlan Suderman (@ArlanFF101) August 12, 2025

“‘For every 10 cent drop in [marketing year average] corn price, farmers on average will receive an extra $1.2 billion in payments. Some farmers will max out on the payment limits so the final number might be less,’ Neiffer said in a note to subscribers,” Brasher and Ward reported. “Arlan Suderman, chief commodities economist for the StoneX Group, noted in an X post that revenue insurance indemnities also could increase this year ‘if low prices hold through October.'”