The frustration in the room at Commodity Classic has been palpable following a year in 2025 where strong production was again unable to overcome swelling costs and expenses. Farmers here…

Low Mississippi River Levels to Again Disrupt Harvest Shipping

Agri-Pulse’s Noah Wicks reported that “water levels in parts of the Ohio and Mississippi rivers are likely to reach critically low stages soon, forcing shippers to light-load harvest-season grain barges for the fourth year in a row.”

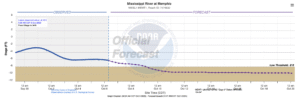

“Readings on the Ohio River at Cairo, Illinois, have already fallen below that gauge’s ‘low threshold,’ while those on the Mississippi River at Memphis, are projected to do so by Tuesday,” Wicks reported. “With harvest season already underway, agricultural shippers are being forced to load their barges lighter due to the threat of low water conditions developing in coming weeks. ‘We’ve had low water levels for four years in a row now,’ said Mike Seyfert, president and CEO of the National Grain and Feed Association. ‘What I would say is, it certainly doesn’t make things easier.'”

“Barge rates have risen, adding additional shipping costs for grain elevators that trickle back down to the farm level,” Wicks reported. “Gary Williams, the director of the Upper Mississippi Waterway Association, said between current commodity prices and shipping costs, Midwestern corn and soybean farmers have been looking to store their grain in ‘every single nook and cranny’ they can.”

“Barge freight rates from Cairo to Memphis were $19.53 per ton on Sept. 23, a 31% increase from a month prior, according to USDA’s most recent Grain Transportation Report. However, they remain 14% lower than they were at the same time last year,” Wicks reported. “Barged grain movements fell from 2.4 million short tons to 502,000 short tons between the week of Aug. 4 and the week of Sept. 12, a 79% drop, said Daniel Munch, an economist for the American Farm Bureau Federation. In a recent analysis, Munch found that soybean movements sank 89%, corn movements dropped 72% and wheat movements fell 55%.”

“He attributes some of the drop to Coast Guard vessel loading restrictions, noting that ‘when barges can’t sink as far and pull as many tows or barges behind each boat, that means they are moving less volume for the same price. Farmers who sell to grain elevators are indirectly paying the additional shipping costs by receiving lower prices for their grain,’ he said,” according to Wicks’ reporting. “‘This is kind of just adding on to the list of problems and market hurdles that crop producers, especially row crop producers, are facing this year,’ Munch said.”

AgWeb’s Margy Eckelkamp reported that “looking at the forecast, the next seven to 10 days doesn’t show much promise for precipitation along the Mississippi River Valley or the Ohio River Valley, which notably feeds the lower Mississippi. However, the end of October could turn wetter, which might slow the finish of harvest but could recharge the vital artery in our inland waterways.”

Low Water Levels to Impact Prices for Producers

Forbes’ Steve Banker reported that “this comes at the worst possible time for farmers. This is the peak period when Midwest corn and soybeans are transported to New Orleans for export to the global market. These crops support the U.S. export program.”

“If the low water materializes, it could further depress prices that have already been hurt by China’s reduced buying due to tariffs,” Banker reported. “(Mike) Steenhoek, (the executive director of the Soy Transportation Coalition) adds, ‘when you already have a softening of demand, the last thing you want is for any additional profitability to be siphoned off because our transportation system is not operating at full capacity.’”

“China is the world’s largest soybean buyer, importing more soybeans over the last five years than every other country combined, according to the American Soybean Association,” Banker reported. “But as the United States and China remain locked in a trade war, farmers like Scott Thomsen are caught in the middle of the conflict. Thomsen, a fourth-generation Nebraskan farmer who farms corn, cattle, and soybeans, said ‘China has not bought a single export cargo of beans so far this year, which is not very typical.'”

“Farmers receive lower bids from grain elevators when transportation delays are imminent,” Banker reported. “Reduced shipment capacity and slower transport down the river could delay delivery of U.S. agricultural exports to Gulf terminals. This gives foreign competitors, such as Brazil and Argentina, an opportunity to fill the gap.”