U.S. farmers are facing one of the widest gaps in a decade between what they pay to produce food and what they earn from selling it. New USDA data released…

Farm Economy to Stabilize in 2026, Ag Economists Predict

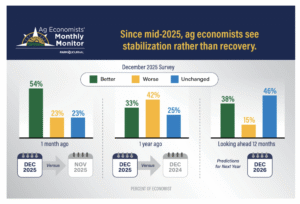

AgWeb’s Tyne Morgan reported that “as 2026 ushers in a fresh start, agricultural economists say the U.S. farm economy has stopped sliding, but it’s far from fully healed. The December Ag Economists’ Monthly Monitor shows month-to-month sentiment is improving, but deep structural strain remains — especially in row crops. Meanwhile, livestock markets continue to provide strength. Crop producers face another year of tight margins driven by high input costs, weak prices and unresolved trade and policy uncertainty.”

“‘There’s cautious optimism,’ the economists say,” according to Morgan’s reporting, “‘but very little belief that 2026 will bring a meaningful rebound without cost relief or stronger demand.'”

“Economists see the ag economy holding its ground — but not gaining strength,” Morgan reported. “54% say the ag economy is somewhat better than one month ago. Compared with a year ago: 42% say conditions are worse (and) 33% say they are better. Looking ahead 12 months: 46% expect conditions unchanged, 38% expect improvement (and) 15% expect conditions to worsen.”

“‘Momentum has improved since mid-2025,’ (Seth) Meyer (director of the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri) notes, ‘but tight margins have been with us for a long time. Turning that around requires demand growth, not just price stabilization,'” Morgan reported.

“Grant Gardner, assistant Extension professor at the University of Kentucky, tells AgriTalk’s Chip Flory: “I think as we move into kind of this next marketing year, you’re looking at what looks like a breakeven and not a loss, but breakeven still doesn’t look great after three years of breakeven or losses,'” Morgan reported. “He says even with the $11 billion in Farmer Bridge Program payments, it won’t drastically change the outlook for the farm economy.”

Input Costs, Trade Remain Top 2026 Ag Economy Concerns

AgWeb’s Morgan reported that “looking to 2026, economists overwhelmingly point to input costs, not interest rates, as the biggest barrier to profitability. Nearly 70% cited input prices as the largest challenge as well, far ahead of trade concerns or capital availability.”

“‘We have too much supply and not enough demand for row crops,’ one economist wrote,” according to Morgan’s reporting. “Another said: ‘Input costs are still too high.'”

“Trade remains a central wild card, especially relationships with China and uncertainty around global supply. Several respondents cited trade disputes and agreements as critical factors, along with questions about the size of South American crops and how that could shape global competition in the months ahead,” Morgan reported. “Policy uncertainty was also featured prominently, with economists pointing to domestic biofuels policy, government payments and broader market signals as factors influencing both short-term cash flow and longer-term demand growth.”

CoBank’s Thomas Halverson wrote that “federal policy uncertainty remains a key issue for rural industries. The Farm Bill is the single most important policy platform for rural America and American agriculture, serving as a vital safety net for an industry that feeds the world and that undergirds our national security. The current version of the Farm Bill dates to 2018. Though it has been extended through September 2026, it would be far better for Congress to reauthorize a new five-year Farm Bill that incorporates current marketplace conditions for agriculture, which have changed a great deal over the past several years. It is impossible to overstate the importance of this legislation to the well-being of farmers and rural communities.”

Farmer Expectations of Financial Performance in 2026 Largely Unchanged from 2025

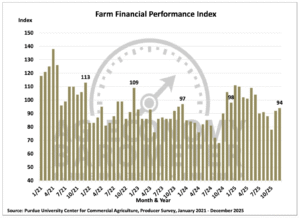

FarmWeekNow reported that “farmer sentiment dipped slightly in December as trade uncertainty hangs over the agriculture industry, according to the Purdue University/CME Group Ag Economy Barometer. The barometer dropped 3 points to 136, with the decline attributable to a softening in farmers’ long-term outlook.”

“Farmers’ expectations for their farms’ financial performance remained mostly unchanged in December. The Farm Financial Performance Index inched up 2 points to 94, reflecting more producers expecting this year’s farm financial performance to be similar to last year’s,” FarmWeekNow reported. “The Farm Capital Investment Index also rose 2 points to 58. Despite this increase, most producers (60%) still see December as a bad time to make large farm investments.”

Agri-Pulse’s Philip Brasher reported that “‘producers were more optimistic than they had been in their broad outlook toward exports, with only 5% of those surveyed saying they expect exports to decline this year. However, when asked to focus more specifically on soybeans, a key agricultural export, their outlook was notably less sanguine. In December, 13% of corn and soybean growers said they expect soybean exports to decline over the upcoming five years, up from 8% of growers who felt that way in November,’ according to a summary of the report.”

“‘Similarly, the percentage of growers who expect soybean exports to increase in the next five years fell from 47% in November to 39% in December,'” Brasher reported.